Alternatives to Akeneo PIM

1. Catalogix

+Pros

- AI-powered automation

- 5x faster processing speed

- 90-99% accuracy in apparel attribute identification

-Cons

- Data quality dependency

- Category-specific performance variations

- Implementation complexity

One highlighted feature and why it's amazing

The data ingestion system uses AI mapping algorithms to transform disparate data sources from ERPs, PLMs, and spreadsheets into unified catalog formats.

Another highlighted feature of why it’s amazing

Automatically creating SEO-optimized product titles, descriptions, and video content from structured product data.

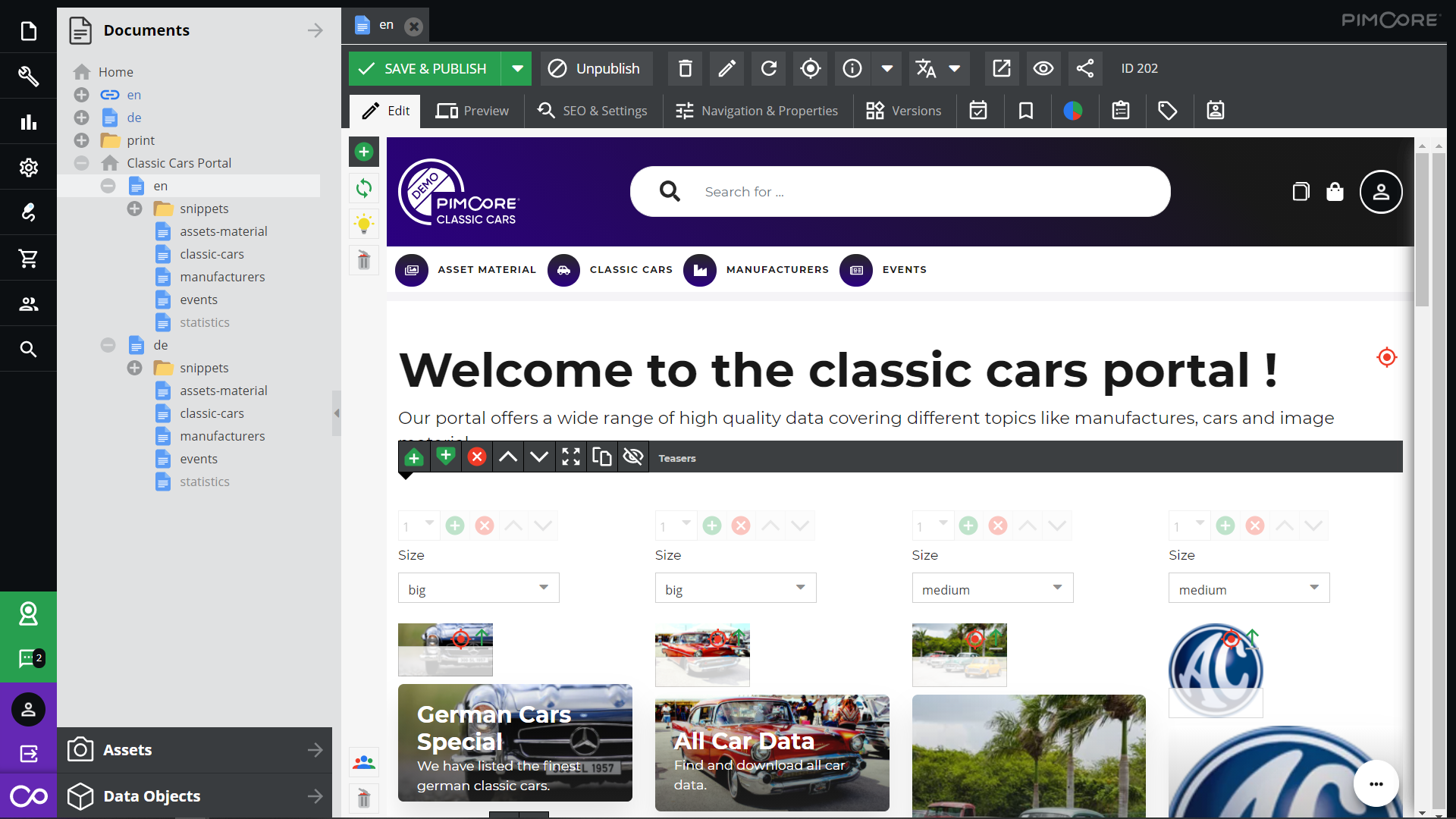

2. Pimcore

+Pros

- Integrated platform approach combining PIM, DAM, and CMS capabilities within a single system.

- Open-core architecture providing unlimited extensibility and customization without vendor restrictions.

- API-first design enabling connections to any AI/ML infrastructure.

-Cons

- Implementation complexity and technical resource requirements.

- Backend administrative complexity compared to streamlined SaaS alternatives.

One highlighted feature and why it's amazing

Comprehensive product information management with unlimited hierarchies and nested variants with content inheritance.

Another highlighted feature of why it’s amazing

Centers on Pimcore Copilot, an integrated AI assistant enabling automated content generation, image/video synthesis from text prompts, and custom workflow creation.

3. Plytix

+Pros

- Integrated PIM-DAM architecture that eliminates data silos

- OpenAI integration for attribute-level text generation

- Significantly lower entry costs compared to enterprise solutions

-Cons

- API customization limitations for complex integrations

- Design inflexibility in Brand Portal and PDF template customization

- Significant cost differential between basic subscriptions and AI add-ons

One highlighted feature and why it's amazing

Forms the core of Plytix's differentiation, leveraging OpenAI integration for automated product descriptions and attribute-level text generation.

Another highlighted feature of why it’s amazing

Centralizes product data with digital asset management in a unified system, contrasting competitors' modular approaches that require separate tools.

Other Alternatives

Rierino

SAP Commerce Cloud

Salsify

Stibo Systems STEP

inRiver PIM

How We Researched This Guide

About This Guide: This comprehensive analysis is based on extensive competitive intelligence and real-world implementation data from leading AI vendors. StayModern updates this guide quarterly to reflect market developments and vendor performance changes.

215+ verified sources per analysis including official documentation, customer reviews, analyst reports, and industry publications.

- • Vendor documentation & whitepapers

- • Customer testimonials & case studies

- • Third-party analyst assessments

- • Industry benchmarking reports

Standardized assessment framework across 8 key dimensions for objective comparison.

- • Technology capabilities & architecture

- • Market position & customer evidence

- • Implementation experience & support

- • Pricing value & competitive position

Research is refreshed every 90 days to capture market changes and new vendor capabilities.

- • New product releases & features

- • Market positioning changes

- • Customer feedback integration

- • Competitive landscape shifts

Every claim is source-linked with direct citations to original materials for verification.

- • Clickable citation links

- • Original source attribution

- • Date stamps for currency

- • Quality score validation

Analysis follows systematic research protocols with consistent evaluation frameworks.

- • Standardized assessment criteria

- • Multi-source verification process

- • Consistent evaluation methodology

- • Quality assurance protocols

Buyer-focused analysis with transparent methodology and factual accuracy commitment.

- • Objective comparative analysis

- • Transparent research methodology

- • Factual accuracy commitment

- • Continuous quality improvement

Quality Commitment: If you find any inaccuracies in our analysis on this page, please contact us at research@staymodern.ai. We're committed to maintaining the highest standards of research integrity and will investigate and correct any issues promptly.