Salsify: Complete Buyer's Guide

Complete Buyer's Guide

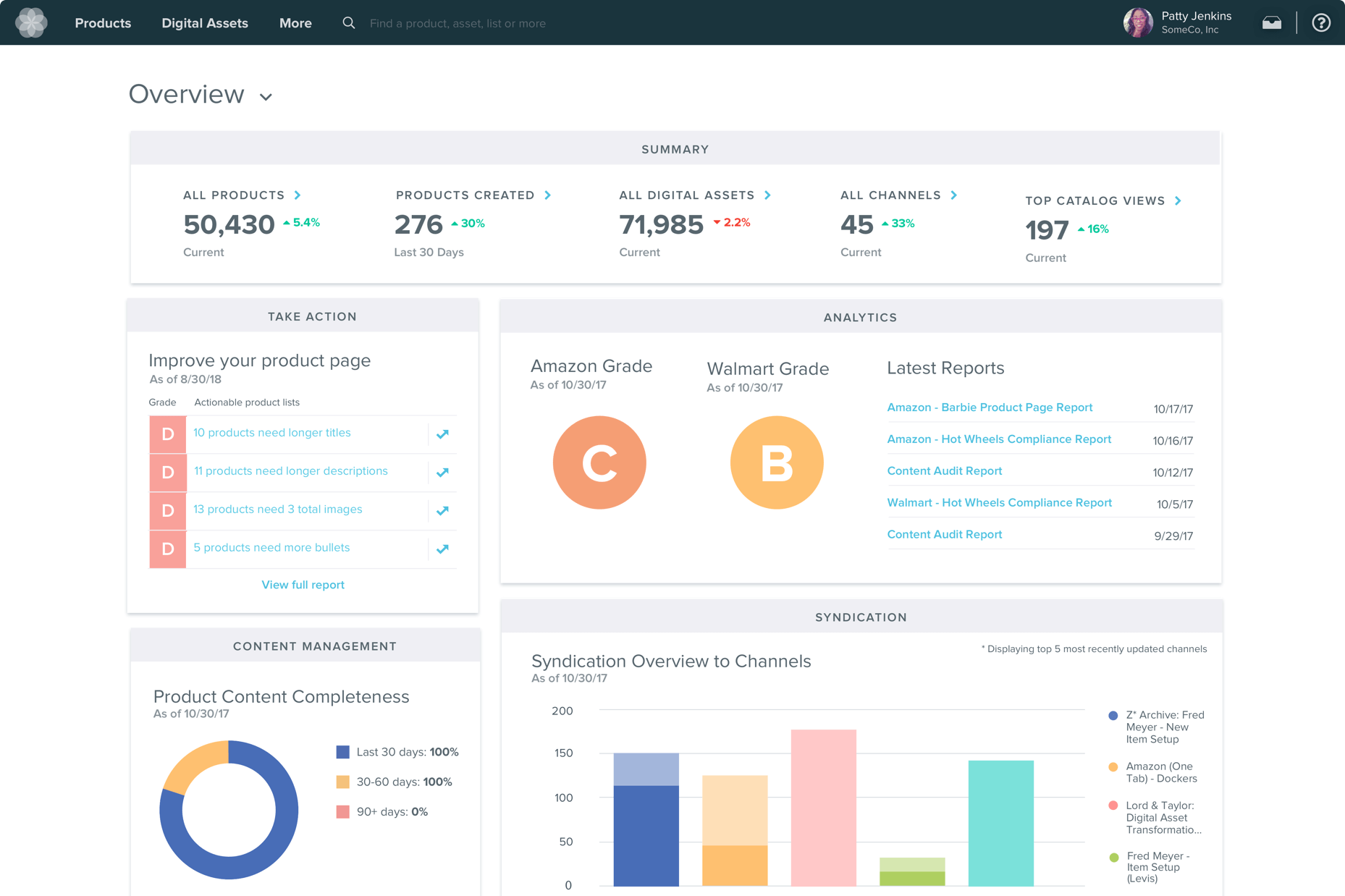

Salsify positions itself as a unified Product Experience Management (PXM) platform that consolidates product information management (PIM), digital asset management (DAM), and analytics capabilities into a single solution for omnichannel commerce operations.

Market Position & Maturity

Market Standing

Salsify occupies a strong leadership position in the Product Experience Management market, holding Forrester Leadership positioning (Q4 2023) with top scores in syndication, API architecture, and supplier onboarding capabilities[44].

Company Maturity

The company demonstrates operational maturity through its ability to serve complex enterprise implementations, evidenced by successful deployments across major brands including Samsonite, Danone, KIND Snack Bars, and Wastequip[49][51][52][68].

Industry Recognition

Industry recognition extends beyond analyst positioning to include practical market adoption across 15 regional GDSN markets with local validation capabilities[41][67].

Longevity Assessment

Long-term viability appears supported by strong market positioning and customer adoption, though the significant variance in customer satisfaction between segments raises questions about scalability of support operations and customer success capabilities across different market tiers.

Proof of Capabilities

Customer Evidence

Wastequip's transformation serves as a comprehensive validation case, where the industrial equipment manufacturer successfully consolidated 37,000 SKUs across 12 brands, achieving 100% channel consistency and 65% faster product launches through Salsify's unified PXM architecture[68].

Quantified Outcomes

Jordan Manufacturing achieved 92% reduction in listing errors and cut time-to-market from months to days[48], while KIND Snack Bars experienced 10% sales lift and 79% increase in bullet-point compliance after implementing AI-driven GDSN validation[51].

Market Validation

Market validation extends to rapid deployment scenarios, with Danone accelerating 1,000+ listings in 90 days[52].

Competitive Wins

The platform's pre-built connectors for Amazon and Walmart reduce integration complexity compared to custom approaches[48][70], while support for 15 regional GDSN markets with local validation rules provides superior global capability versus regional solutions[41][67].

Reference Customers

Reference customer diversity spans from mid-market retailers to enterprise manufacturers, with successful implementations across complex scenarios including multi-brand consolidations, international market expansion, and AI-driven content automation.

AI Technology

Salsify's AI capabilities leverage OpenAI Accelerator integration for generative content creation and data optimization, enabling automated product description generation with vendor claims of 80% reduction in manual content creation time[47][60].

Architecture

Salsify's technical foundation centers on a unified Product Experience Management (PXM) architecture that integrates PIM, DAM, and analytics capabilities within a single platform, eliminating the integration complexity typically associated with multi-vendor solutions[42][43][53].

Primary Competitors

Salsify competes directly with Syndigo in the enterprise space while overlapping with Akeneo in the mid-market segment.

Competitive Advantages

Primary competitive advantages include pre-built connectors for Amazon and Walmart that reduce integration complexity compared to custom approaches[48][70], and support for 15 regional GDSN markets with local validation rules providing superior global capability versus regional solutions[41][67].

Market Positioning

Market positioning targets omnichannel retailers requiring sophisticated synchronization and AI-driven automation, competing on unified architecture rather than specialized functionality.

Win/Loss Scenarios

Win/loss scenarios favor Salsify when organizations prioritize unified architecture, AI-driven content automation, and real-time channel validation.

Key Features

Pros & Cons

Use Cases

Integrations

Pricing

Featured In Articles

Comprehensive analysis of Catalog Management for Ecommerce for Ecommerce businesses and online retailers. Expert evaluation of features, pricing, and implementation.

How We Researched This Guide

About This Guide: This comprehensive analysis is based on extensive competitive intelligence and real-world implementation data from leading AI vendors. StayModern updates this guide quarterly to reflect market developments and vendor performance changes.

70+ verified sources per analysis including official documentation, customer reviews, analyst reports, and industry publications.

- • Vendor documentation & whitepapers

- • Customer testimonials & case studies

- • Third-party analyst assessments

- • Industry benchmarking reports

Standardized assessment framework across 8 key dimensions for objective comparison.

- • Technology capabilities & architecture

- • Market position & customer evidence

- • Implementation experience & support

- • Pricing value & competitive position

Research is refreshed every 90 days to capture market changes and new vendor capabilities.

- • New product releases & features

- • Market positioning changes

- • Customer feedback integration

- • Competitive landscape shifts

Every claim is source-linked with direct citations to original materials for verification.

- • Clickable citation links

- • Original source attribution

- • Date stamps for currency

- • Quality score validation

Analysis follows systematic research protocols with consistent evaluation frameworks.

- • Standardized assessment criteria

- • Multi-source verification process

- • Consistent evaluation methodology

- • Quality assurance protocols

Buyer-focused analysis with transparent methodology and factual accuracy commitment.

- • Objective comparative analysis

- • Transparent research methodology

- • Factual accuracy commitment

- • Continuous quality improvement

Quality Commitment: If you find any inaccuracies in our analysis on this page, please contact us at research@staymodern.ai. We're committed to maintaining the highest standards of research integrity and will investigate and correct any issues promptly.