inRiver PIM: Complete Buyer's Guide

AI-enhanced product information management solution

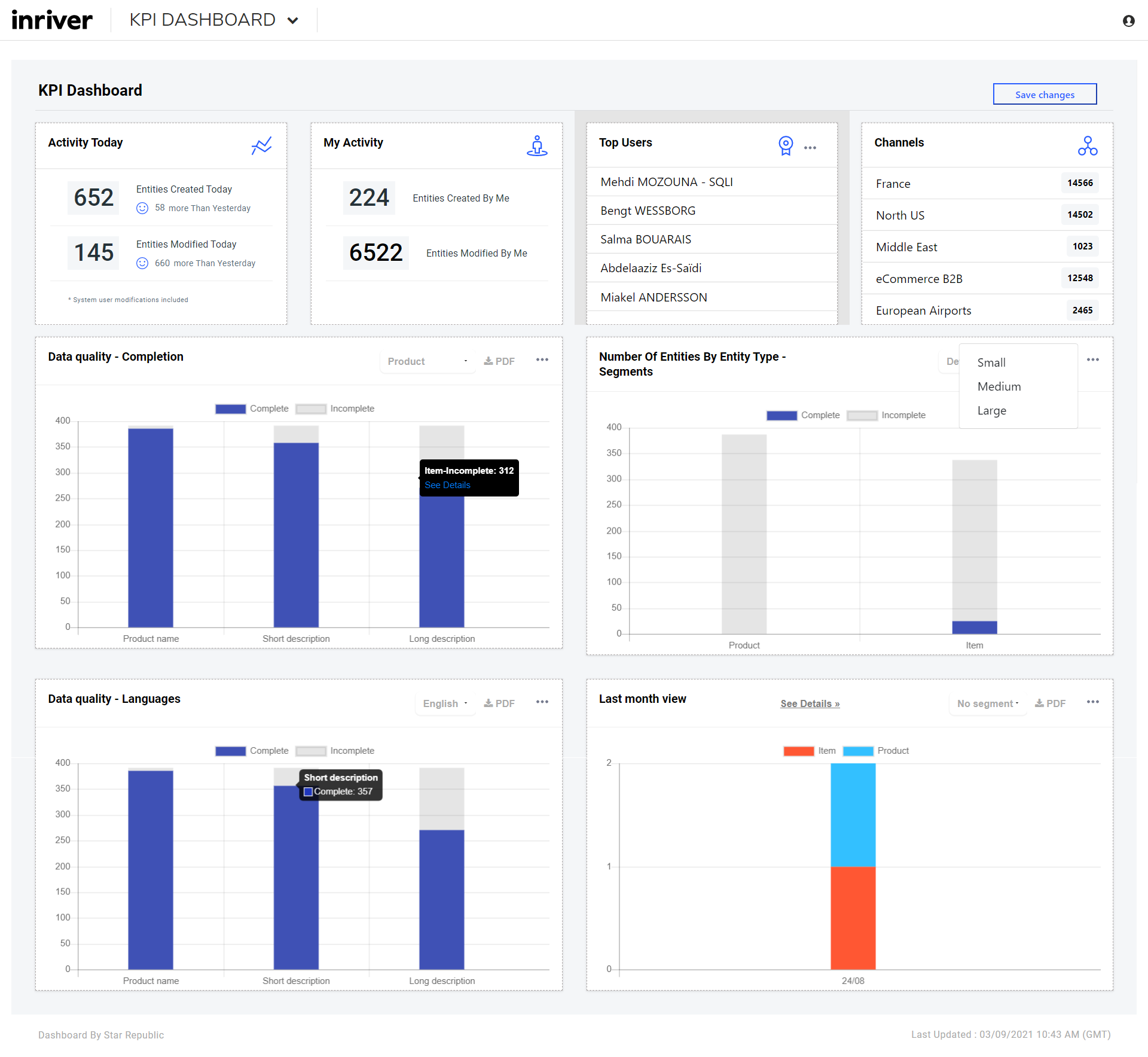

inRiver PIM positions itself as an AI-enhanced product information management solution designed for mid-market to enterprise ecommerce businesses requiring sophisticated catalog management across multiple channels. The platform integrates generative AI capabilities with traditional PIM functionality, offering automated content generation, batch editing, and custom model training for complex product catalogs [41][47].

Market Position & Maturity

Market Standing

inRiver operates within a robust and expanding PIM market, with the global catalog management software market reaching $2.14 billion in 2024 and projected 11.1% CAGR through 2030 [49][52][53][54].

Company Maturity

inRiver's market maturity demonstrates through documented enterprise customer implementations, though the vendor's custom pricing model and implementation complexity suggest positioning toward sophisticated buyers rather than broad market adoption.

Growth Trajectory

Enterprise adoption patterns show 97% of organizations with $1M+ revenue planning increased AI spending in 2025 [53][54].

Industry Recognition

The vendor's competitive positioning emphasizes AI-enhanced functionality and API-first architecture within the mid-enterprise PIM market segment.

Strategic Partnerships

Strategic partnerships with implementation providers like Layer One demonstrate ecosystem development [42].

Longevity Assessment

The platform's positioning within the competitive landscape emphasizes technical flexibility and AI customization capabilities, differentiating from both simpler SaaS alternatives and more rigid enterprise solutions.

Proof of Capabilities

Customer Evidence

Jacuzzi's Enterprise Transformation provides the most comprehensive evidence of inRiver's implementation patterns and outcomes. The project centralized product data across B2B and B2C channels for 20,000+ SKUs across 450+ retailer relationships [42][48].

Quantified Outcomes

Jacuzzi achieved measurable business outcomes including contribution to direct-to-consumer growth from 4% to 14% of total business [42].

Case Study Analysis

The transformation process required systematic taxonomy unification for product attributes, DAM integration for automated image management, and workflow rule configuration for marketplace-specific product variants [42][48].

Market Validation

Market Validation indicators include positioning within the expanding PIM market reaching $2.14 billion in 2024 with 11.1% CAGR through 2030 [49][52][53][54].

Competitive Wins

AI Capability Validation shows particular strength in content localization and workflow automation, positioning inRiver competitively for businesses requiring multilingual catalog management [47].

Reference Customers

Jacuzzi's implementation demonstrates inRiver's capability to handle enterprise-scale complexity while supporting diverse distribution strategies [42][48].

AI Technology

inRiver's AI transformation centers on three core capabilities integrated throughout the enrichment workflow, representing a sophisticated approach to automated catalog management [41].

Architecture

The platform's API-first architecture provides flexibility for complex integrations, though it requires technical resources for optimal configuration and maintenance [43].

Competitive Advantages

Primary Competitive Advantages include custom AI model training with export compatibility to OpenAI and Google Vertex AI, elastic data model adaptation for changing catalog requirements, and sophisticated workflow automation for complex distribution networks [41][43].

Market Positioning

inRiver's competitive positioning emphasizes AI-enhanced functionality and API-first architecture within the mid-enterprise PIM market, differentiating from both simpler SaaS alternatives and more rigid enterprise solutions [43][47].

Win/Loss Scenarios

Win/Loss Scenarios favor inRiver for organizations with complex catalog requirements, substantial SKU counts, and technical resources for implementation and maintenance.

Key Features

Pros & Cons

Use Cases

Featured In Articles

Comprehensive analysis of Catalog Management for Ecommerce for Ecommerce businesses and online retailers. Expert evaluation of features, pricing, and implementation.

How We Researched This Guide

About This Guide: This comprehensive analysis is based on extensive competitive intelligence and real-world implementation data from leading AI vendors. StayModern updates this guide quarterly to reflect market developments and vendor performance changes.

56+ verified sources per analysis including official documentation, customer reviews, analyst reports, and industry publications.

- • Vendor documentation & whitepapers

- • Customer testimonials & case studies

- • Third-party analyst assessments

- • Industry benchmarking reports

Standardized assessment framework across 8 key dimensions for objective comparison.

- • Technology capabilities & architecture

- • Market position & customer evidence

- • Implementation experience & support

- • Pricing value & competitive position

Research is refreshed every 90 days to capture market changes and new vendor capabilities.

- • New product releases & features

- • Market positioning changes

- • Customer feedback integration

- • Competitive landscape shifts

Every claim is source-linked with direct citations to original materials for verification.

- • Clickable citation links

- • Original source attribution

- • Date stamps for currency

- • Quality score validation

Analysis follows systematic research protocols with consistent evaluation frameworks.

- • Standardized assessment criteria

- • Multi-source verification process

- • Consistent evaluation methodology

- • Quality assurance protocols

Buyer-focused analysis with transparent methodology and factual accuracy commitment.

- • Objective comparative analysis

- • Transparent research methodology

- • Factual accuracy commitment

- • Continuous quality improvement

Quality Commitment: If you find any inaccuracies in our analysis on this page, please contact us at research@staymodern.ai. We're committed to maintaining the highest standards of research integrity and will investigate and correct any issues promptly.