Stripe Radar: Complete Buyer's Guide

AI-powered fraud detection platform

Stripe Radar is an AI-powered fraud detection platform that leverages machine learning trained on Stripe's global transaction network to identify fraud patterns in real-time for ecommerce businesses and online retailers [39][40].

Market Position & Maturity

Market Standing

Stripe Radar operates from a position of significant market strength within the fraud detection landscape, leveraging Stripe's established payment processing infrastructure that handles hundreds of billions in annual transaction volume [39][40].

Company Maturity

Stripe's payment processing infrastructure supports millions of businesses globally, providing the data foundation that powers Radar's machine learning capabilities [39].

Growth Trajectory

Growth trajectory benefits from Stripe's overall market expansion and increasing fraud detection adoption rates. Industry data suggests 19.3% CAGR growth in AI fraud detection markets [5][6][12][13].

Industry Recognition

Industry recognition stems primarily from Stripe's overall market leadership rather than specific fraud detection awards or analyst recognition [39][42].

Strategic Partnerships

Strategic partnerships and enterprise relationships provide market validation, with documented implementations across logistics (Sendle), fashion retail (Missguided), and various SMB segments [51][52].

Longevity Assessment

The platform's integration within Stripe's core payment infrastructure ensures long-term viability tied to Stripe's continued market leadership in payment processing [43].

Proof of Capabilities

Customer Evidence

Sendle's logistics operation achieved nearly 30% reduction in US fraud losses with documented 11x ROI using Radar for Fraud Teams [51]. Missguided's fashion retail transformation provides evidence of operational efficiency gains [52].

Quantified Outcomes

Sendle achieved nearly 30% reduction in US fraud losses with documented 11x ROI [51]. Missguided realized 40% operational cost reduction while maintaining conversion rate improvements [52].

Case Study Analysis

Sendle's implementation showcases the platform's effectiveness in high-volume, time-sensitive fraud detection scenarios [51]. Missguided's implementation resulted in operational efficiency gains and conversion rate improvements [52].

Market Validation

Market validation emerges through customer retention and expansion patterns. Sendle's documented 11x ROI suggests strong value realization [51].

Competitive Wins

Competitive displacement evidence shows success in replacing traditional fraud detection approaches. Missguided's transition from manual screening to fully automated fraud detection represents displacement of legacy approaches [51][52].

Reference Customers

Beyond Sendle and Missguided, the platform reports implementations across Xero, Jobber, and FreshBooks [41].

AI Technology

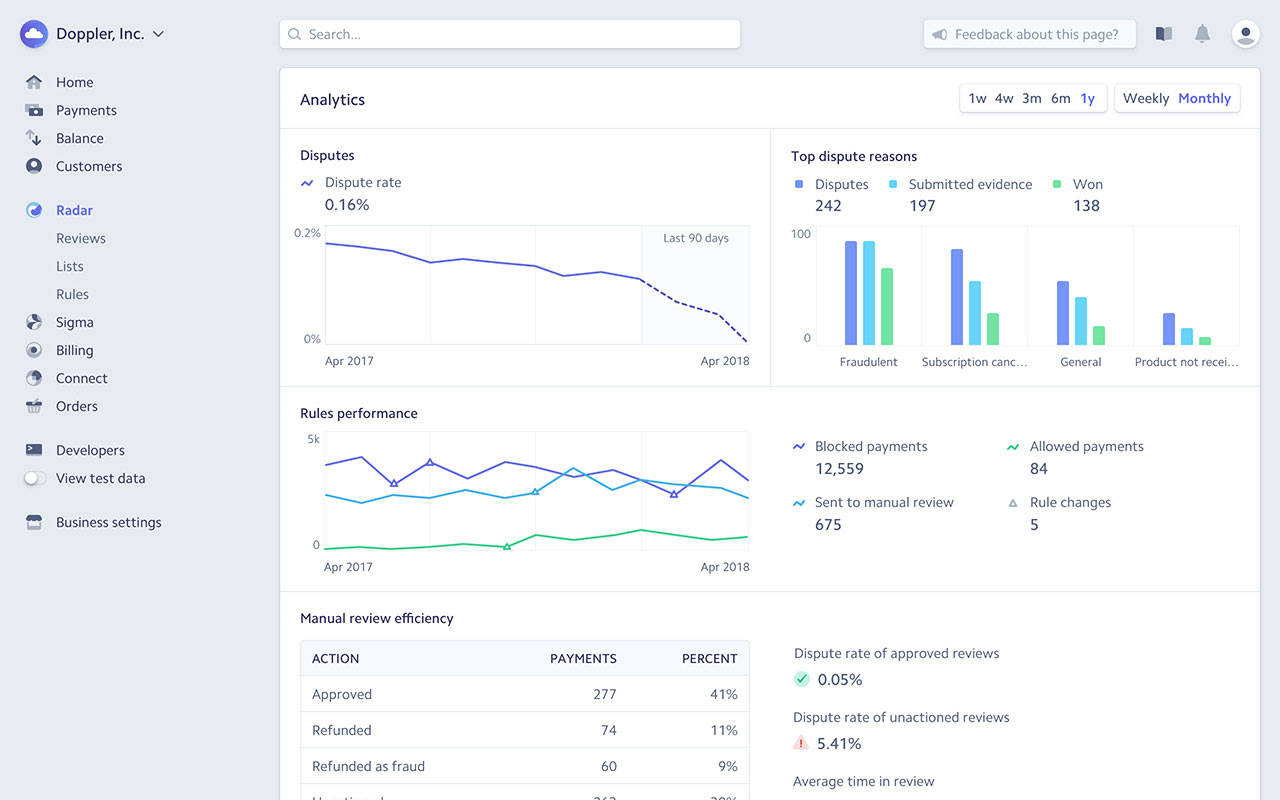

Stripe Radar's AI foundation centers on network-effect machine learning that processes transaction data from Stripe's global payment network to identify fraud patterns in real-time [39][40].

Architecture

The system's core architecture evaluates over 1,000 transaction characteristics including payment method, billing information, behavioral patterns, and network intelligence to generate risk scores within 100 milliseconds [40][43].

Primary Competitors

Primary competitors include Signifyd for enterprise behavioral biometrics, Riskified for ambiguous transaction verification, and Kount for policy-based decisioning approaches [3][15][16][17].

Competitive Advantages

Competitive advantages center on network effects from Stripe's global transaction data, with 92% card recognition rates providing theoretical advantages over isolated fraud detection systems [39][57].

Market Positioning

Market positioning shows strength in SMB and mid-market segments due to turnkey deployment capabilities, while enterprise implementations often prefer hybrid solutions [52][55].

Win/Loss Scenarios

Win/loss scenarios favor Stripe Radar for businesses requiring integrated deployment within existing Stripe infrastructure and those needing rapid implementation timelines [52][55].

Key Features

Pros & Cons

Use Cases

Pricing

Featured In Articles

Comprehensive analysis of Fraud Detection for Ecommerce for Ecommerce businesses and online retailers. Expert evaluation of features, pricing, and implementation.

How We Researched This Guide

About This Guide: This comprehensive analysis is based on extensive competitive intelligence and real-world implementation data from leading AI vendors. StayModern updates this guide quarterly to reflect market developments and vendor performance changes.

57+ verified sources per analysis including official documentation, customer reviews, analyst reports, and industry publications.

- • Vendor documentation & whitepapers

- • Customer testimonials & case studies

- • Third-party analyst assessments

- • Industry benchmarking reports

Standardized assessment framework across 8 key dimensions for objective comparison.

- • Technology capabilities & architecture

- • Market position & customer evidence

- • Implementation experience & support

- • Pricing value & competitive position

Research is refreshed every 90 days to capture market changes and new vendor capabilities.

- • New product releases & features

- • Market positioning changes

- • Customer feedback integration

- • Competitive landscape shifts

Every claim is source-linked with direct citations to original materials for verification.

- • Clickable citation links

- • Original source attribution

- • Date stamps for currency

- • Quality score validation

Analysis follows systematic research protocols with consistent evaluation frameworks.

- • Standardized assessment criteria

- • Multi-source verification process

- • Consistent evaluation methodology

- • Quality assurance protocols

Buyer-focused analysis with transparent methodology and factual accuracy commitment.

- • Objective comparative analysis

- • Transparent research methodology

- • Factual accuracy commitment

- • Continuous quality improvement

Quality Commitment: If you find any inaccuracies in our analysis on this page, please contact us at research@staymodern.ai. We're committed to maintaining the highest standards of research integrity and will investigate and correct any issues promptly.