Alternatives to Ordergroove

1. Bold Subscriptions

+Pros

- Native Shopify Plus integration provides seamless deployment without complex API dependencies.

- Proven AI revenue optimization with measurable outcomes, including 40% reduction in operational workload and 18% retention lift.

- Convertible subscription management handles complex inventory scenarios without reconciliation issues.

-Cons

- Shopify-centric approach limits compatibility outside the Shopify ecosystem.

- Lacks native AI churn prediction capabilities, relying on third-party integrations.

- Some customers report portal bugs causing support ticket increases.

One highlighted feature and why it's amazing

Represents Bold's core AI-powered capability set, utilizing machine learning algorithms to analyze customer behavior and optimize recurring revenue opportunities.

Another highlighted feature of why it’s amazing

Provides seamless deployment without complex API dependencies that affect platform-agnostic solutions.

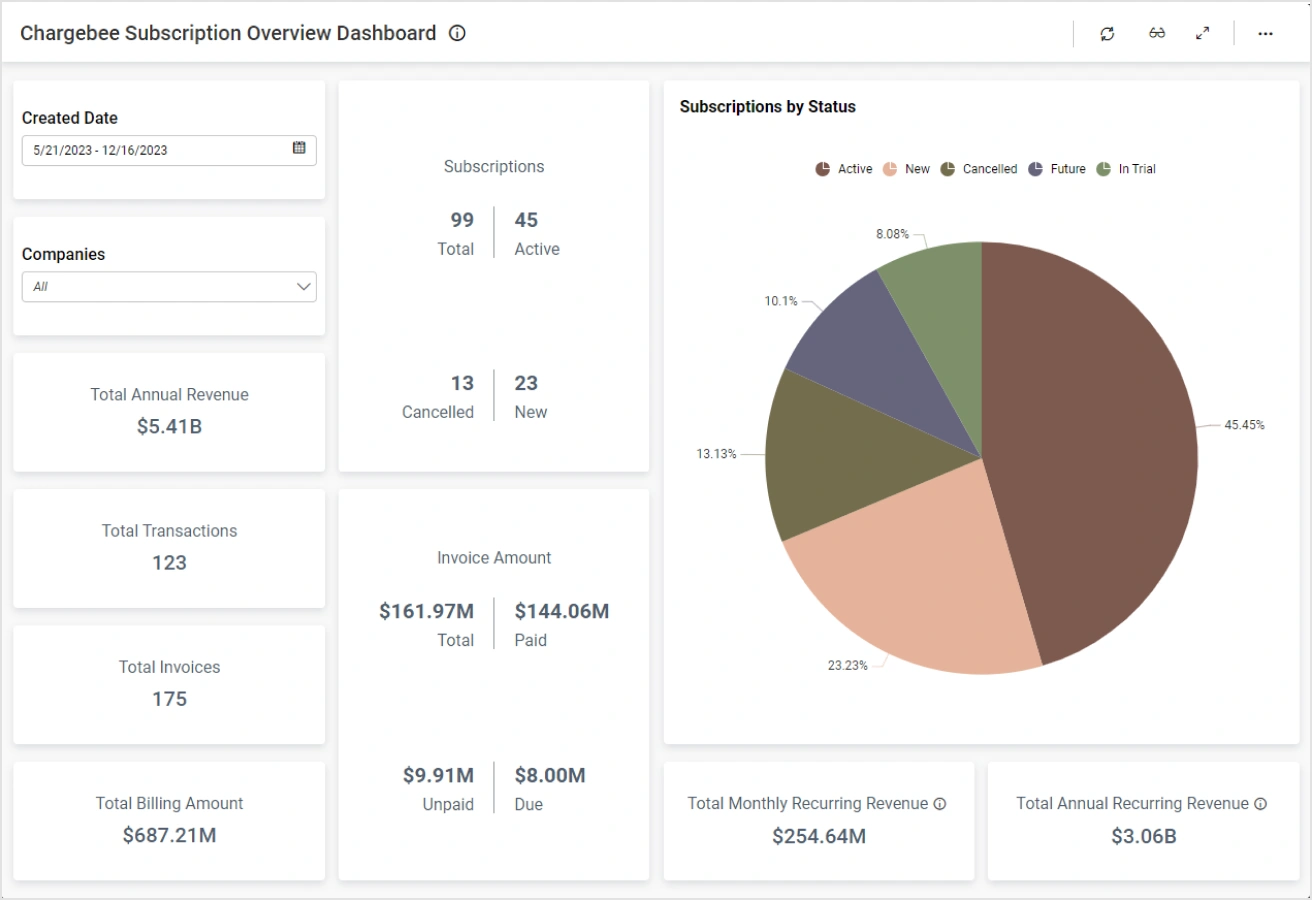

2. Chargebee

+Pros

- Comprehensive global compliance capabilities supporting 180+ currencies with automated VAT/GST calculation

- AI-driven churn prediction with documented customer success

- Schemaless usage ingestion handling unstructured AI product usage data

-Cons

- UI complexity that may challenge less technical users

- Portal customization restrictions potentially impacting brand consistency

- 0.75% overage fee that can become significant for high-growth businesses

One highlighted feature and why it's amazing

Uses machine learning to analyze subscription patterns and identify at-risk customers, enabling proactive retention through ML-based 'Smart Targeting' .

Another highlighted feature of why it’s amazing

Schemaless usage ingestion that handles unstructured AI product usage data for real-time billing alignment .

3. Recharge Analytics

+Pros

- Proven customer success through documented implementations .

- Access to benchmarking data from 20,000+ brands .

- Native Shopify ecosystem integration reduces implementation complexity.

-Cons

- Enterprise compliance analytics lag behind specialized vendors .

- AI methodology lacks independent verification.

- Data reconciliation challenges during migration .

One highlighted feature and why it's amazing

Recharge Analytics provides comprehensive churn dashboards that enabled Apothékary to achieve $10M in recurring revenue through predictive cancellation prevention .

Another highlighted feature of why it’s amazing

The platform leverages data from 20,000+ brands and 100M+ subscribers to provide comparative analytics and industry positioning insights unavailable from standalone tools .

Other Alternatives

Recurly

Stay AI

Stripe Billing

Subbly

Zuora

How We Researched This Guide

About This Guide: This comprehensive analysis is based on extensive competitive intelligence and real-world implementation data from leading AI vendors. StayModern updates this guide quarterly to reflect market developments and vendor performance changes.

226+ verified sources per analysis including official documentation, customer reviews, analyst reports, and industry publications.

- • Vendor documentation & whitepapers

- • Customer testimonials & case studies

- • Third-party analyst assessments

- • Industry benchmarking reports

Standardized assessment framework across 8 key dimensions for objective comparison.

- • Technology capabilities & architecture

- • Market position & customer evidence

- • Implementation experience & support

- • Pricing value & competitive position

Research is refreshed every 90 days to capture market changes and new vendor capabilities.

- • New product releases & features

- • Market positioning changes

- • Customer feedback integration

- • Competitive landscape shifts

Every claim is source-linked with direct citations to original materials for verification.

- • Clickable citation links

- • Original source attribution

- • Date stamps for currency

- • Quality score validation

Analysis follows systematic research protocols with consistent evaluation frameworks.

- • Standardized assessment criteria

- • Multi-source verification process

- • Consistent evaluation methodology

- • Quality assurance protocols

Buyer-focused analysis with transparent methodology and factual accuracy commitment.

- • Objective comparative analysis

- • Transparent research methodology

- • Factual accuracy commitment

- • Continuous quality improvement

Quality Commitment: If you find any inaccuracies in our analysis on this page, please contact us at research@staymodern.ai. We're committed to maintaining the highest standards of research integrity and will investigate and correct any issues promptly.