Stripe Billing: Complete Buyer's Guide

AI-powered billing automation for ecommerce businesses

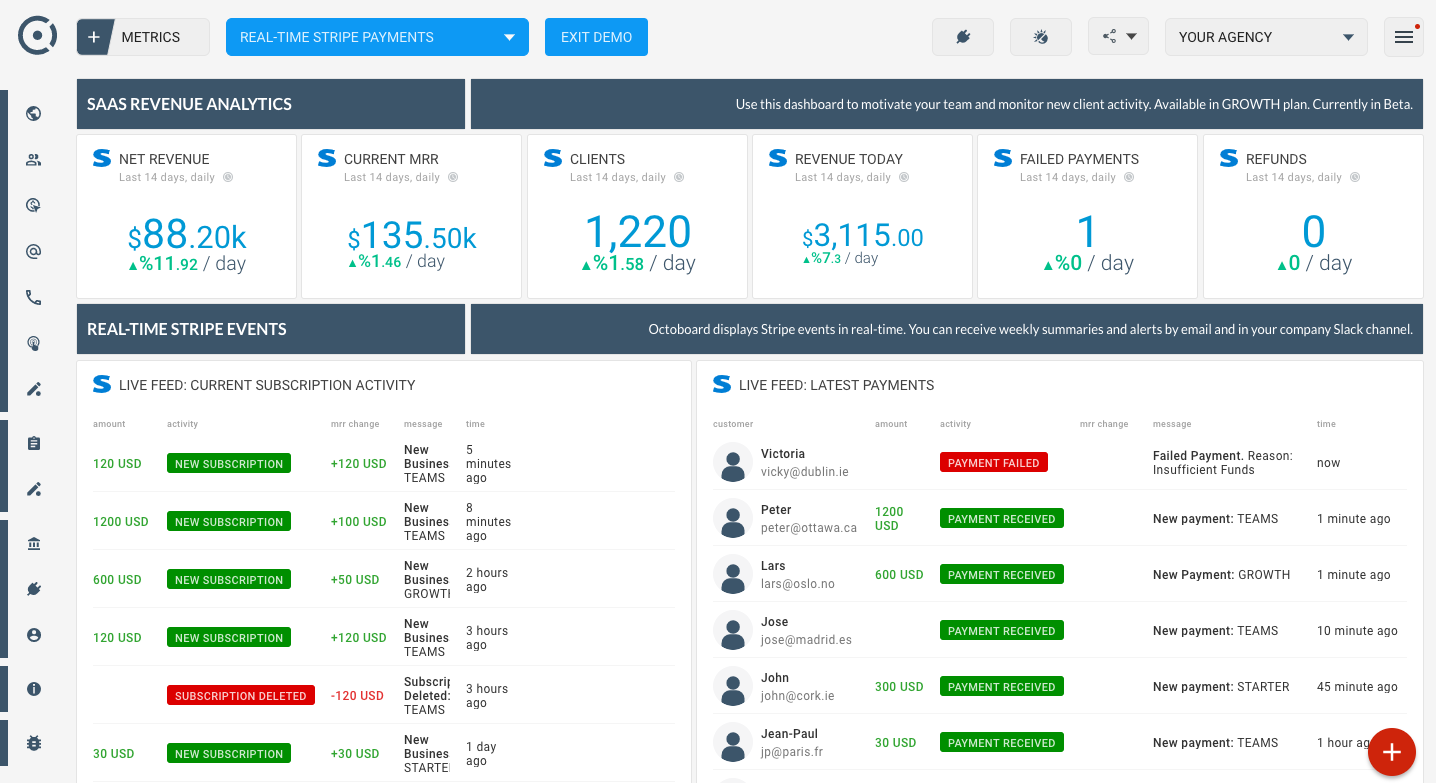

Stripe Billing represents the convergence of payment processing excellence and subscription management sophistication, delivering AI-powered billing automation for ecommerce businesses scaling subscription revenue models. Built on Stripe's Payments Foundation Model—trained on tens of billions of transactions—the platform combines intelligent payment recovery, automated global tax compliance, and predictive analytics capabilities within a unified billing infrastructure[39].

Market Position & Maturity

Market Standing

Stripe Billing occupies a dominant position in the unified payment and subscription management market, leveraging Stripe's established infrastructure processing over $1 trillion annually and serving 75% of Forbes AI 50 companies[42][46].

Company Maturity

Company maturity demonstrates through operational scale and customer diversity spanning mid-market retailers to enterprise technology companies. Customer evidence includes implementations at Leonardo AI (scaling to $10M ARR), Anthropic (40% payment conversion improvement), and Deliveroo (£100M annual recovery), indicating proven capability across different business models and scale requirements[51][42][47].

Growth Trajectory

Growth trajectory evidence includes expanding AI capabilities through the Payments Foundation Model and increasing enterprise adoption across technology sectors. The platform's $9 ROI for every $1 invested demonstrates strong value proposition driving customer retention and expansion[47].

Industry Recognition

Industry recognition emerges through customer adoption patterns among high-growth technology companies and documented performance metrics exceeding industry benchmarks.

Strategic Partnerships

Strategic partnerships within the Shopify ecosystem and broader ecommerce platform integrations indicate continued market expansion and ecosystem development.

Longevity Assessment

Vendor stability considerations include payment processing dependencies creating potential switching costs and technical dependencies on Stripe's infrastructure requiring disaster recovery planning for organizations with strict availability requirements[53].

Proof of Capabilities

Customer Evidence

Enterprise-scale customer implementations validate Stripe Billing's capabilities across diverse business models and scale requirements. Leonardo AI achieved $10M ARR in its first year with Stripe Billing's automated features contributing to backend efficiency and payment optimization, while recovering 40% of failed payments—5x the industry average—through Smart Retries system[51]. Deliveroo demonstrates enterprise-scale impact with £100M annually recovered through Smart Retries optimization, validating AI-powered payment recovery at massive transaction volumes[47].

Quantified Outcomes

Quantified performance outcomes consistently exceed industry benchmarks across multiple metrics. Anthropic accelerated payment conversion by 40% using Stripe Link while maintaining automated global tax compliance[42]. LiveX AI reported 200% improvement in churn prevention through Stripe-integrated AI agents offering dynamic discounts during retention conversations[41]. The platform's Smart Retries recover 57% of failed recurring payments on average, significantly outperforming rule-based alternatives[39].

Market Validation

Market validation emerges through adoption patterns among high-growth technology companies. Stripe Billing serves 75% of Forbes AI 50 companies and processes over $1 trillion annually, indicating strong market penetration among growth-focused businesses[42][46]. Customer retention evidence includes the platform's $9 ROI for every $1 invested in Billing services, demonstrating sustained value realization driving continued adoption[47].

Competitive Wins

Competitive displacement evidence shows success against specialized subscription platforms through operational simplicity and unified vendor management. Mid-market retailers complete integrations in 8 weeks using Stripe's REST API, while Shopify ecosystem integrations demonstrate 40% reduced integration workload compared to custom implementations[27][23].

Reference Customers

Reference customer diversity spans technology companies (Leonardo AI, Anthropic), global platforms (Deliveroo), and mid-market retailers, validating platform flexibility across different business models. Customer feedback identifies specific strengths in payment failure recovery and global compliance automation, while noting limitations in advanced subscription analytics requiring supplementary tools for data-intensive use cases[56].

AI Technology

Stripe Billing's AI-powered architecture centers on the Payments Foundation Model, a machine learning system trained on tens of billions of global transactions to optimize subscription revenue performance and payment processing efficiency[39]. The platform's Smart Retries system represents production-ready AI capability, analyzing 500+ customer attributes—including behavioral patterns, seasonality trends, payment history, and transaction context—to predict optimal retry timing for failed subscription payments with documented 40% recovery rates versus typical industry averages[47][51].

Architecture

Architecture scalability supports enterprise-grade implementations through API-first design enabling rapid integration with existing ecommerce platforms. The platform demonstrates particular strength within the Shopify ecosystem where prebuilt connectors reduce integration workload by 40% compared to custom implementations[23]. Technical infrastructure includes automated tax compliance across 60+ countries, usage-based billing analytics, and real-time subscription lifecycle tracking integrated with Stripe's global payment processing network[51][54].

Primary Competitors

Primary competitive landscape positions Stripe Billing against specialized subscription platforms like Zuora and Recurly, payment-focused solutions with billing add-ons, and comprehensive business platforms with subscription modules.

Competitive Advantages

Competitive advantages center on payment method diversity and global processing capabilities compared to subscription-focused competitors. 189 currency support and integrated payment processing provide operational advantages for international ecommerce businesses, while API-first architecture enables faster integration with existing platforms, particularly within the Shopify ecosystem where prebuilt connectors accelerate deployment[51][23]. Smart Retries AI capabilities demonstrate superior performance to rule-based alternatives with documented 40% recovery rates versus typical industry averages[51].

Market Positioning

Market positioning emphasizes operational simplicity and faster implementation timelines versus specialized feature depth. Customer evidence shows mid-market retailers completing integrations in 8 weeks versus enterprise implementations requiring 12-24 months for complex requirements, indicating clear positioning for organizations prioritizing speed over specialized capabilities[27][30].

Win/Loss Scenarios

Win/loss scenarios favor Stripe when unified payment and subscription management provides operational advantages, particularly for businesses prioritizing rapid deployment and global payment processing. Technology companies and digital product businesses demonstrate consistent success with Stripe's approach. Alternative consideration applies when advanced revenue recognition, complex subscription modifications, or sophisticated analytics requirements exceed Stripe's native capabilities, where enterprises with existing payment processors may achieve better economics through specialized subscription platforms[50].

Key Features

Pros & Cons

Use Cases

Integrations

Pricing

Featured In Articles

Comprehensive analysis of Subscription Analytics for Ecommerce for Ecommerce businesses and online retailers. Expert evaluation of features, pricing, and implementation.

How We Researched This Guide

About This Guide: This comprehensive analysis is based on extensive competitive intelligence and real-world implementation data from leading AI vendors. StayModern updates this guide quarterly to reflect market developments and vendor performance changes.

56+ verified sources per analysis including official documentation, customer reviews, analyst reports, and industry publications.

- • Vendor documentation & whitepapers

- • Customer testimonials & case studies

- • Third-party analyst assessments

- • Industry benchmarking reports

Standardized assessment framework across 8 key dimensions for objective comparison.

- • Technology capabilities & architecture

- • Market position & customer evidence

- • Implementation experience & support

- • Pricing value & competitive position

Research is refreshed every 90 days to capture market changes and new vendor capabilities.

- • New product releases & features

- • Market positioning changes

- • Customer feedback integration

- • Competitive landscape shifts

Every claim is source-linked with direct citations to original materials for verification.

- • Clickable citation links

- • Original source attribution

- • Date stamps for currency

- • Quality score validation

Analysis follows systematic research protocols with consistent evaluation frameworks.

- • Standardized assessment criteria

- • Multi-source verification process

- • Consistent evaluation methodology

- • Quality assurance protocols

Buyer-focused analysis with transparent methodology and factual accuracy commitment.

- • Objective comparative analysis

- • Transparent research methodology

- • Factual accuracy commitment

- • Continuous quality improvement

Quality Commitment: If you find any inaccuracies in our analysis on this page, please contact us at research@staymodern.ai. We're committed to maintaining the highest standards of research integrity and will investigate and correct any issues promptly.