Alternatives to Omnia Dynamic Pricing

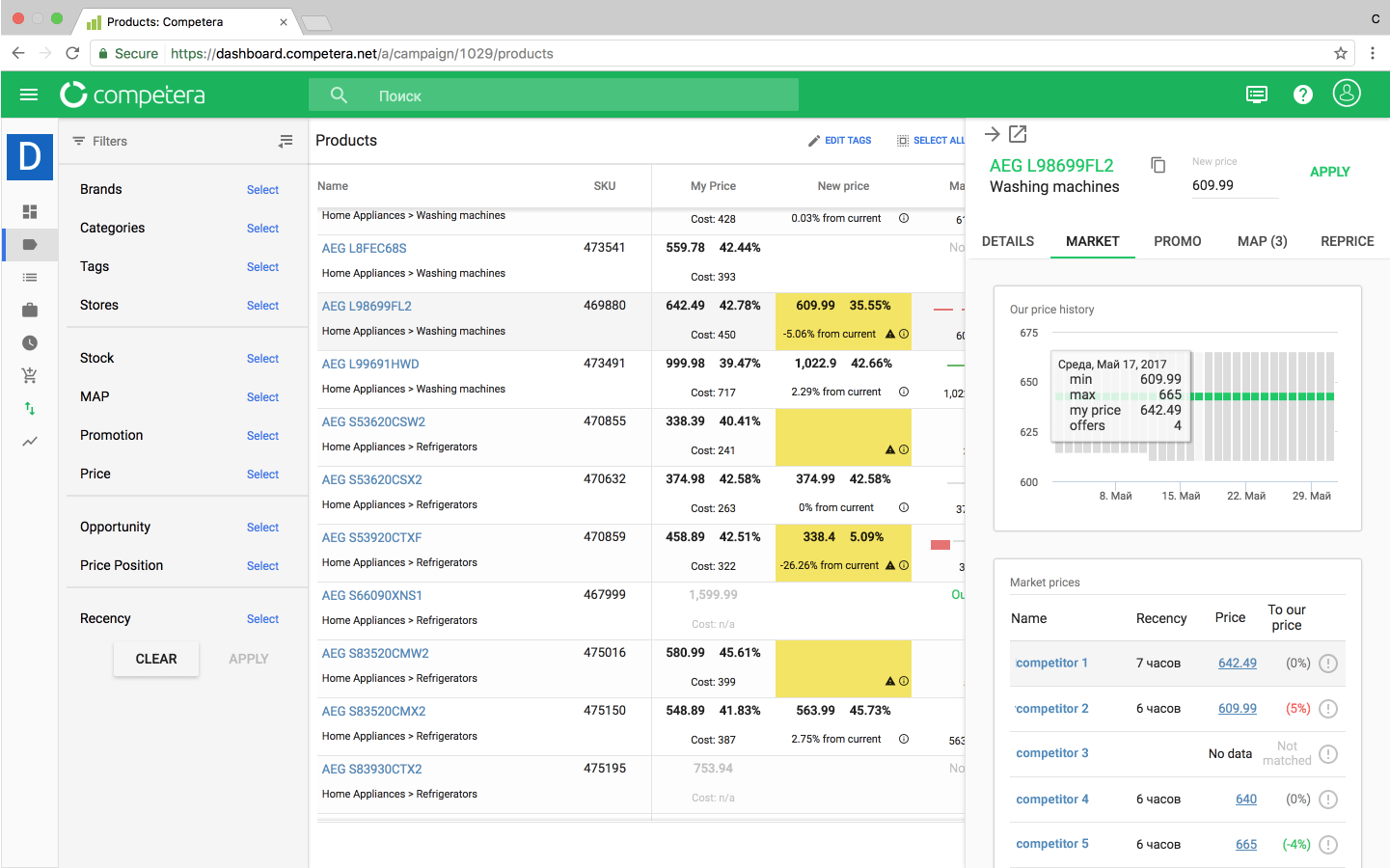

1. Competera

+Pros

- Sophisticated AI capabilities

- Real-time competitive intelligence

- Demand-centric pricing models

-Cons

- Implementation complexity

- Resource requirements for successful deployment

One highlighted feature and why it's amazing

Analyzes over 20 pricing and non-pricing factors to generate SKU-level price recommendations.

Another highlighted feature of why it’s amazing

Links substitute and complementary products to understand how pricing changes in one category affect demand across related products.

2. InformedRepricer

+Pros

- Marketplace-Specific Optimization .

- Automated Profit Protection .

- Rapid Initial Setup .

- API Integration Capabilities .

-Cons

- Walmart Performance Constraints .

- Implementation Reality Gaps .

- Limited Channel Coverage .

- Evidence Validation Challenges.

One highlighted feature and why it's amazing

Combines Buy Box competition analysis, inventory level monitoring, and competitor pricing intelligence to automate price adjustments specifically for marketplace dynamics .

Another highlighted feature of why it’s amazing

Automatically calculates minimum and maximum price boundaries using integrated cost and fee data .

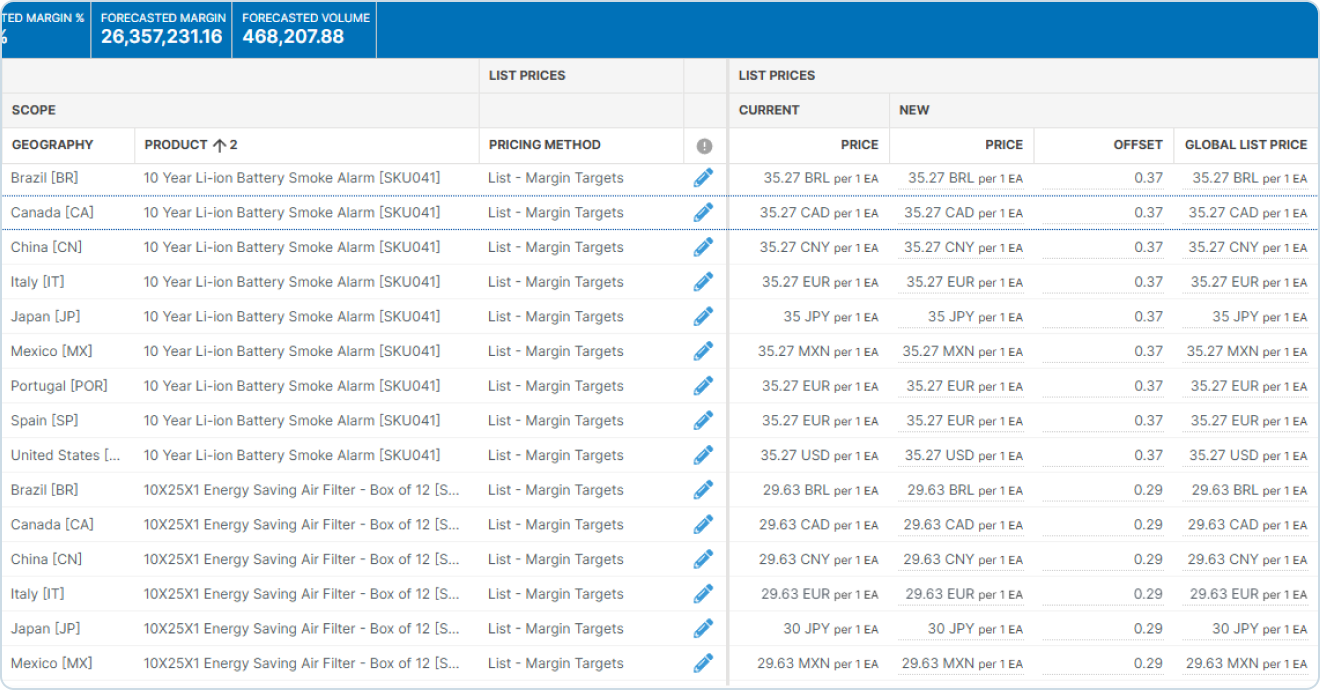

3. PROS Pricing

+Pros

- The platform's ability to process over 400 million daily price calculations with 90%+ prediction accuracy.

- AI Transparency Leadership: Unlike 'black box' AI solutions, PROS Pricing provides visual dashboards displaying model performance metrics, prediction confidence levels, and decision logic.

- Enterprise Integration Excellence: Comprehensive ERP integration capabilities with major platforms like SAP S/4HANA enable seamless data flow between pricing optimization and core business systems.

-Cons

- The platform requires 12-16 week deployment timelines with 4-10 weeks for data migration.

- Implementation costs of $50K-$300K plus annual maintenance of 15-20% of license fees.

- Sales team adoption resistance occurs in B2B implementations where commission structures aren't realigned with new pricing workflows.

One highlighted feature and why it's amazing

The platform's neural networks process over 400 million daily price calculations with 90%+ prediction accuracy, enabling continuous price optimization based on market conditions, competitor actions, and demand patterns.

Another highlighted feature of why it’s amazing

PROS Pricing provides seamless integration with Shopify and Magento APIs for dynamic repricing, enabling synchronized pricing across multiple channels.

Other Alternatives

Quicklizard

SuperAGI Font Tools

Wiser Dynamic Pricing

How We Researched This Guide

About This Guide: This comprehensive analysis is based on extensive competitive intelligence and real-world implementation data from leading AI vendors. StayModern updates this guide quarterly to reflect market developments and vendor performance changes.

187+ verified sources per analysis including official documentation, customer reviews, analyst reports, and industry publications.

- • Vendor documentation & whitepapers

- • Customer testimonials & case studies

- • Third-party analyst assessments

- • Industry benchmarking reports

Standardized assessment framework across 8 key dimensions for objective comparison.

- • Technology capabilities & architecture

- • Market position & customer evidence

- • Implementation experience & support

- • Pricing value & competitive position

Research is refreshed every 90 days to capture market changes and new vendor capabilities.

- • New product releases & features

- • Market positioning changes

- • Customer feedback integration

- • Competitive landscape shifts

Every claim is source-linked with direct citations to original materials for verification.

- • Clickable citation links

- • Original source attribution

- • Date stamps for currency

- • Quality score validation

Analysis follows systematic research protocols with consistent evaluation frameworks.

- • Standardized assessment criteria

- • Multi-source verification process

- • Consistent evaluation methodology

- • Quality assurance protocols

Buyer-focused analysis with transparent methodology and factual accuracy commitment.

- • Objective comparative analysis

- • Transparent research methodology

- • Factual accuracy commitment

- • Continuous quality improvement

Quality Commitment: If you find any inaccuracies in our analysis on this page, please contact us at research@staymodern.ai. We're committed to maintaining the highest standards of research integrity and will investigate and correct any issues promptly.