Alternatives to Bloomreach

1. Adobe Analytics (Experience Cloud)

+Pros

- Advanced attribution modeling capabilities with 9+ customizable attribution models.

- Adobe Sensei AI integration delivers anomaly detection, propensity scoring, and algorithmic attribution.

- Ecosystem integration advantages create unified customer data workflows within the Adobe Experience Cloud.

-Cons

- Implementation complexity requires substantial technical resources and extended deployment timelines.

- Mixed AI performance reveals 8% higher engagement but 9% lower conversion rates compared to non-AI traffic.

- Cost barriers include pricing ranging from $48,000 to over $350,000 annually.

One highlighted feature and why it's amazing

Adobe Analytics offers 9+ customizable attribution models compared to Google Analytics 4's 6 fixed options.

Another highlighted feature of why it’s amazing

Provides anomaly detection, propensity scoring, and algorithmic attribution capabilities.

2. Amplitude

+Pros

- Sophisticated behavioral analytics capabilities that outperform traditional rule-based approaches .

- Real-time experimentation features deploy changes through feature flags without developer dependency .

- Documented customer success with conversion improvements ranging from 9-46% .

-Cons

- Significant implementation complexity requiring dedicated technical teams .

- Non-technical users frequently describe chart customization as challenging .

- Minimum annual commitments exceeding $50,000 for advanced features .

One highlighted feature and why it's amazing

Amplitude's core product capabilities center on behavioral event tracking combined with AI-driven predictive analytics, creating a comprehensive platform for customer journey optimization .

Another highlighted feature of why it’s amazing

AI automation features represent a significant differentiator, designed to detect friction points, run experiments, and deploy optimization solutions with reduced manual intervention .

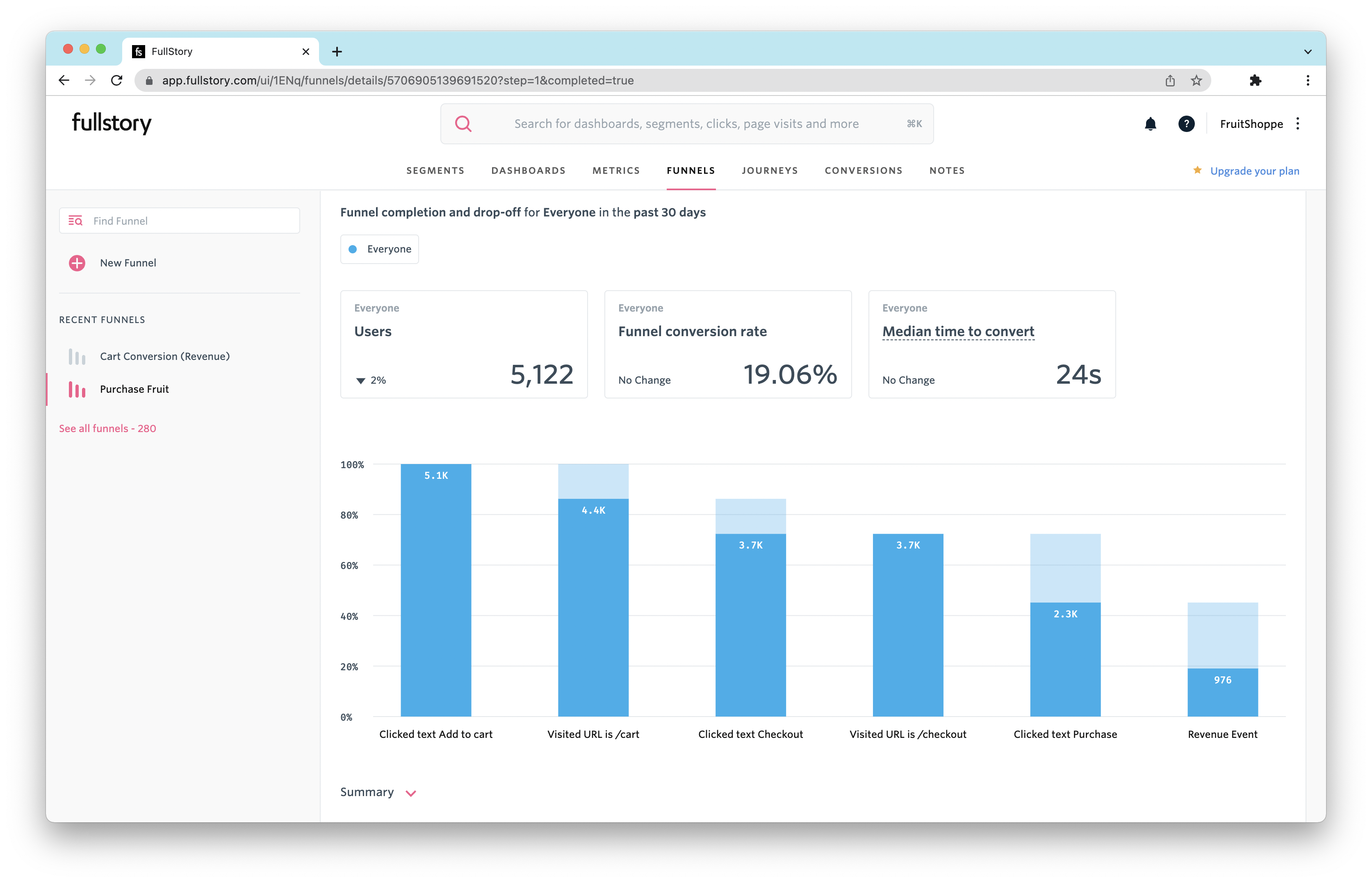

3. FullStory

+Pros

- Superior session replay quality

- AI-powered friction scoring

- Autocapture technology

-Cons

- Batch processing approach creating latency

- Mobile SDK constraints requiring custom event mapping

- Lack of native inventory forecasting capabilities

One highlighted feature and why it's amazing

Leverages Google's Gemini LLM to automate previously manual analysis tasks and reduce multi-session analysis time from hours to minutes.

Another highlighted feature of why it’s amazing

Eliminates manual event tagging requirements by automatically capturing user interactions across web and mobile properties, significantly reducing ongoing maintenance compared to manual tagging approaches.

Other Alternatives

Google Analytics 4

Heap

Hotjar AI Pro

Mixpanel

Segment

How We Researched This Guide

About This Guide: This comprehensive analysis is based on extensive competitive intelligence and real-world implementation data from leading AI vendors. StayModern updates this guide quarterly to reflect market developments and vendor performance changes.

227+ verified sources per analysis including official documentation, customer reviews, analyst reports, and industry publications.

- • Vendor documentation & whitepapers

- • Customer testimonials & case studies

- • Third-party analyst assessments

- • Industry benchmarking reports

Standardized assessment framework across 8 key dimensions for objective comparison.

- • Technology capabilities & architecture

- • Market position & customer evidence

- • Implementation experience & support

- • Pricing value & competitive position

Research is refreshed every 90 days to capture market changes and new vendor capabilities.

- • New product releases & features

- • Market positioning changes

- • Customer feedback integration

- • Competitive landscape shifts

Every claim is source-linked with direct citations to original materials for verification.

- • Clickable citation links

- • Original source attribution

- • Date stamps for currency

- • Quality score validation

Analysis follows systematic research protocols with consistent evaluation frameworks.

- • Standardized assessment criteria

- • Multi-source verification process

- • Consistent evaluation methodology

- • Quality assurance protocols

Buyer-focused analysis with transparent methodology and factual accuracy commitment.

- • Objective comparative analysis

- • Transparent research methodology

- • Factual accuracy commitment

- • Continuous quality improvement

Quality Commitment: If you find any inaccuracies in our analysis on this page, please contact us at research@staymodern.ai. We're committed to maintaining the highest standards of research integrity and will investigate and correct any issues promptly.