Alternatives to Albert

1. Criteo

+Pros

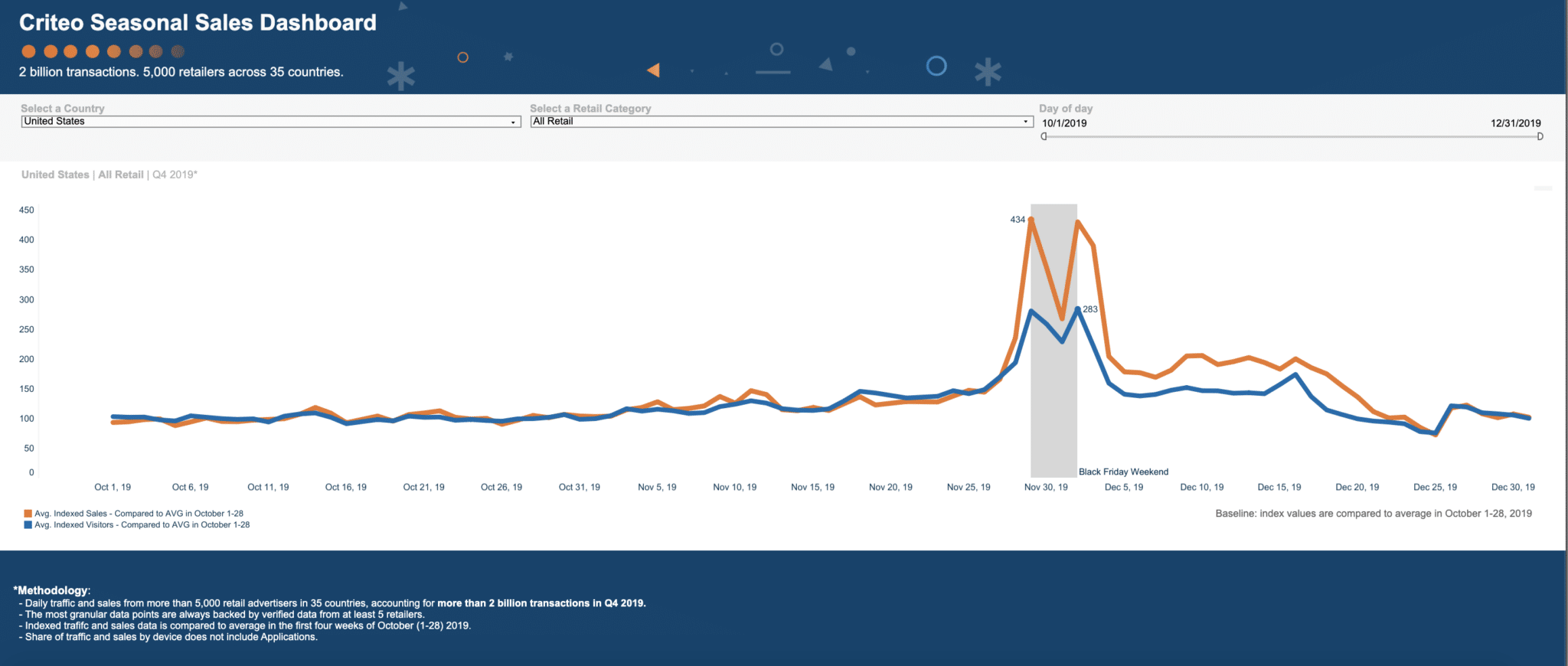

- Commerce-specific AI capabilities that process over $1 trillion in annual transaction data from 720 million daily active shoppers.

- DeepKNN vector database delivering over 10% click-through rate increases through behavioral embeddings.

- Proven customer success with premium retail brands achieving 1,000%+ purchase completion uplift and 60% year-over-year growth.

-Cons

- Technical complexity requiring 6-8 weeks for deployment versus 2 weeks for traditional tools.

- Minimum 10,000 user interactions needed for AI effectiveness, limiting accessibility for smaller retailers.

- Implementation challenges including API integration difficulties and 5+ business day requirements for campaign modifications.

One highlighted feature and why it's amazing

Powered by transaction-driven AI that processes over $1 trillion in annual commerce data.

Another highlighted feature of why it’s amazing

Enables behavioral embeddings and purchase grouping analysis, delivering over 10% click-through rate increases through sophisticated product-level targeting unavailable in general advertising tools.

2. Madgicx

+Pros

- Integrated Creative Workflow combining an Ad Library of 1M+ ads with AI-powered creative generation

- iOS Attribution Recovery through Madgicx Cloud Tracking

- Real-World Creative Intelligence using actual successful campaign examples

- Autonomous Optimization reducing manual oversight burden

-Cons

- Google Ads Functionality Gap providing only reporting capabilities

- Conversion Volume Dependency limiting effectiveness for businesses without sufficient monthly conversion data

- Platform Concentration Risk from exclusive Meta focus

- Implementation Complexity with setup challenges

- Budget Threshold Requirements suggesting $2,000-$5,000+ monthly ad spend minimums

One highlighted feature and why it's amazing

Conducts daily AI audits of ad accounts to automatically recommend optimizations and execute budget adjustments based on performance data .

Another highlighted feature of why it’s amazing

Integrates an Ad Library of 1M+ ads with AI-powered creative generation tools .

Other Alternatives

Optmyzr

Phrasee

Revealbot (birch)

Skai

How We Researched This Guide

About This Guide: This comprehensive analysis is based on extensive competitive intelligence and real-world implementation data from leading AI vendors. StayModern updates this guide quarterly to reflect market developments and vendor performance changes.

288+ verified sources per analysis including official documentation, customer reviews, analyst reports, and industry publications.

- • Vendor documentation & whitepapers

- • Customer testimonials & case studies

- • Third-party analyst assessments

- • Industry benchmarking reports

Standardized assessment framework across 8 key dimensions for objective comparison.

- • Technology capabilities & architecture

- • Market position & customer evidence

- • Implementation experience & support

- • Pricing value & competitive position

Research is refreshed every 90 days to capture market changes and new vendor capabilities.

- • New product releases & features

- • Market positioning changes

- • Customer feedback integration

- • Competitive landscape shifts

Every claim is source-linked with direct citations to original materials for verification.

- • Clickable citation links

- • Original source attribution

- • Date stamps for currency

- • Quality score validation

Analysis follows systematic research protocols with consistent evaluation frameworks.

- • Standardized assessment criteria

- • Multi-source verification process

- • Consistent evaluation methodology

- • Quality assurance protocols

Buyer-focused analysis with transparent methodology and factual accuracy commitment.

- • Objective comparative analysis

- • Transparent research methodology

- • Factual accuracy commitment

- • Continuous quality improvement

Quality Commitment: If you find any inaccuracies in our analysis on this page, please contact us at research@staymodern.ai. We're committed to maintaining the highest standards of research integrity and will investigate and correct any issues promptly.