Twilio Segment: Complete Buyer's Guide

Enterprise customer data platform with AI-powered SMS marketing

Twilio Segment is an enterprise customer data platform (CDP) with integrated AI-powered SMS marketing capabilities, specifically designed for large ecommerce businesses requiring comprehensive customer data unification alongside sophisticated messaging automation.

Market Position & Maturity

Market Standing

Segment maintains a strong enterprise market position with notable clients including Instacart, FOX, Adevinta, and Bonobos, validating its capability to serve high-scale, complex customer data requirements[35][47][48][50].

Company Maturity

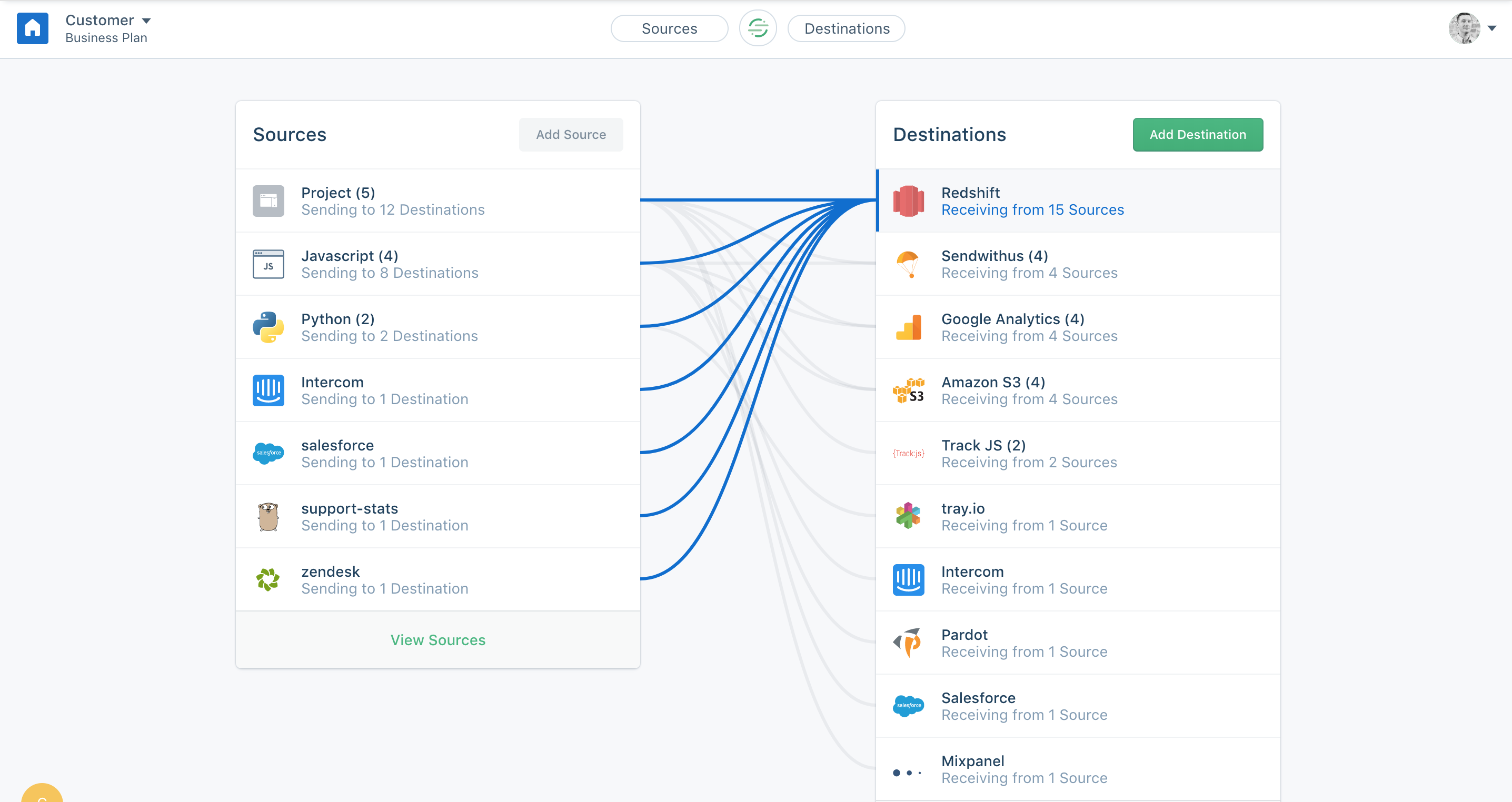

The company demonstrates operational maturity through its comprehensive integration ecosystem supporting 450+ destinations including major data warehouses and marketing platforms[35][46].

Growth Trajectory

Segment's enterprise focus is reflected in its pricing structure, with Business tier starting at $25,000/year, indicating substantial feature depth beyond basic CDP functionality[43].

Industry Recognition

Segment's market positioning emphasizes comprehensive data integration over SMS-specific optimization, creating distinct competitive advantages for organizations with complex, multi-channel customer journeys[35][46].

Longevity Assessment

The platform's technical maturity is evidenced by successful enterprise implementations achieving measurable business outcomes: Adevinta's €190K/year cost savings, Instacart's 40% faster analytics deployment, and Bonobos' 3x offline conversion improvements[47][48][50].

Proof of Capabilities

Customer Evidence

Instacart achieved 40% faster analytics deployment using Segment's unified data architecture, enabling the grocery delivery platform to unify cross-channel data from web, mobile, Zendesk, and SendGrid into centralized customer profiles[47].

Quantified Outcomes

Adevinta delivered a 12% ROI increase and saved €190K/year in marketing costs through Segment's AI-driven real-time audience segmentation and suppression lists[48].

Case Study Analysis

Bonobos leveraged Segment's predictive models to achieve 3x offline conversions by correlating online campaigns with offline purchases through Facebook POS integration[50].

Market Validation

FOX implemented Segment for comprehensive customer data management across their digital properties, demonstrating the platform's scalability for high-volume, multi-brand media operations[35].

Reference Customers

Enterprise implementations consistently demonstrate Segment's ability to handle complex, multi-channel data requirements while delivering measurable business outcomes.

AI Technology

Segment's technical foundation centers on binary classification models with decision trees that generate predictive scores for customer events like purchases or churn, positioning the platform as an enterprise-grade solution for complex customer behavior forecasting[36][38].

Architecture

The platform's unified CDP architecture connects SMS with 450+ destinations including data warehouses, enabling comprehensive customer journey orchestration beyond isolated messaging campaigns[35][46].

Primary Competitors

Competitors like Postscript focus on Shopify-centric deployment, while Segment provides broader platform integration supporting 450+ destinations[35][46].

Competitive Advantages

Segment's natural-language audience creation through generative AI provides advantages over data governance-focused competitors like mParticle[49].

Market Positioning

Segment's competitive positioning emphasizes comprehensive data integration over SMS-specific optimization, creating distinct advantages for enterprises with complex, multi-channel customer journeys[35][46].

Win/Loss Scenarios

Segment wins against alternatives when organizations require comprehensive customer data strategy beyond SMS marketing, but loses when buyers prioritize rapid deployment, single-platform focus, or specialized SMS features like geofencing that Segment doesn't offer natively[39][41][43].

Key Features

Pros & Cons

Use Cases

Integrations

Pricing

Featured In Articles

Comprehensive analysis of SMS Marketing for Ecommerce for Ecommerce businesses and online retailers. Expert evaluation of features, pricing, and implementation.

How We Researched This Guide

About This Guide: This comprehensive analysis is based on extensive competitive intelligence and real-world implementation data from leading AI vendors. StayModern updates this guide quarterly to reflect market developments and vendor performance changes.

53+ verified sources per analysis including official documentation, customer reviews, analyst reports, and industry publications.

- • Vendor documentation & whitepapers

- • Customer testimonials & case studies

- • Third-party analyst assessments

- • Industry benchmarking reports

Standardized assessment framework across 8 key dimensions for objective comparison.

- • Technology capabilities & architecture

- • Market position & customer evidence

- • Implementation experience & support

- • Pricing value & competitive position

Research is refreshed every 90 days to capture market changes and new vendor capabilities.

- • New product releases & features

- • Market positioning changes

- • Customer feedback integration

- • Competitive landscape shifts

Every claim is source-linked with direct citations to original materials for verification.

- • Clickable citation links

- • Original source attribution

- • Date stamps for currency

- • Quality score validation

Analysis follows systematic research protocols with consistent evaluation frameworks.

- • Standardized assessment criteria

- • Multi-source verification process

- • Consistent evaluation methodology

- • Quality assurance protocols

Buyer-focused analysis with transparent methodology and factual accuracy commitment.

- • Objective comparative analysis

- • Transparent research methodology

- • Factual accuracy commitment

- • Continuous quality improvement

Quality Commitment: If you find any inaccuracies in our analysis on this page, please contact us at research@staymodern.ai. We're committed to maintaining the highest standards of research integrity and will investigate and correct any issues promptly.