TaxJar: Complete Buyer's Guide

Marketplace-focused tax automation specialist

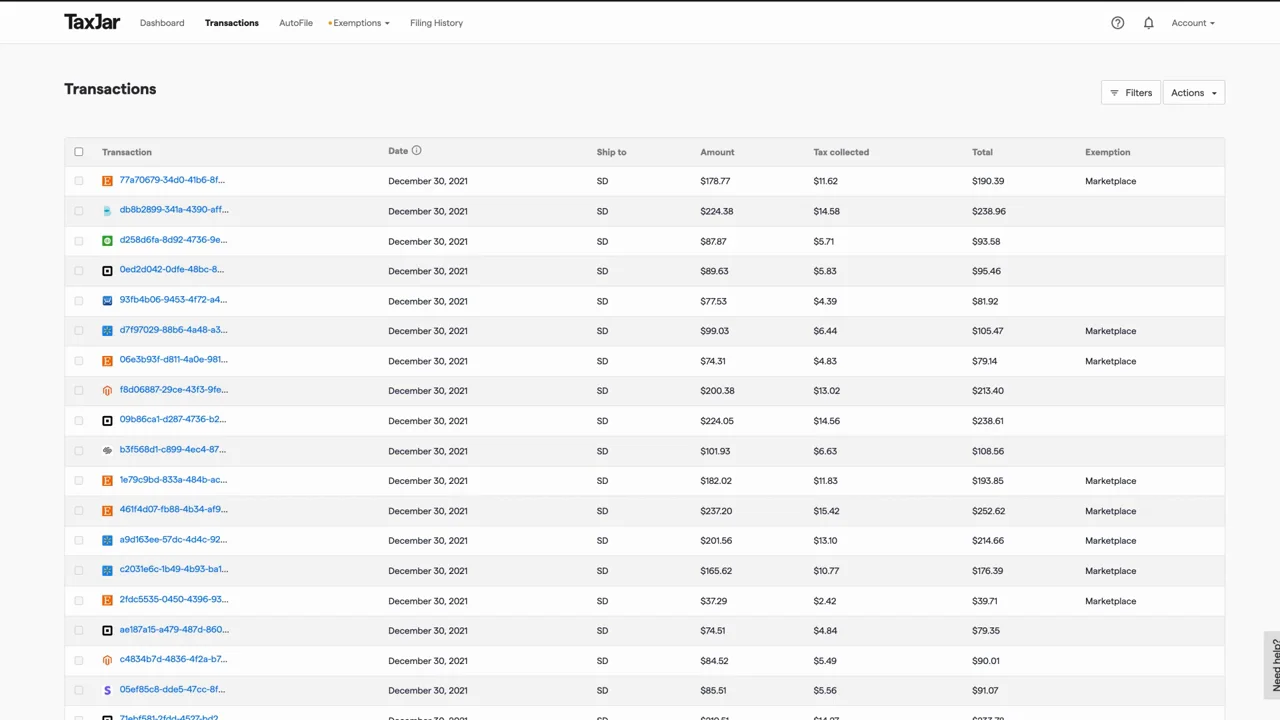

TaxJar is a specialized ecommerce tax compliance platform that automates sales tax management for online retailers and marketplace sellers through AI-powered automation and marketplace tax aggregation capabilities.

Market Position & Maturity

Market Standing

TaxJar holds the number-two mid-market share position after Avalara in the ecommerce tax compliance market, though specific benchmark methodology requires validation[64][67].

Company Maturity

The company demonstrates strong market maturity through its acquisition by Stripe, providing financial stability and strategic backing from a major fintech platform[10].

Growth Trajectory

The platform shows consistent growth trajectory through documented customer success stories across diverse industries including direct-to-consumer brands (45%), marketplace sellers (30%), and SaaS companies (25%)[57][64].

Industry Recognition

Industry recognition includes validation through customer case studies and documented ROI achievements, though specific analyst recognition or awards require additional verification[56][64].

Strategic Partnerships

Strategic partnerships enhance market position, particularly the Stripe integration that creates unified payment and tax processing capabilities[49][60].

Longevity Assessment

The focused approach appears sustainable given the large addressable market in U.S. ecommerce tax compliance[64][67].

Proof of Capabilities

Customer Evidence

Plant Therapy achieved 40 hours monthly savings through TaxJar's automation, reallocating staff from manual compliance to strategic initiatives[57].

Quantified Outcomes

TrendSetters documented an 80% reduction in tax management time through AutoFile and Nexus Insights features[64].

Case Study Analysis

Every Man Jack reduced compliance effort by 90% post-implementation, noting seamless integration with existing systems[62].

Market Validation

Quantified market validation shows TaxJar serving 68% small to mid-market businesses with $1-5M annual revenue, indicating successful market penetration in the target segment[64][66].

Competitive Wins

Global Value Commerce implemented TaxJar despite complex multi-channel operations, with CFO Mark Larson reporting: 'We now handle 5x sales volume without added staff'[62].

Reference Customers

Tech Titans achieved a 60% reduction in fines through TaxJar's compliance automation[64].

AI Technology

TaxJar's technical foundation centers on Emmet, an AI engine that automates product tax categorization and provides real-time taxability recommendations with greater than 90% accuracy[56][61].

Architecture

The platform's API-first architecture enables rapid deployment, with documented 3-week migration timelines compared to competitors' 10-week averages[64].

Primary Competitors

Primary competitors include Avalara (market leader with 1,200+ pre-built integrations), Sovos (global VAT specialist with 200+ country coverage), and Vertex (omnichannel retail focus)[9][11][12][22][26][28][50][51][54].

Competitive Advantages

Competitive advantages center on marketplace tax aggregation, offering consolidated reporting for Amazon, Walmart, and Etsy versus Avalara's channel-specific modules[60][64].

Market Positioning

TaxJar holds number-two mid-market share after Avalara, though specific benchmark methodology requires validation[64][67].

Win/Loss Scenarios

Win scenarios favor TaxJar for marketplace sellers requiring consolidated reporting, subscription businesses needing recurring billing compliance, and SMBs seeking rapid deployment with 3-week implementation timelines[46][58][60][64]. Loss scenarios occur when businesses require global VAT automation, extensive B2B exemption management, or native support for specialized marketplaces like NewEgg and Wish[50][51][54][60][63][67][70].

Key Features

Pros & Cons

Use Cases

Integrations

Pricing

Featured In Articles

Comprehensive analysis of Tax Compliance for Ecommerce for Ecommerce businesses and online retailers. Expert evaluation of features, pricing, and implementation.

How We Researched This Guide

About This Guide: This comprehensive analysis is based on extensive competitive intelligence and real-world implementation data from leading AI vendors. StayModern updates this guide quarterly to reflect market developments and vendor performance changes.

71+ verified sources per analysis including official documentation, customer reviews, analyst reports, and industry publications.

- • Vendor documentation & whitepapers

- • Customer testimonials & case studies

- • Third-party analyst assessments

- • Industry benchmarking reports

Standardized assessment framework across 8 key dimensions for objective comparison.

- • Technology capabilities & architecture

- • Market position & customer evidence

- • Implementation experience & support

- • Pricing value & competitive position

Research is refreshed every 90 days to capture market changes and new vendor capabilities.

- • New product releases & features

- • Market positioning changes

- • Customer feedback integration

- • Competitive landscape shifts

Every claim is source-linked with direct citations to original materials for verification.

- • Clickable citation links

- • Original source attribution

- • Date stamps for currency

- • Quality score validation

Analysis follows systematic research protocols with consistent evaluation frameworks.

- • Standardized assessment criteria

- • Multi-source verification process

- • Consistent evaluation methodology

- • Quality assurance protocols

Buyer-focused analysis with transparent methodology and factual accuracy commitment.

- • Objective comparative analysis

- • Transparent research methodology

- • Factual accuracy commitment

- • Continuous quality improvement

Quality Commitment: If you find any inaccuracies in our analysis on this page, please contact us at research@staymodern.ai. We're committed to maintaining the highest standards of research integrity and will investigate and correct any issues promptly.