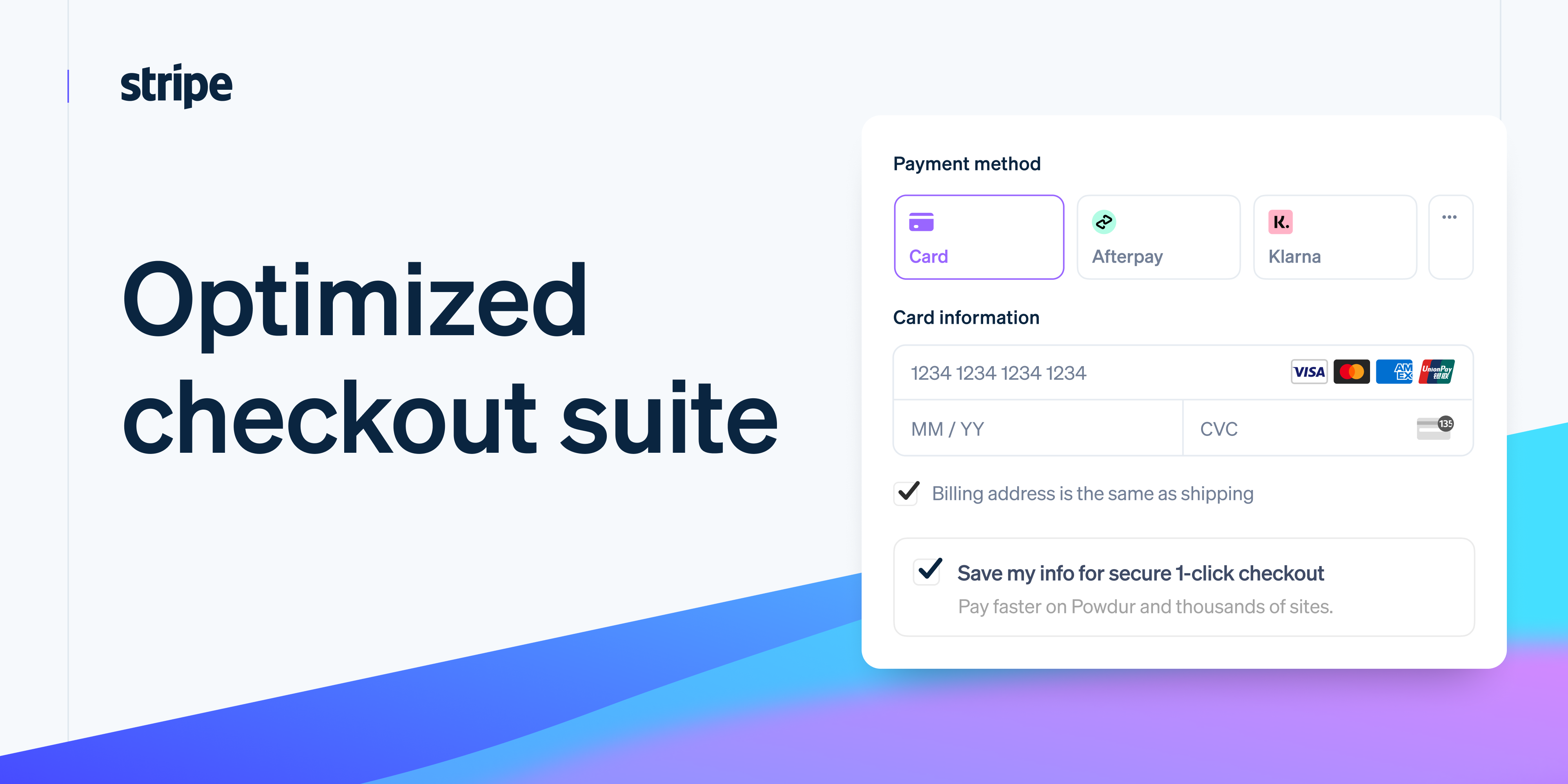

Stripe Optimized Checkout Suite: Complete Buyer's Guide

AI-powered checkout optimization platform

Stripe Optimized Checkout Suite is an AI-powered checkout optimization platform that leverages machine learning models trained on billions of transactions to dynamically personalize payment flows for enterprise-scale ecommerce operations. The suite positions itself as a comprehensive solution that goes beyond traditional payment processing by using 100+ real-time signals to intelligently prioritize payment methods, reduce checkout friction, and increase conversion rates[52][58].

Market Position & Maturity

Market Standing

Stripe Optimized Checkout Suite occupies a leadership position in the enterprise AI checkout optimization market, competing directly against established players like Adyen Uplift and Bolt's Checkout 2.0 for high-volume retailer deployments[18][19][20].

Company Maturity

Stripe's global payment processing infrastructure supports 100+ payment methods across multiple regions, with established partnerships enabling local payment method integration in markets including France (Cartes Bancaires), Thailand (PromptPay), and Sweden (Swish)[49][51].

Strategic Partnerships

Strategic partnerships and ecosystem positioning strengthen Stripe's market position through comprehensive payment method support and regional market access[49][51].

Longevity Assessment

Long-term viability assessment suggests strong market position sustainability through network effects and data advantages. Stripe's access to billions of transactions creates AI model training advantages that smaller competitors cannot easily replicate, while the platform's integrated approach to payment processing and optimization creates switching cost barriers that support customer retention[38][57][58].

Proof of Capabilities

Customer Evidence

Thinkific achieved a 36% increase in average order value after implementing Stripe's AI-powered buy-now-pay-later option prioritization[49].

Quantified Outcomes

Enterprise retail implementations consistently demonstrate fraud reduction capabilities, with multiple clients reporting 30% reduction in false-positive fraud flags while maintaining security standards[55][58].

Market Validation

Market adoption evidence includes documented implementations across multiple verticals, though specific customer attribution remains limited in available research[49][51][55][58].

Competitive Wins

Competitive validation emerges through direct performance comparisons. While Adyen Uplift increases transaction success rates by up to 6% and Bolt's Checkout 2.0 leverages 80M+ shopper recognition[18][20], Stripe's integrated approach delivers 12% revenue increases and 7.4% higher conversion rates through comprehensive payment optimization[19].

AI Technology

Stripe Optimized Checkout Suite's technical foundation centers on its Payments Foundation Model, a machine learning system trained on billions of transactions across Stripe's global network to enable intelligent payment optimization[57][58].

Architecture

The platform's AI architecture processes 100+ real-time signals including device type, geographic location, transaction history, and network-wide payment success rates to dynamically personalize checkout experiences for individual customers[52][58].

Primary Competitors

Primary competitors include Adyen Uplift and Bolt's Checkout 2.0[18][19][20].

Competitive Advantages

Stripe's competitive advantages center on its unified platform architecture that eliminates the need for separate payment processing and optimization vendors, simplifying vendor management while providing comprehensive transaction handling capabilities[19][58].

Market Positioning

Market positioning strategy focuses on enterprise-scale deployments where comprehensive capabilities justify implementation complexity.

Win/Loss Scenarios

Stripe wins against competitors when organizations require comprehensive international payment method support, sophisticated fraud detection capabilities, and unified payment processing architecture. The platform loses when organizations prioritize rapid deployment, have limited technical resources, or require primarily domestic payment processing without complex fraud prevention needs.

Key Features

Pros & Cons

Use Cases

Integrations

Pricing

Featured In Articles

Comprehensive analysis of Checkout Optimization for Ecommerce for Ecommerce businesses and online retailers. Expert evaluation of features, pricing, and implementation.

How We Researched This Guide

About This Guide: This comprehensive analysis is based on extensive competitive intelligence and real-world implementation data from leading AI vendors. StayModern updates this guide quarterly to reflect market developments and vendor performance changes.

59+ verified sources per analysis including official documentation, customer reviews, analyst reports, and industry publications.

- • Vendor documentation & whitepapers

- • Customer testimonials & case studies

- • Third-party analyst assessments

- • Industry benchmarking reports

Standardized assessment framework across 8 key dimensions for objective comparison.

- • Technology capabilities & architecture

- • Market position & customer evidence

- • Implementation experience & support

- • Pricing value & competitive position

Research is refreshed every 90 days to capture market changes and new vendor capabilities.

- • New product releases & features

- • Market positioning changes

- • Customer feedback integration

- • Competitive landscape shifts

Every claim is source-linked with direct citations to original materials for verification.

- • Clickable citation links

- • Original source attribution

- • Date stamps for currency

- • Quality score validation

Analysis follows systematic research protocols with consistent evaluation frameworks.

- • Standardized assessment criteria

- • Multi-source verification process

- • Consistent evaluation methodology

- • Quality assurance protocols

Buyer-focused analysis with transparent methodology and factual accuracy commitment.

- • Objective comparative analysis

- • Transparent research methodology

- • Factual accuracy commitment

- • Continuous quality improvement

Quality Commitment: If you find any inaccuracies in our analysis on this page, please contact us at research@staymodern.ai. We're committed to maintaining the highest standards of research integrity and will investigate and correct any issues promptly.