Simon Data Customer Data Platform: Complete Buyer's Guide

Composable customer data platform for real-time marketing activation

Simon Data is a composable customer data platform engineered for real-time marketing activation within Snowflake environments, positioning itself as the solution for organizations seeking AI-powered personalization without traditional vendor lock-in complexities.

Market Position & Maturity

Market Standing

Simon Data has established leader status in G2's CDP Grid® for three consecutive quarters, demonstrating sustained market recognition and customer satisfaction relative to established competitors [133][138][148].

Company Maturity

Company maturity reflects focused market positioning within the composable CDP segment, serving primarily mid-market to enterprise retailers including notable customers like ASOS, BARK, Tecovas, and The Farmer's Dog [132][135][141].

Industry Recognition

Industry recognition includes consistent customer satisfaction metrics and retention patterns, with frequently praised support responsiveness in customer feedback [138][148].

Strategic Partnerships

Strategic partnerships with Snowflake and Anthropic provide critical technology foundation advantages, enabling warehouse-native AI processing through Snowflake Cortex AI integration and advanced language models via Claude AI capabilities [131][134][137].

Longevity Assessment

Long-term viability appears strong within the Snowflake ecosystem, though market expansion depends on broader cloud data warehouse adoption trends and continued Snowflake partnership alignment.

Proof of Capabilities

Customer Evidence

ASOS generated $77.5 million in incremental revenue through cross-channel personalization campaigns orchestrated via Simon Data's AI-powered journey capabilities [132]. The Farmer's Dog achieved 80 engineering hours/month in time savings while increasing email experimentation velocity by 10x through Simon's unified data workflows [135][141]. BARK delivered 97% year-over-year revenue per user lift through personalized lifecycle campaigns powered by Simon Data's AI capabilities [132][139].

Market Validation

Market validation includes G2 CDP Grid® leader status for three consecutive quarters, indicating sustained competitive performance and customer satisfaction relative to established alternatives [133][138][148].

AI Technology

Simon Data's Composable AI Agents represent a fundamental architectural innovation in customer data platform design, operating as warehouse-native intelligence that processes contextual customer signals without requiring data migration or traditional CDP infrastructure [131][134].

Architecture

Technical architecture centers on warehouse-native processing that preserves data ownership while enabling enterprise-scale personalization. Unlike traditional CDPs that require data replication, Simon Data operates directly within existing Snowflake environments, supporting 45+ destination integrations without vendor lock-in complexities [130][142].

Primary Competitors

Main alternatives include Treasure Data and Hightouch.

Competitive Advantages

Competitive advantages include Snowflake Cortex AI integration providing native machine learning capabilities, Anthropic's Claude models for advanced language processing, and sub-minute latency for real-time activation that outperforms traditional CDP batch processing approaches [130][131][134][142].

Market Positioning

Market differentiation centers on the composable architecture approach that addresses the 84% of CMOs citing fragmented data systems as their top AI implementation barrier [58].

Win/Loss Scenarios

Win scenarios favor Simon Data for organizations requiring immediate AI-powered personalization within existing Snowflake infrastructure, sophisticated predictive segmentation capabilities, and real-time campaign activation without vendor lock-in complexities.

Key Features

Pros & Cons

Use Cases

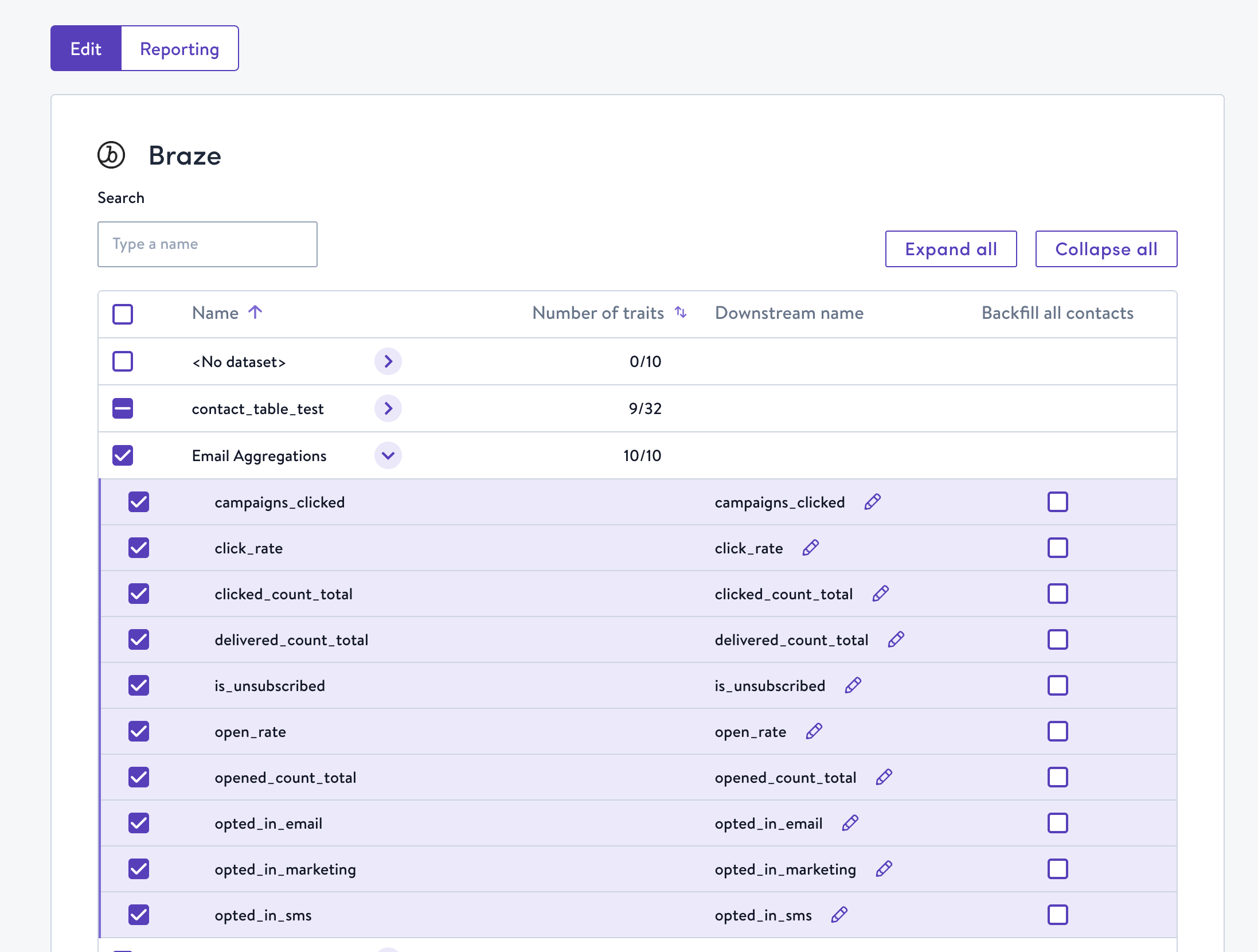

Integrations

Pricing

Featured In Articles

Comprehensive analysis of AI Brand Positioning for AI Marketing & Advertising for AI Marketing & Advertising professionals. Expert evaluation of features, pricing, and implementation.

How We Researched This Guide

About This Guide: This comprehensive analysis is based on extensive competitive intelligence and real-world implementation data from leading AI vendors. StayModern updates this guide quarterly to reflect market developments and vendor performance changes.

148+ verified sources per analysis including official documentation, customer reviews, analyst reports, and industry publications.

- • Vendor documentation & whitepapers

- • Customer testimonials & case studies

- • Third-party analyst assessments

- • Industry benchmarking reports

Standardized assessment framework across 8 key dimensions for objective comparison.

- • Technology capabilities & architecture

- • Market position & customer evidence

- • Implementation experience & support

- • Pricing value & competitive position

Research is refreshed every 90 days to capture market changes and new vendor capabilities.

- • New product releases & features

- • Market positioning changes

- • Customer feedback integration

- • Competitive landscape shifts

Every claim is source-linked with direct citations to original materials for verification.

- • Clickable citation links

- • Original source attribution

- • Date stamps for currency

- • Quality score validation

Analysis follows systematic research protocols with consistent evaluation frameworks.

- • Standardized assessment criteria

- • Multi-source verification process

- • Consistent evaluation methodology

- • Quality assurance protocols

Buyer-focused analysis with transparent methodology and factual accuracy commitment.

- • Objective comparative analysis

- • Transparent research methodology

- • Factual accuracy commitment

- • Continuous quality improvement

Quality Commitment: If you find any inaccuracies in our analysis on this page, please contact us at research@staymodern.ai. We're committed to maintaining the highest standards of research integrity and will investigate and correct any issues promptly.