SAP: Complete Buyer's Guide

Enterprise-grade solution for AI-driven sales forecasting

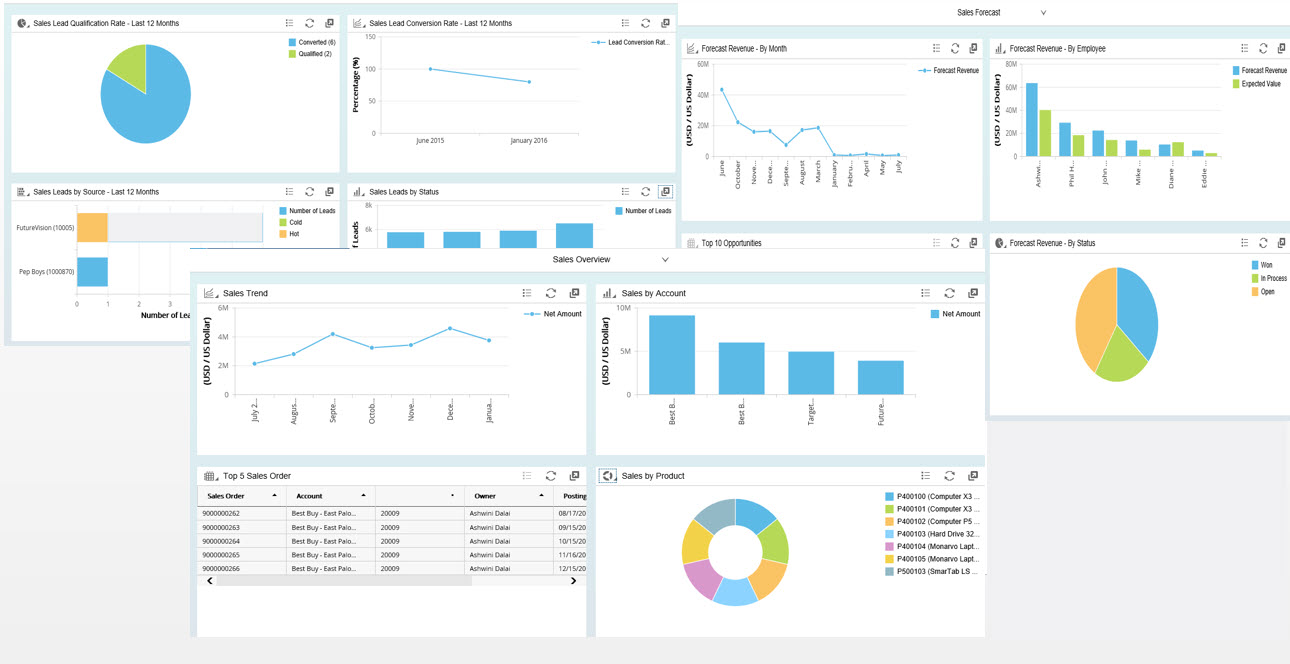

SAP's Integrated Business Planning (IBP) platform leverages machine learning and generative AI to address demand planning, inventory optimization, and sales operations—capabilities that appeal to ecommerce businesses managing complex global supply chains[40][46].

Market Position & Maturity

Market Standing

SAP maintains a dominant enterprise position in the ERP-integrated AI forecasting market, leveraging its established SAP ecosystem presence to deliver unified planning capabilities that standalone solutions cannot match.

Company Maturity

The company's market maturity is evidenced by its ability to handle complex, global enterprise deployments across multiple industries. Documented implementations span technology companies like Nvidia, consumer goods manufacturers, and food companies like Arla Foods, demonstrating operational scale and stability across diverse sectors[51][52][53].

Growth Trajectory

Growth trajectory shows continued investment in AI capabilities, with recent innovations including predictive forecasting in SAP Sales Cloud, AI-powered outlier correction in IBP, and generative AI tools through the SAP CX AI Toolkit[40][46]. The upcoming SAP Revenue Growth Management launching in Q3 2025 represents continued product development and market expansion efforts[48].

Industry Recognition

TrustRadius recognized SAP IBP with awards for Best Feature Set, Best Relationship, and Best Value for Price in 2023[54].

Strategic Partnerships

Strategic partnerships strengthen market position, particularly the DataRobot partnership that enhances IBP with advanced AI forecasting capabilities[55].

Longevity Assessment

Longevity assessment benefits from SAP's established enterprise software position and continued R&D investment in AI capabilities. The platform's integration with SAP's broader ecosystem provides stability for organizations already committed to SAP systems.

Proof of Capabilities

Customer Evidence

Nvidia's technology company transformation achieved over 10,000 annual productivity hours saved for planners and 4-day faster revenue target cycles by consolidating 12+ Excel-based planning models into a unified SAP IBP environment over 9-month deployment phases per business unit[53].

Quantified Outcomes

Quantified customer outcomes include a consumer goods manufacturer reducing forecast error (WMAPE) to 12%, representing 88% accuracy in production deployment[43]. Arla Foods implemented SAP IBP Demand Sensing to capture big data signals for short-term forecasting, achieving reduced scrap while improving customer service levels and inventory turnover[52].

Case Study Analysis

A CPG company achieved consensus planning across 7 global sales offices within 6 months, eliminating reactive demand adjustments through unified planning processes[51].

Market Validation

Market validation comes from TrustRadius recognition with awards for Best Feature Set, Best Relationship, and Best Value for Price in 2023[54].

Competitive Wins

Competitive wins demonstrate SAP's ability to consolidate complex planning environments. The Nvidia case study shows successful displacement of fragmented Excel-based systems with unified AI-driven planning, achieving both productivity gains and cycle time improvements[53].

Reference Customers

Reference customers span multiple industries including technology (Nvidia), consumer goods manufacturing, and food production (Arla Foods), demonstrating breadth of successful enterprise implementations[51][52][53].

AI Technology

SAP's AI technology foundation centers on machine learning algorithms for demand sensing, predictive analytics for sales forecasting, and generative AI for content creation and expert recommendations[40][46].

Architecture

Architecture and deployment leverage SAP's cloud-native infrastructure with tight ERP integration. The platform requires SAP Cloud Platform Integration for data synchronization, with implementations often requiring substantial data historization periods before go-live[44][51].

Primary Competitors

Main alternatives include Blue Yonder and Oracle.

Competitive Advantages

SAP's primary competitive advantage lies in its ERP-embedded AI capabilities for enterprises already using SAP systems, where native integration eliminates the middleware complexity that standalone solutions require[46][54].

Market Positioning

Market positioning shows SAP excelling in manufacturing and CPG environments with documented success stories, but ecommerce-specific case studies remain limited[51][52][53].

Win/Loss Scenarios

Win scenarios favor SAP when organizations require sophisticated supply chain planning, existing SAP system integration, unified enterprise planning capabilities, and complex global operations with multiple sales channels[46][53][54]. Loss scenarios occur when businesses prioritize rapid implementation, ecommerce-specific features, transparent pricing, or specialized online retail capabilities over comprehensive enterprise planning.

Key Features

Pros & Cons

Use Cases

Integrations

Featured In Articles

Comprehensive analysis of Sales Forecasting for Ecommerce for Ecommerce businesses and online retailers. Expert evaluation of features, pricing, and implementation.

How We Researched This Guide

About This Guide: This comprehensive analysis is based on extensive competitive intelligence and real-world implementation data from leading AI vendors. StayModern updates this guide quarterly to reflect market developments and vendor performance changes.

55+ verified sources per analysis including official documentation, customer reviews, analyst reports, and industry publications.

- • Vendor documentation & whitepapers

- • Customer testimonials & case studies

- • Third-party analyst assessments

- • Industry benchmarking reports

Standardized assessment framework across 8 key dimensions for objective comparison.

- • Technology capabilities & architecture

- • Market position & customer evidence

- • Implementation experience & support

- • Pricing value & competitive position

Research is refreshed every 90 days to capture market changes and new vendor capabilities.

- • New product releases & features

- • Market positioning changes

- • Customer feedback integration

- • Competitive landscape shifts

Every claim is source-linked with direct citations to original materials for verification.

- • Clickable citation links

- • Original source attribution

- • Date stamps for currency

- • Quality score validation

Analysis follows systematic research protocols with consistent evaluation frameworks.

- • Standardized assessment criteria

- • Multi-source verification process

- • Consistent evaluation methodology

- • Quality assurance protocols

Buyer-focused analysis with transparent methodology and factual accuracy commitment.

- • Objective comparative analysis

- • Transparent research methodology

- • Factual accuracy commitment

- • Continuous quality improvement

Quality Commitment: If you find any inaccuracies in our analysis on this page, please contact us at research@staymodern.ai. We're committed to maintaining the highest standards of research integrity and will investigate and correct any issues promptly.