LexisNexis PatentSight+: Complete Review

Transforming complex patent data into strategic business intelligence

LexisNexis PatentSight+ AI Capabilities & Performance Evidence

Core AI Functionality

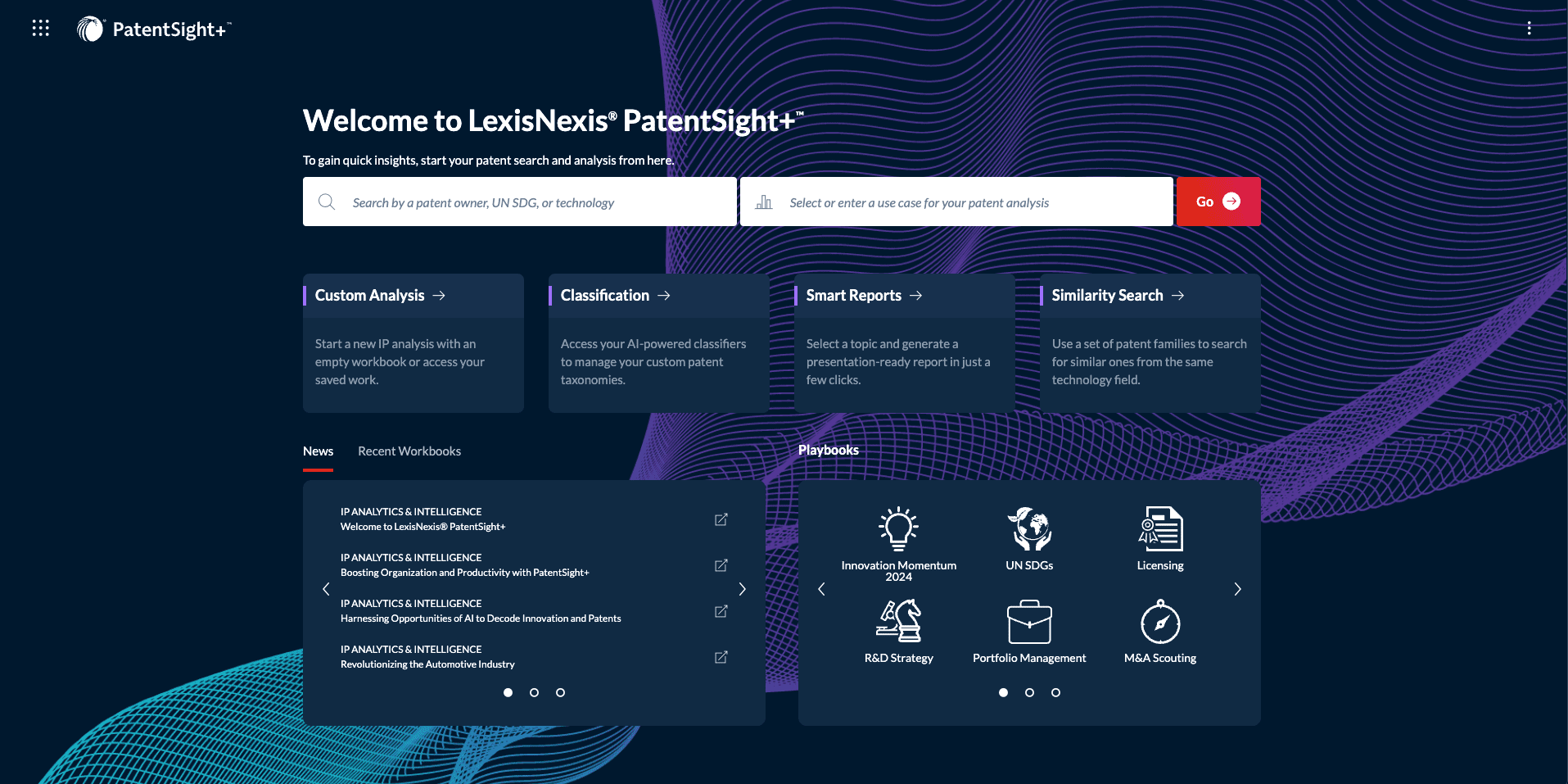

PatentSight+ incorporates TechDiscovery AI as an optional add-on, utilizing generative AI and machine learning algorithms to generate patent landscape overviews with minimal keyword input [48]. The solution supports both IP professionals and non-patent experts in discovering new spaces or counter-checking existing searches [48]. Quick Insights functionality expedites analysis through intuitive guided experiences, enabling users to input search queries focused on Owner, Technology Cluster, or SDG with readily populated selection sheets [48].

The platform's Patent Asset Index™ calculation derives from citation-based Technology Relevance™ and Market Coverage™ of patent families [47], providing systematic portfolio strength measurement. US Litigation Data integration elevates searches with litigation materials, providing access to US court cases and patent board materials related to chosen patent families [48].

Performance Validation Through Customer Evidence

The Siemens case study provides quantifiable performance validation, reporting a 47.2% IoT patent portfolio strength increase between 2016 and August 2020, representing what the company claims as the only market player showing clear average patent quality improvement [57][58]. However, baseline measurement methodology and calculation details for this improvement require verification for comprehensive assessment.

Han Santos PLLC demonstrates M&A due diligence efficiency, with the firm reporting $700 million in client acquisitions in 2021, which they attribute partly to PatentSight analysis capabilities [51]. The platform enables processing "huge volumes of patent data in short periods," supporting client guidance with data-driven insights during tight deadlines [51].

Competitive Positioning Analysis

PatentSight+ differentiates itself through published methodology transparency. As C.G. Moore from McBee Moore & Vanik IP emphasizes: "The difference here is that the methodology has been published and the base assumptions are known. Once I can explain that to in-house counsel and they can understand that enough to take it to their management, it's no longer a mystery" [50].

The platform's database maintains worldwide patent document coverage with weekly updates and 2-day lag [47], comparing favorably to competitors requiring longer update cycles. However, systematic competitive comparison across precision rates, database coverage, and feature depth requires additional verification against specific alternatives.

Use Case Strength Documentation

PatentSight+ demonstrates particular strength in M&A due diligence scenarios. McBee Moore & Vanik IP utilized the platform for comparative analysis identifying relative portfolio size over time, relative portfolio value, technology overlaps, patent filing pace, and technology relevance [50][52]. The methodology transparency enabled in-house counsel understanding sufficient for management presentation, eliminating mystery elements in IP valuation [50].

For portfolio strategy transformation, the Siemens implementation illustrates systematic quality-driven patent strategy development. Patent Asset Index™ provided objective measurement of global technological strength and innovation, supporting the transition from quantity-focused to value-driven IP strategy [57].

Customer Evidence & Implementation Reality

Customer Success Patterns

Documented customer implementations reveal consistent patterns of value delivery in specific use cases. Han Santos PLLC leverages PatentSight for M&A due diligence, enabling resource optimization where "we're able to get the raw data quickly so we can spend more time on the analysis and on giving value to the clients," according to Patent Analyst Richard Dodson [51]. This capability positioning enables the firm to transcend external advisor roles, becoming strategic partners in deal making and negotiations [51].

The McBee Moore & Vanik case study demonstrates IP due diligence value where Patent Asset Index™ scores showed exact value, size, and potential of portfolios, highlighting patent families protecting assets useful to acquiring companies [50]. Implementation results enabled decision-making where IP represented major assets, with the business making decisions not to proceed with unsuitable matches based on PatentSight analysis [52].

Implementation Experiences and Challenges

The Siemens transformation illustrates comprehensive implementation complexity, requiring a 4-year systematic approach with organizational change management [57][58]. This timeline suggests substantial resource commitment beyond software deployment, involving cross-functional coordination between legal, technical, and business teams.

Implementation success factors include patent analyst expertise and workflow integration with existing processes. Han Santos success depends on combining rapid data processing with human analytical capability, where technology enables faster path to insights rather than replacing human judgment [51].

Support Quality Assessment

Customer feedback indicates strong vendor relationship management. Han Santos measures success through repeat client business: "Clients don't say 'good job'—they just give you more work and continue to make use of you. The fact that we have a long stream of repeat work is really how we measure success" [51]. This pattern suggests sustained value delivery supporting ongoing client relationships.

Beat Weibel from Siemens emphasizes platform-organization fit: "PatentSight is quite a good match for Siemens. The tool came out of a university and has an academic objective, not just a commercial one" [58]. This academic foundation appeals to organizations prioritizing methodological rigor over purely commercial solutions.

Common Implementation Challenges

PatentSight delivery methods include API, FTP, or requested formats with stock-listed company mapping to financial identifiers [47]. Integration complexity may arise with legacy systems requiring custom development or data format conversion. The Siemens case study suggests multi-year implementation timelines requiring sustained organizational commitment [57][58].

Data quality assurance depends on specialized multilingual research teams and sophisticated legal status tracking systems [47]. However, accuracy relies on patent office source quality and corporate structure change documentation, creating potential gaps in ownership tracking that organizations must evaluate against their specific requirements.

LexisNexis PatentSight+ Pricing & Commercial Considerations

Investment Analysis

PatentSight pricing requires direct contact with LexisNexis for current information, following enterprise software pricing models typical in the patent analytics market. The broader market demonstrates subscription-based pricing with enterprise-grade platforms typically ranging $50K-$200K annually based on comparable solutions [6], though specific PatentSight+ pricing requires vendor consultation.

Organizations must evaluate total cost of ownership including training requirements, workflow integration expenses, and ongoing subscription fees. The Siemens case study suggests multi-year implementation investments requiring sustained organizational commitment beyond initial software costs [57][58].

Commercial Terms and Flexibility

PatentSight+ offers various delivery frequencies including weekly, monthly, quarterly, or annual updates [47], providing flexibility for different organizational requirements. The platform implements sophisticated worldwide legal status tracking with historical analysis capabilities from 2010, with patent information extending to early 1990s [47].

API integration capabilities enable custom workflows and third-party application development, supporting specialized organizational requirements. However, integration complexity with legacy systems may require additional development investment [47].

ROI Evidence from Customer Implementations

Han Santos provides documented ROI evidence through $700 million in client acquisitions during 2021, which the firm attributes partly to PatentSight analysis capabilities [51]. The firm's ability to process large patent data volumes in compressed timeframes enables competitive advantage in M&A deal evaluation and client service delivery.

The Siemens transformation demonstrates qualitative benefits including improved return on investment for patents despite maintaining similar annual filing volumes [58]. Patent quality focus enables strategic business development recommendations including R&D investment guidance and competitive advantage improvement [58].

Budget Fit Assessment

PatentSight+ targets enterprise organizations with substantial patent portfolios and complex analytical requirements. Large enterprises represent over 70% of patent analytics market adoption [39], suggesting the platform's positioning aligns with its primary buyer segment's budget capacity.

Organizations should evaluate ROI potential against specific use cases. M&A-focused law firms like Han Santos demonstrate clear value realization through deal volume and client retention [51], while portfolio optimization use cases like Siemens require longer implementation timelines for measurable outcomes [57][58].

Competitive Analysis: LexisNexis PatentSight+ vs. Alternatives

Competitive Strengths

PatentSight+ differentiates through methodology transparency and published Patent Asset Index™ calculation approaches [47][50]. This transparency advantage enables attorney explanation to in-house counsel and management teams, addressing a critical requirement in legal environments where "black box" AI solutions face resistance.

Database coverage spanning worldwide patent documents with weekly updates and 2-day lag [47] provides competitive positioning against platforms requiring longer update cycles. Specialized multilingual research teams supporting data quality maintenance may offer advantages over automated-only approaches [47].

Integration with Bloomberg financial data [13] and UN SDG mapping capabilities [31][36] provide differentiated analytical dimensions unavailable in basic patent analytics platforms. These features support corporate sustainability reporting and strategic business alignment requirements.

Competitive Limitations

PatentSight+ operates within the industry-standard 30-50% AI precision range for prior art searches [11], requiring human oversight comparable to alternative solutions. Organizations seeking higher automation levels may find limited differentiation in core AI analytical accuracy.

The platform's enterprise positioning may create barriers for smaller law firms requiring cost-effective patent analysis solutions. Alternative vendors like PatSeer achieve 9.4/10 ease of setup ratings with user-centric design [37], potentially offering better fit for resource-constrained implementations.

Vendor concentration risk emerges through LexisNexis's multiple IP product offerings, creating dependency concerns for organizations requiring specialized capabilities from dedicated vendors [48][55].

Selection Criteria for PatentSight+ vs. Alternatives

Organizations should select PatentSight+ when requiring:

- Methodology transparency for client and management communication [50]

- Enterprise-grade database coverage with rapid update cycles [47]

- Integration with financial and sustainability reporting systems [13][31]

- Established vendor relationship and support infrastructure

Alternative solutions may provide better value when prioritizing:

- Rapid deployment and user-friendly interfaces (PatSeer) [37]

- Specialized prosecution analytics (AcclaimIP) [19]

- Cost-effective solutions for smaller portfolios

- Vendor diversification strategies avoiding concentration risk

Market Positioning Context

PatentSight+ competes within the comprehensive patent analytics platform segment alongside Clarivate and other enterprise vendors. The platform's academic foundation and methodological rigor [58] position it favorably for organizations prioritizing analytical transparency over proprietary AI algorithms.

However, market consolidation toward integrated IP management platforms creates competitive pressure from vendors offering broader IP workflow coverage beyond patent analytics [5].

Implementation Guidance & Success Factors

Implementation Requirements

Successful PatentSight+ deployment requires cross-functional coordination between legal, technical, and business teams. The Siemens transformation illustrates systematic implementation spanning 4 years with organizational change management [57][58], suggesting substantial resource commitment beyond software configuration.

Technical requirements include API integration specialists and data quality analysts for workflow customization [8][23]. Legal resources must include IP attorneys for methodology validation and claim analysis processes [25][34]. Business resources require licensing professionals and portfolio managers for strategic alignment [26][29].

Success Enablers

Patent analyst expertise represents a critical success factor. Han Santos success depends on combining PatentSight's rapid data processing with experienced analytical capability, where technology enables insight generation rather than replacing human judgment [51].

Organizational commitment to quality-driven patent strategy proves essential. The Siemens case study demonstrates the importance of executive support and systematic change management for realizing patent portfolio optimization benefits [57][58].

Methodology transparency enables client communication and internal buy-in. McBee Moore & Vanik's experience highlights how published Patent Asset Index™ calculations facilitate management presentation and decision-making support [50].

Risk Considerations and Mitigation Strategies

Data quality dependency on patent office sources and corporate structure tracking creates potential accuracy gaps [47]. Organizations should establish validation processes and maintain awareness of database limitations affecting analysis reliability.

Implementation complexity with legacy systems may require custom development investment [47]. Phased deployment approaches can mitigate integration risks while enabling incremental value realization.

Vendor dependency through LexisNexis's comprehensive IP product portfolio [48][55] should be balanced against platform capabilities and organizational risk tolerance.

Decision Framework for Organizational Fit

Organizations evaluating PatentSight+ should assess:

- Portfolio Complexity: Large patent portfolios with complex competitive landscapes benefit most from comprehensive analytics [47]

- Use Case Alignment: M&A due diligence and portfolio optimization demonstrate strongest value realization [50][51][57]

- Resource Capacity: Multi-year implementation timelines require sustained organizational commitment [57][58]

- Methodology Requirements: Client communication and management reporting benefit from transparent analytical approaches [50]

- Integration Needs: API capabilities and data format flexibility support workflow customization [47]

Verdict: When LexisNexis PatentSight+ Is (and Isn't) the Right Choice

Best Fit Scenarios

PatentSight+ excels for organizations requiring comprehensive patent portfolio analytics with methodological transparency. The platform demonstrates particular strength in M&A due diligence scenarios, as evidenced by Han Santos's $700 million in client acquisitions [51] and McBee Moore & Vanik's successful merger evaluation processes [50][52].

Large law firms and corporate legal departments managing substantial patent portfolios benefit from Patent Asset Index™ scoring methodology and database comprehensiveness [47]. The Siemens transformation illustrates value realization for strategic portfolio optimization requiring objective quality measurement [57][58].

Organizations prioritizing vendor stability and comprehensive support infrastructure find advantages in LexisNexis's established market position and multi-product IP platform [48][55]. Academic foundation and published methodologies appeal to firms requiring rigorous analytical transparency [50][58].

Alternative Considerations

Smaller law firms or organizations with limited implementation resources may find better value in user-centric solutions like PatSeer, which achieves 9.4/10 setup ratings [37]. Rapid deployment requirements favor platforms with simplified workflows over comprehensive enterprise solutions requiring multi-year implementation timelines.

Organizations prioritizing specialized capabilities like prosecution analytics may benefit from dedicated vendors like AcclaimIP [19] or MaxVal [22][27] rather than comprehensive platforms. Cost-conscious buyers requiring basic patent analysis without enterprise features should evaluate alternatives with transparent pricing models.

Vendor diversification strategies may favor multi-vendor approaches over comprehensive platforms creating dependency risks. Organizations requiring cutting-edge AI capabilities should compare PatentSight+'s 30-50% precision rates [11] against emerging specialized AI solutions.

Decision Criteria for Evaluation

Legal/Law Firm AI Tools professionals should evaluate PatentSight+ based on:

- Use Case Alignment: M&A due diligence and portfolio optimization show strongest evidence [50][51][57]

- Resource Capacity: Multi-year implementation requirements and cross-functional coordination needs [57][58]

- Client Communication: Methodology transparency benefits for management and client reporting [50]

- Portfolio Scale: Large patent portfolios justify comprehensive analytics investment [47]

- Integration Requirements: API capabilities and workflow customization needs [47]

Next Steps for Further Evaluation

Organizations considering PatentSight+ should:

- Request Demonstration: Utilize actual patent portfolio data for proof-of-concept validation [21][24]

- Evaluate Methodology Fit: Assess Patent Asset Index™ alignment with organizational quality metrics [47][50]

- Resource Planning: Calculate total implementation cost including personnel and integration requirements

- Reference Validation: Interview current customers in similar use cases and organizational contexts

- Alternative Comparison: Benchmark against specialized vendors and comprehensive platform alternatives

- Pilot Program: Structure limited deployment for value validation before enterprise commitment

PatentSight+ represents a mature patent analytics platform with documented customer success in specific use cases. Organizations with alignment between platform capabilities and strategic requirements can realize substantial value, while those with different needs should carefully evaluate alternatives before committing to the comprehensive enterprise approach.

How We Researched This Guide

About This Guide: This comprehensive analysis is based on extensive competitive intelligence and real-world implementation data from leading AI vendors. StayModern updates this guide quarterly to reflect market developments and vendor performance changes.

58+ verified sources per analysis including official documentation, customer reviews, analyst reports, and industry publications.

- • Vendor documentation & whitepapers

- • Customer testimonials & case studies

- • Third-party analyst assessments

- • Industry benchmarking reports

Standardized assessment framework across 8 key dimensions for objective comparison.

- • Technology capabilities & architecture

- • Market position & customer evidence

- • Implementation experience & support

- • Pricing value & competitive position

Research is refreshed every 90 days to capture market changes and new vendor capabilities.

- • New product releases & features

- • Market positioning changes

- • Customer feedback integration

- • Competitive landscape shifts

Every claim is source-linked with direct citations to original materials for verification.

- • Clickable citation links

- • Original source attribution

- • Date stamps for currency

- • Quality score validation

Analysis follows systematic research protocols with consistent evaluation frameworks.

- • Standardized assessment criteria

- • Multi-source verification process

- • Consistent evaluation methodology

- • Quality assurance protocols

Buyer-focused analysis with transparent methodology and factual accuracy commitment.

- • Objective comparative analysis

- • Transparent research methodology

- • Factual accuracy commitment

- • Continuous quality improvement

Quality Commitment: If you find any inaccuracies in our analysis on this page, please contact us at research@staymodern.ai. We're committed to maintaining the highest standards of research integrity and will investigate and correct any issues promptly.