Google Display & Video 360: Complete Buyer's Guide

Google's enterprise-grade demand-side platform

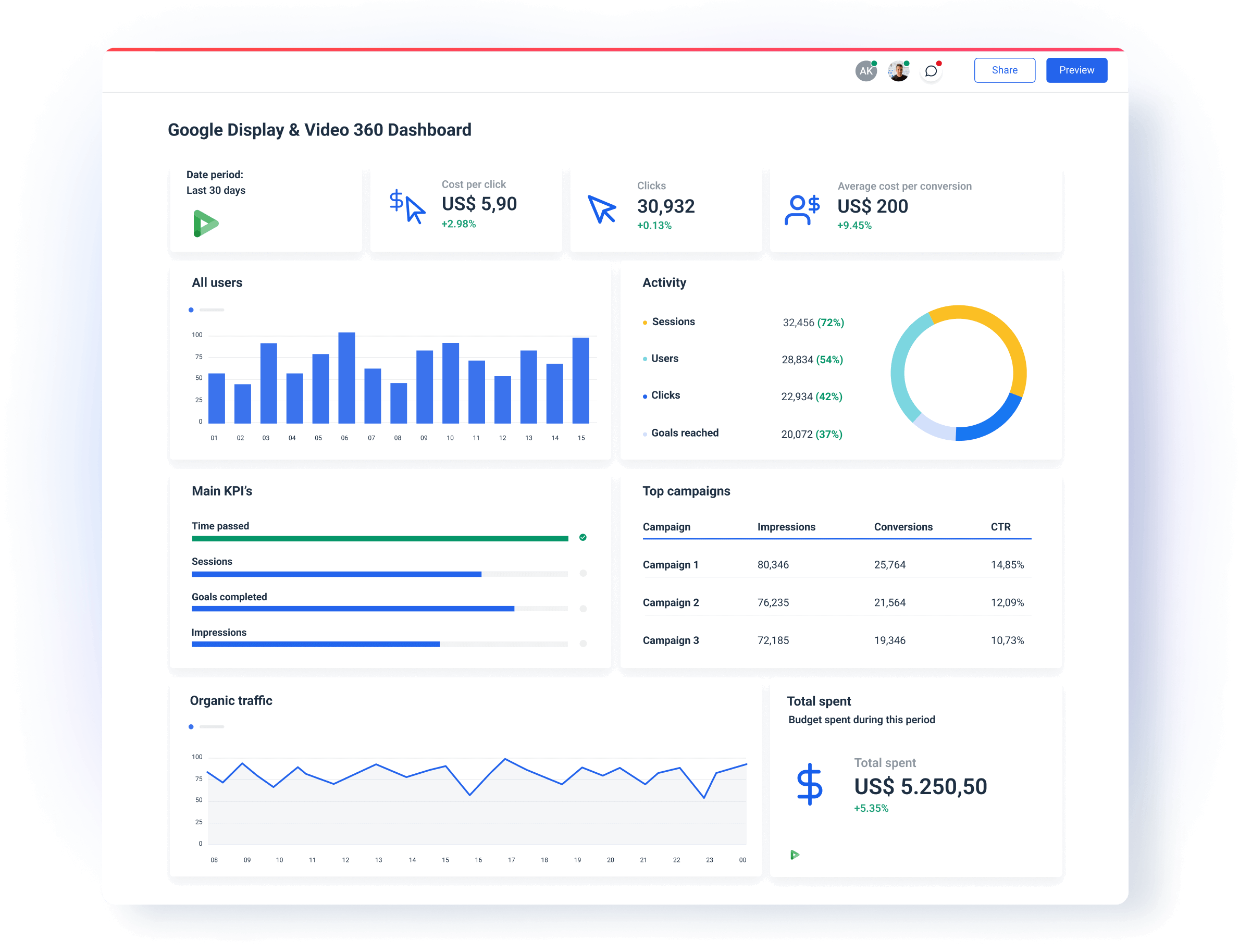

Google Display & Video 360 (DV360) represents Google's enterprise-grade demand-side platform that integrates AI-driven programmatic advertising capabilities across display, video, and connected TV channels. It positions as a comprehensive programmatic solution that delivers embedded machine learning algorithms for automated bidding, dynamic creative optimization, and cross-channel campaign orchestration rather than bolt-on AI features[129].

Market Position & Maturity

Market Standing

Google Display & Video 360 maintains a dominant position in the enterprise DSP market through its integration with Google's comprehensive advertising ecosystem and access to premium inventory including YouTube and Google Preferred[133].

Company Maturity

The platform's market maturity is evidenced by its extensive publisher relationships, with programmatic access to over 20,000 publisher domains through PAIR technology[133].

Growth Trajectory

Enterprise market penetration is demonstrated through documented implementations across major brands including Mitsubishi Motors, Adidas, Sky TV Italia, Omni Hotels, and Avon[137][138][139][140][142].

Industry Recognition

Technological leadership is evidenced by DV360's position among the first enterprise DSPs to integrate conversational AI interfaces for campaign management[130][131].

Strategic Partnerships

Strategic ecosystem integration provides significant competitive advantages through native connectivity with Google Analytics 4, Campaign Manager 360, and BigQuery ML[129][138][142].

Longevity Assessment

Regulatory compliance leadership is evidenced through privacy-centric innovations like PAIR technology, which addresses emerging regulatory requirements while maintaining targeting effectiveness[139].

Proof of Capabilities

Customer Evidence

Documented enterprise customer success spans multiple industries with quantified performance improvements. Mitsubishi Motors achieved a 14x conversion rate increase through AI-powered propensity modeling integrated with BigQuery ML[142]. Sky TV Italia realized a 165% conversion lift with 50% lower cost-per-acquisition by combining DV360 with Campaign Manager 360 for centralized conversion tracking[138].

Quantified Outcomes

Privacy-compliant targeting effectiveness is proven through Omni Hotels' PAIR technology implementation, which delivered 4x conversion rate improvements and 4x cost-per-acquisition reduction compared to cookie-based targeting approaches[139].

Case Study Analysis

Dynamic creative optimization validation comes from Avon's native advertising implementation, achieving 434% higher click-through rates using DV360-native ads compared to standard display formats[140].

Market Validation

Market validation is supported by documented implementations across diverse industries including automotive (Mitsubishi), retail (Adidas), media (Sky TV), hospitality (Omni Hotels), and beauty (Avon)[137][138][139][140][142].

Competitive Wins

Premium inventory access validation is demonstrated through Adidas's CTV campaign optimization, which achieved 37.5% cost savings through AI-managed frequency capping via the Commitment Optimizer[137].

Reference Customers

Enterprise market penetration is demonstrated through documented implementations across major brands including Mitsubishi Motors, Adidas, Sky TV Italia, Omni Hotels, and Avon[137][138][139][140][142].

AI Technology

DV360's AI foundation centers on embedded machine learning algorithms integrated directly into campaign workflows rather than supplementary AI tools. The platform's automated bidding system leverages real-time contextual signals including user behavior patterns and historical performance data to adjust bids dynamically[129].

Architecture

Custom bidding capabilities through Goal Builder and Python scripting enable algorithm customization prioritizing specific conversion events from Floodlight or Google Analytics 4[129].

Primary Competitors

Key competitors include The Trade Desk, Amazon DSP, and Adobe Advertising Cloud.

Competitive Advantages

DV360's primary competitive advantages center on premium inventory access through Google's publisher relationships and PAIR technology integration[133].

Market Positioning

Inventory access differentiation provides significant competitive advantages through exclusive access to YouTube, Google Preferred, and premium publisher networks unavailable to competing DSPs[133].

Win/Loss Scenarios

Win/loss scenarios favor DV360 for organizations requiring premium inventory access, Google ecosystem integration, and sophisticated AI capabilities with dedicated technical resources.

Key Features

Pros & Cons

Use Cases

Integrations

Featured In Articles

Comprehensive analysis of AI Banner Ad Tools for AI Marketing & Advertising for AI Marketing & Advertising professionals. Expert evaluation of features, pricing, and implementation.

How We Researched This Guide

About This Guide: This comprehensive analysis is based on extensive competitive intelligence and real-world implementation data from leading AI vendors. StayModern updates this guide quarterly to reflect market developments and vendor performance changes.

148+ verified sources per analysis including official documentation, customer reviews, analyst reports, and industry publications.

- • Vendor documentation & whitepapers

- • Customer testimonials & case studies

- • Third-party analyst assessments

- • Industry benchmarking reports

Standardized assessment framework across 8 key dimensions for objective comparison.

- • Technology capabilities & architecture

- • Market position & customer evidence

- • Implementation experience & support

- • Pricing value & competitive position

Research is refreshed every 90 days to capture market changes and new vendor capabilities.

- • New product releases & features

- • Market positioning changes

- • Customer feedback integration

- • Competitive landscape shifts

Every claim is source-linked with direct citations to original materials for verification.

- • Clickable citation links

- • Original source attribution

- • Date stamps for currency

- • Quality score validation

Analysis follows systematic research protocols with consistent evaluation frameworks.

- • Standardized assessment criteria

- • Multi-source verification process

- • Consistent evaluation methodology

- • Quality assurance protocols

Buyer-focused analysis with transparent methodology and factual accuracy commitment.

- • Objective comparative analysis

- • Transparent research methodology

- • Factual accuracy commitment

- • Continuous quality improvement

Quality Commitment: If you find any inaccuracies in our analysis on this page, please contact us at research@staymodern.ai. We're committed to maintaining the highest standards of research integrity and will investigate and correct any issues promptly.