Dynamic Yield: Complete Buyer's Guide

AI-powered personalization platform for enterprise retailers

Dynamic Yield is an AI-powered personalization platform designed for enterprise retailers seeking comprehensive conversion optimization beyond basic A/B testing. As a Mastercard subsidiary, Dynamic Yield combines predictive analytics with real-time personalization capabilities, targeting businesses with substantial traffic volumes and unified customer data infrastructure[48][53].

Market Position & Maturity

Market Standing

Dynamic Yield occupies a strong enterprise market position as a Mastercard subsidiary, providing significant financial stability and strategic backing that differentiates it from standalone personalization vendors[53][58].

Company Maturity

The Mastercard acquisition provides substantial financial backing and strategic direction, eliminating typical startup risks associated with independent personalization vendors[53][56].

Growth Trajectory

Dynamic Yield's position within Mastercard's portfolio suggests strong long-term viability and continued investment in platform capabilities[53][58].

Industry Recognition

As part of Mastercard's ecosystem, Dynamic Yield benefits from enterprise-level partnerships and strategic relationships that enhance its market credibility[48][57].

Strategic Partnerships

Dynamic Yield's integration with Mastercard data creates differentiation from pure experimentation tools, though it faces competitive pressure from specialized solutions like Nacelle[56][58][59].

Longevity Assessment

Dynamic Yield's position within Mastercard's portfolio suggests strong long-term viability and continued investment in platform capabilities[53][58].

Proof of Capabilities

Customer Evidence

Dynamic Yield demonstrates proven enterprise capabilities through its client base including McDonald's and MediaMarkt, according to company sources, showcasing its ability to handle large-scale, complex personalization implementations across diverse industries[48][57].

Market Validation

As part of Mastercard's ecosystem, Dynamic Yield benefits from financial stability and strategic backing that validates its market position[53][56].

Competitive Wins

Compared to Optimizely's experimentation-focused approach, Dynamic Yield emphasizes predictive analytics and cross-channel personalization, creating differentiation in the enterprise personalization market[58][59].

Reference Customers

Dynamic Yield serves enterprise clients including McDonald's and MediaMarkt according to company sources[48][57].

AI Technology

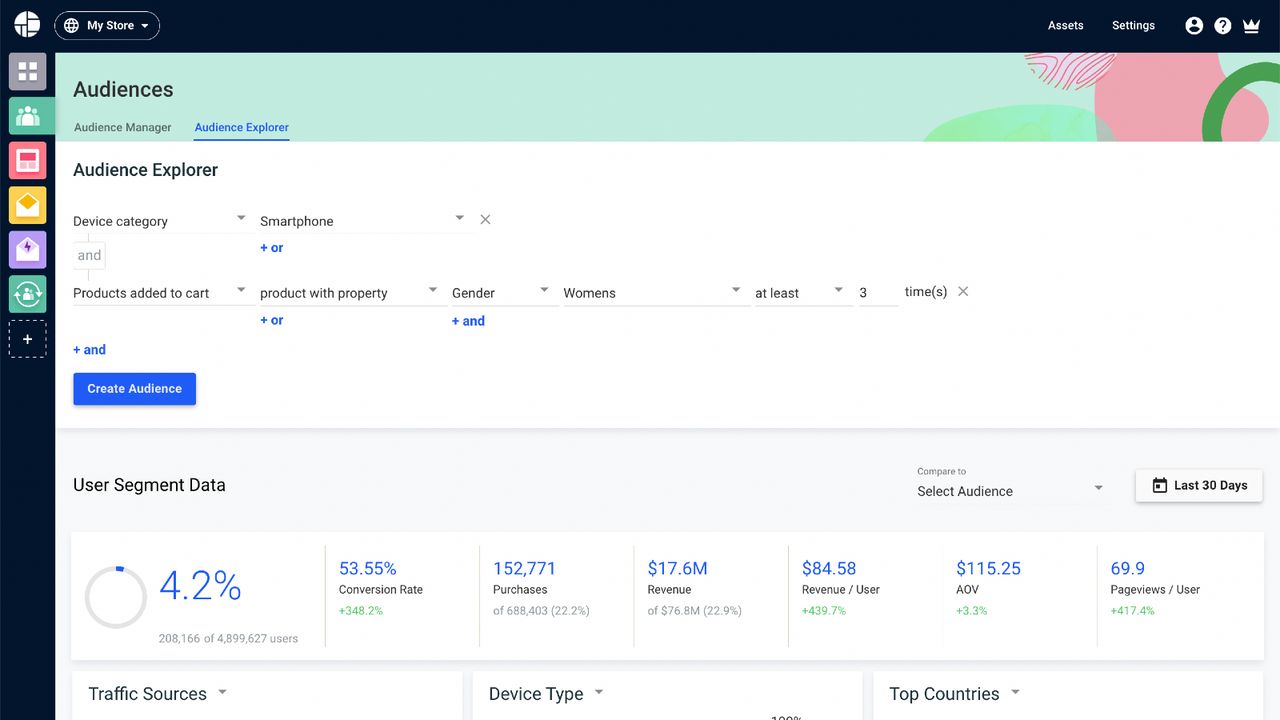

Dynamic Yield's AI-powered personalization engine operates through real-time behavioral analytics and predictive targeting, enabling personalized experiences across customer touchpoints[48][44].

Architecture

Dynamic Yield's technical infrastructure requires unified customer data integration and substantial technical resources for optimal performance[43][53][55].

Primary Competitors

Dynamic Yield competes directly with comprehensive personalization platforms like Optimizely while emphasizing predictive analytics over pure experimentation depth[56][58][59].

Competitive Advantages

Dynamic Yield's unique market position stems from its Predictive Spend Insights capability leveraging Mastercard's transaction data for geo-based behavioral modeling[58].

Market Positioning

Dynamic Yield occupies the enterprise personalization space, competing with comprehensive platforms rather than specialized tools[56][58][59].

Win/Loss Scenarios

Organizations prioritizing predictive analytics and cross-channel personalization may favor Dynamic Yield, while those focused on experimentation depth might prefer Optimizely[45][56][58].

Key Features

Pros & Cons

Use Cases

Featured In Articles

Comprehensive analysis of CRO / Revenue Boosting for Ecommerce for Ecommerce businesses and online retailers. Expert evaluation of features, pricing, and implementation.

How We Researched This Guide

About This Guide: This comprehensive analysis is based on extensive competitive intelligence and real-world implementation data from leading AI vendors. StayModern updates this guide quarterly to reflect market developments and vendor performance changes.

59+ verified sources per analysis including official documentation, customer reviews, analyst reports, and industry publications.

- • Vendor documentation & whitepapers

- • Customer testimonials & case studies

- • Third-party analyst assessments

- • Industry benchmarking reports

Standardized assessment framework across 8 key dimensions for objective comparison.

- • Technology capabilities & architecture

- • Market position & customer evidence

- • Implementation experience & support

- • Pricing value & competitive position

Research is refreshed every 90 days to capture market changes and new vendor capabilities.

- • New product releases & features

- • Market positioning changes

- • Customer feedback integration

- • Competitive landscape shifts

Every claim is source-linked with direct citations to original materials for verification.

- • Clickable citation links

- • Original source attribution

- • Date stamps for currency

- • Quality score validation

Analysis follows systematic research protocols with consistent evaluation frameworks.

- • Standardized assessment criteria

- • Multi-source verification process

- • Consistent evaluation methodology

- • Quality assurance protocols

Buyer-focused analysis with transparent methodology and factual accuracy commitment.

- • Objective comparative analysis

- • Transparent research methodology

- • Factual accuracy commitment

- • Continuous quality improvement

Quality Commitment: If you find any inaccuracies in our analysis on this page, please contact us at research@staymodern.ai. We're committed to maintaining the highest standards of research integrity and will investigate and correct any issues promptly.