Crayon Competitive Intelligence Platform: Complete Review

Enterprise-focused competitive intelligence solution

Crayon Competitive Intelligence Platform Analysis: Capabilities & Fit Assessment

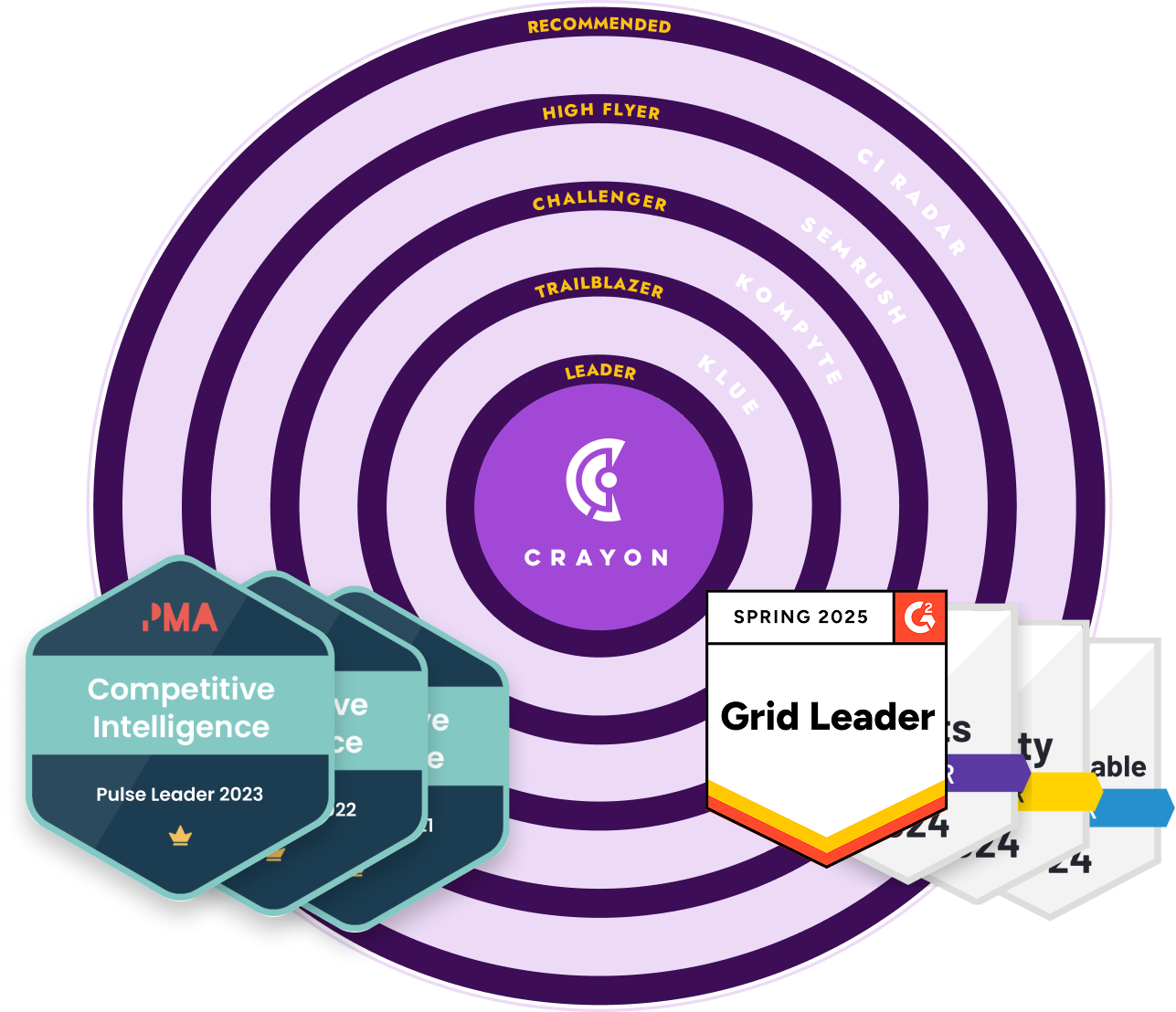

Crayon has established itself as a G2 leader in the competitive intelligence segment[137], serving enterprises through AI-powered competitive monitoring and battlecard automation. The platform targets the $8.2 billion competitive intelligence market, projected to reach $16.8 billion by 2030[138], with particular strength in real-time website change tracking and sales enablement integration.

Key capabilities center on three core areas: automated competitor monitoring across 200,000+ sources[138], AI-curated intelligence through Sparks AI that generates battlecards from sales call analysis[143], and integrated distribution through Slack and Salesforce workflows[145][146]. The platform differentiates itself through real-time website change tracking with annotations[143] and self-updating battlecards that reduce manual content maintenance burdens[139][142].

Target audience fit aligns strongest with mid-market to enterprise organizations requiring structured competitive intelligence workflows. The median contract value of $30,000[136] and enterprise pricing starting at $15,000+ annually[134] positions Crayon for organizations with dedicated competitive intelligence or product marketing functions rather than small marketing teams.

Bottom-line assessment reveals a capable platform for enterprises seeking automated competitive monitoring with strong CRM integration, though implementation complexity and human verification requirements[130] may challenge organizations lacking dedicated CI resources or technical implementation capacity.

Crayon AI Capabilities & Performance Evidence

Core AI functionality operates through three primary engines: Sparks AI for automated battlecard generation from sales conversation analysis[143], news summarization capabilities that condense competitor articles into shareable insights[143], and sentiment grading using natural language processing to score competitor content sentiment[143]. The platform processes competitive intelligence from websites, social media, and job boards, though human verification requirements may slow enterprise scalability[130].

Performance validation demonstrates measurable customer outcomes across documented implementations. Alteryx achieved a 40% battlecard adoption lift within 60 days and recorded a 22% competitive win rate increase[139][142]. Dropbox reported significant increases in battlecard usage after implementation[141], while Salsify documented that 78% of competitive revenue was influenced by Crayon implementation, though correlation versus causation remains unclear[142]. These results suggest consistent value delivery for organizations with structured sales enablement processes.

Competitive positioning shows Crayon's technical advantages over alternatives in specific areas. Compared to Klue's 7-8 week setup period with less mature AI[149], Crayon offers more developed AI capabilities, though still requires substantial implementation timelines. Against Kompyte's 500M source processing with narrower integration scope[149], Crayon provides broader CRM connectivity but potentially less comprehensive source coverage. Brandwatch's sentiment analysis specialization offers deeper social listening capabilities than Crayon's general competitive monitoring approach.

Use case strength emerges most clearly in organizations requiring real-time competitor website monitoring with immediate sales team distribution. The combination of Slack integration[148] and Salesforce connectivity[145][146] creates effective workflows for sales-driven competitive intelligence, particularly when supported by monthly sales team meetings for battlecard optimization[139].

Customer Evidence & Implementation Reality

Customer success patterns consistently show improved battlecard adoption and competitive win rates among enterprise customers with structured sales processes. The evidence from Alteryx (40% adoption lift, 22% win rate increase)[139][142] and documented success at Dropbox[141] suggests Crayon delivers measurable value when implemented with appropriate organizational support and change management.

Implementation experiences reveal significant variation in complexity and timeline requirements. Mid-market implementations require varying timelines based on organizational complexity, while enterprise deployments demand extended periods with substantial resource commitments. The documented 7-8 week setup period[149] aligns with competitor experiences, though organizations should plan for potential human verification bottlenecks in large-scale tracking scenarios[130].

Support quality assessment indicates structured onboarding approaches that can reduce employee resistance[148], with documentation showing successful deployment methodologies including cross-functional team coordination (marketing/IT collaboration) and Slack channel segmentation for targeted intelligence distribution[148]. However, limited independent customer satisfaction data makes comprehensive support quality evaluation challenging.

Common challenges include data quality issues affecting CRM integration success, initial learning curves for AI importance scoring calibration to industry nuances[143], and potential vendor lock-in concerns with proprietary AI models. Web monitoring limitations exclude mobile app changes without custom configurations, which may affect comprehensive competitive tracking for mobile-first competitors.

Crayon Pricing & Commercial Considerations

Investment analysis positions Crayon in the premium segment of competitive intelligence solutions. Enterprise contracts start at $15,000+ annually with a median contract value of $30,000[134][136], including unlimited competitor tracking and user licenses across all tiers[131]. This pricing reflects the platform's enterprise focus but may exclude smaller marketing teams or organizations with limited CI budgets.

Commercial terms follow standard enterprise software patterns with annual contracts preferred for larger organizations[134][136]. The unlimited user and competitor model provides scalability advantages for growing teams, though the absence of a free tier limits evaluation opportunities compared to some competitive alternatives.

ROI evidence from customer implementations shows promising but variable returns. Salsify's reported 78% competitive revenue influence[142] and Alteryx's 22% win rate improvement[139] suggest significant potential value, though baseline methodologies and attribution models require careful evaluation. The Fuze case study highlighting that "wrong intel more damaging than no intel"[140] supports the cost avoidance value proposition for competitive intelligence investment.

Budget fit assessment favors organizations allocating $30,000+ annually for competitive intelligence, particularly those requiring integrated CRM workflows and automated distribution capabilities. Smaller organizations may find better value in solutions like Kompyte ($20-49/month for SMB focus)[149], while enterprises requiring comprehensive social sentiment analysis might consider Brandwatch despite variable pricing structures.

Competitive Analysis: Crayon vs. Alternatives

Competitive strengths position Crayon advantageously in real-time website change monitoring with annotation capabilities[143] and mature CRM integration, particularly with Salesforce[145][146]. The combination of Sparks AI for battlecard automation[143] and integrated Slack distribution[148] creates workflow advantages over competitors requiring manual content updates or separate distribution tools.

Competitive limitations emerge in specific use cases where alternatives provide superior capabilities. Brandwatch offers deeper sentiment analysis specialization for social media monitoring requirements, while Kompyte's 500M source processing may provide broader competitive landscape coverage[149]. Klue's positioning in the market suggests alternative approaches to competitive intelligence workflow, though specific capability comparisons require direct evaluation.

Selection criteria should prioritize Crayon when organizations require integrated CRM workflows, real-time website monitoring, and automated battlecard generation within existing Salesforce/Slack environments. Alternative vendors merit consideration when social sentiment analysis depth (Brandwatch), broader source coverage (Kompyte), or different implementation approaches (Klue) align better with specific organizational requirements.

Market positioning reflects Crayon's G2 leadership recognition[137] and enterprise customer base suggesting established market presence, though the competitive intelligence software market's rapid evolution requires ongoing capability assessment against emerging alternatives and established players expanding their CI offerings.

Implementation Guidance & Success Factors

Implementation requirements demand cross-functional coordination between marketing and IT teams, with particular attention to CRM data quality and integration architecture. Organizations should plan for the documented 7-8 week setup period[149] and allocate resources for staff training on AI importance scoring calibration[143] and competitive intelligence workflow integration.

Success enablers include structured monthly sales team meetings for battlecard optimization[139], effective Slack channel segmentation for targeted intelligence distribution[148], and clean CRM integration to support AI-powered insights generation. The MiQ case study demonstrating 70% sales team adoption within four months[148] illustrates the importance of change management support and structured rollout approaches.

Risk considerations center on data quality issues that can affect project success, human verification bottlenecks potentially slowing large-scale implementations[130], and integration challenges requiring technical expertise. Organizations should evaluate their capacity for AI model calibration and ongoing competitive taxonomy maintenance, particularly in specialized industries like healthcare or fintech[138].

Decision framework should assess organizational readiness across technical infrastructure (CRM integration capability), human resources (dedicated CI or product marketing functions), and change management capacity (cross-functional team coordination). The platform's enterprise positioning requires sufficient budget allocation and implementation resources to achieve documented customer success outcomes.

Verdict: When Crayon Is (and Isn't) the Right Choice

Best fit scenarios favor organizations with established sales processes requiring automated competitive intelligence distribution, particularly those using Salesforce CRM and Slack communication workflows. Enterprise companies with dedicated competitive intelligence functions, budget capacity for $30,000+ annual investments[136], and technical resources for cross-functional implementation will likely achieve outcomes similar to documented customer successes at Alteryx and Dropbox[139][141][142].

Alternative considerations apply when budget constraints favor solutions like Kompyte's SMB-focused pricing[149], when social sentiment analysis depth requirements suggest Brandwatch specialization, or when organizations lack the technical and human resources necessary for successful enterprise CI platform implementation. Smaller marketing teams or organizations requiring immediate deployment may find better value in simpler competitive monitoring tools.

Decision criteria should evaluate budget capacity against enterprise pricing requirements, technical integration needs with existing marketing technology stacks, and organizational readiness for competitive intelligence workflow automation. The combination of G2 leadership recognition[137], documented customer outcomes[139][141][142], and comprehensive CRM integration capabilities[145][146] supports Crayon selection for qualifying organizations.

Next steps for evaluation should include technical integration assessment with existing CRM and communication tools, budget analysis against documented ROI evidence, and organizational readiness evaluation for cross-functional implementation requirements. Organizations meeting Crayon's enterprise positioning criteria should request implementation timeline and resource requirement specifications to validate fit with internal capacity and competitive intelligence objectives.

How We Researched This Guide

About This Guide: This comprehensive analysis is based on extensive competitive intelligence and real-world implementation data from leading AI vendors. StayModern updates this guide quarterly to reflect market developments and vendor performance changes.

149+ verified sources per analysis including official documentation, customer reviews, analyst reports, and industry publications.

- • Vendor documentation & whitepapers

- • Customer testimonials & case studies

- • Third-party analyst assessments

- • Industry benchmarking reports

Standardized assessment framework across 8 key dimensions for objective comparison.

- • Technology capabilities & architecture

- • Market position & customer evidence

- • Implementation experience & support

- • Pricing value & competitive position

Research is refreshed every 90 days to capture market changes and new vendor capabilities.

- • New product releases & features

- • Market positioning changes

- • Customer feedback integration

- • Competitive landscape shifts

Every claim is source-linked with direct citations to original materials for verification.

- • Clickable citation links

- • Original source attribution

- • Date stamps for currency

- • Quality score validation

Analysis follows systematic research protocols with consistent evaluation frameworks.

- • Standardized assessment criteria

- • Multi-source verification process

- • Consistent evaluation methodology

- • Quality assurance protocols

Buyer-focused analysis with transparent methodology and factual accuracy commitment.

- • Objective comparative analysis

- • Transparent research methodology

- • Factual accuracy commitment

- • Continuous quality improvement

Quality Commitment: If you find any inaccuracies in our analysis on this page, please contact us at research@staymodern.ai. We're committed to maintaining the highest standards of research integrity and will investigate and correct any issues promptly.