Adyen: Complete Buyer's Guide

Enterprise payment optimization platform delivering AI-powered routing and fraud prevention for global ecommerce operations.

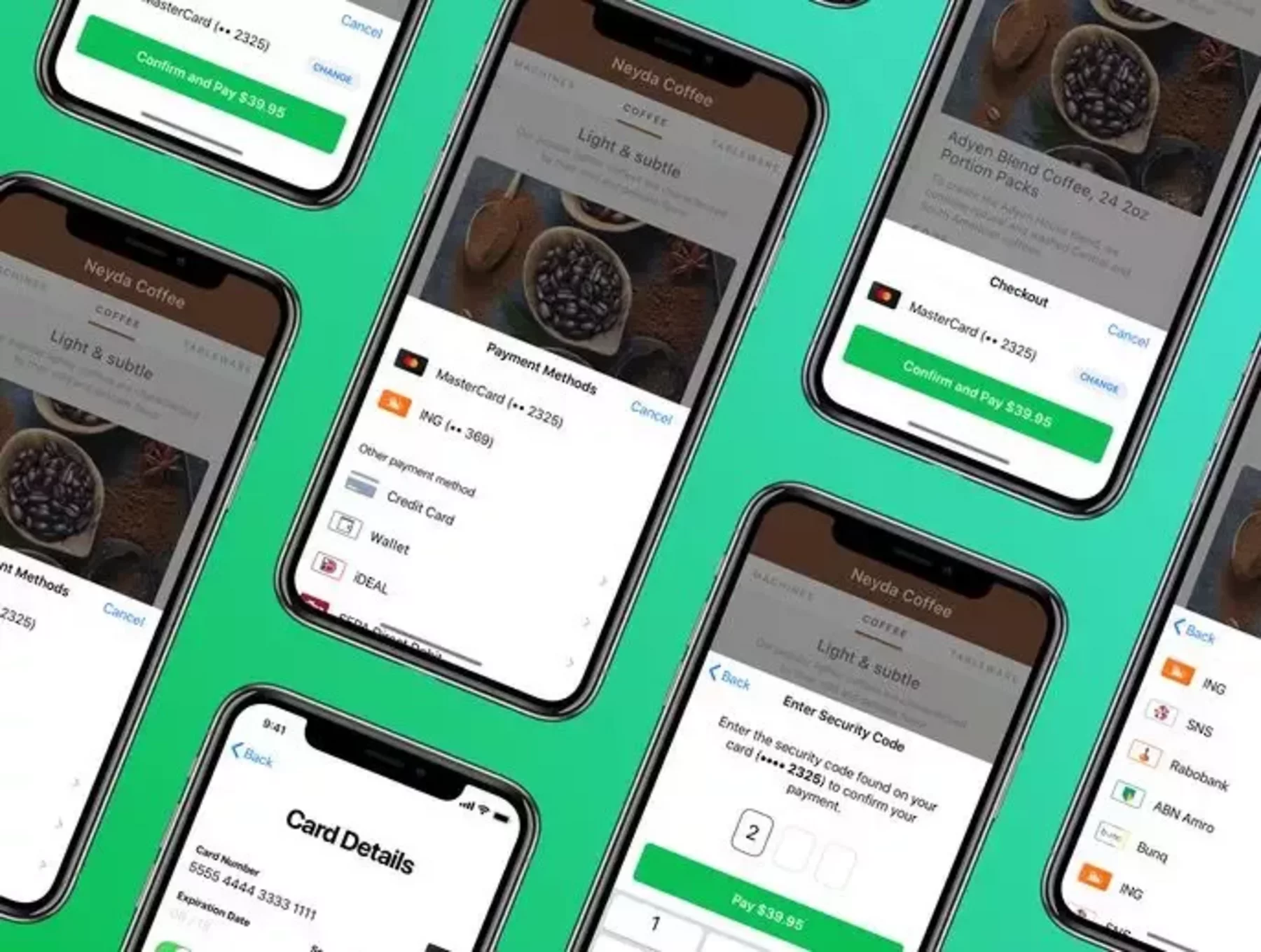

Adyen positions itself as a comprehensive payment optimization platform targeting enterprise ecommerce operations through AI-powered routing and fraud prevention capabilities. The vendor's primary value proposition centers on RevenueAccelerate and the newer Uplift platform, both designed to improve payment authorization rates while reducing fraud losses through machine learning algorithms[39][40][45][50][52][53].

Market Position & Maturity

Market Standing

Adyen serves as a direct payment processor with integrated AI optimization, distinguishing itself from pure-play optimization vendors through unified platform architecture. The company processes payments for enterprises including Microsoft, eBay, and Adobe, handling transactions across 150+ currencies with direct connections to 11,000+ financial institutions[45][49][44][55].

Company Maturity

Adyen's operational scale enables processing of over 1 trillion USD in annual transaction volume, providing the data foundation necessary for effective AI model training and optimization[50][52][53].

Growth Trajectory

The company's strategic partnerships with major ecommerce platforms and direct issuer relationships position it favorably for continued market expansion[43][44][50][52][54][55].

Industry Recognition

Forrester's Q1 2024 Wave ranked Adyen highest in 'vision' among merchant payment providers, though this ranking predates competitive platform updates[48].

Strategic Partnerships

Strategic partnerships with major ecommerce platforms and direct issuer relationships[43][44][50][52][54][55].

Longevity Assessment

Long-term viability indicators include established customer relationships, comprehensive global infrastructure, and continued investment in AI capabilities development[44][45][50][52][55].

Proof of Capabilities

Customer Evidence

Adobe's comprehensive deployment across 22 markets achieved $2.7M annual savings, 26% cost reduction, and 18% fraud decrease in subscription payments through AI-powered routing optimization[44][55].

Quantified Outcomes

Adobe achieved $2.7M annual savings and 18% fraud decrease in subscription payments[44][55].

Case Study Analysis

L'Occitane's global expansion showcases Adyen's strength in multi-currency operations, achieving greater than 98% POS authorization rates globally while adding 40 payment methods and reducing reconciliation time by 20%[55].

Market Validation

Market validation indicators include enterprise customer retention, successful implementations across multiple industries, and documented performance improvements in complex deployment scenarios[43][44][50][52][54][55].

Competitive Wins

Competitive wins against established payment processors demonstrate Adyen's technical advantages in authorization rate optimization and fraud prevention capabilities[42][45][49][51].

Reference Customers

Enterprise customers include Microsoft, eBay, and Adobe[45][49][44][55].

AI Technology

Adyen's AI technology foundation centers on two primary platforms delivering distinct optimization capabilities through machine learning algorithms trained on massive transaction datasets[39][40][45][49].

Architecture

Core AI architecture operates through issuer-specific optimization algorithms that analyze transaction patterns, issuer preferences, and real-time network performance to maximize authorization rates[45][49].

Primary Competitors

Primary competitors include Stripe's developer-friendly Payment Element, Recurly's subscription-specialized features, and PayPal's enterprise solutions[42][51][52][53].

Competitive Advantages

Comprehensive global payment capabilities, direct financial institution relationships, and unified payment processing architecture[45][49].

Market Positioning

Adyen's focus on issuer-specific optimization outperforms Stripe in authorization rate improvements, though implementation complexity remains higher[42][51].

Win/Loss Scenarios

Win scenarios favor Adyen for organizations processing high volumes across multiple currencies requiring sophisticated routing optimization and fraud prevention[43][44][54][55].

Key Features

Pros & Cons

Use Cases

Featured In Articles

Comprehensive analysis of Payment Optimization for Ecommerce for Ecommerce businesses and online retailers. Expert evaluation of features, pricing, and implementation.

How We Researched This Guide

About This Guide: This comprehensive analysis is based on extensive competitive intelligence and real-world implementation data from leading AI vendors. StayModern updates this guide quarterly to reflect market developments and vendor performance changes.

56+ verified sources per analysis including official documentation, customer reviews, analyst reports, and industry publications.

- • Vendor documentation & whitepapers

- • Customer testimonials & case studies

- • Third-party analyst assessments

- • Industry benchmarking reports

Standardized assessment framework across 8 key dimensions for objective comparison.

- • Technology capabilities & architecture

- • Market position & customer evidence

- • Implementation experience & support

- • Pricing value & competitive position

Research is refreshed every 90 days to capture market changes and new vendor capabilities.

- • New product releases & features

- • Market positioning changes

- • Customer feedback integration

- • Competitive landscape shifts

Every claim is source-linked with direct citations to original materials for verification.

- • Clickable citation links

- • Original source attribution

- • Date stamps for currency

- • Quality score validation

Analysis follows systematic research protocols with consistent evaluation frameworks.

- • Standardized assessment criteria

- • Multi-source verification process

- • Consistent evaluation methodology

- • Quality assurance protocols

Buyer-focused analysis with transparent methodology and factual accuracy commitment.

- • Objective comparative analysis

- • Transparent research methodology

- • Factual accuracy commitment

- • Continuous quality improvement

Quality Commitment: If you find any inaccuracies in our analysis on this page, please contact us at research@staymodern.ai. We're committed to maintaining the highest standards of research integrity and will investigate and correct any issues promptly.