Alternatives to Salesforce Einstein

1. Adobe Analytics (Experience Cloud)

+Pros

- Advanced attribution modeling capabilities with 9+ customizable attribution models.

- Adobe Sensei AI integration delivers anomaly detection, propensity scoring, and algorithmic attribution.

- Ecosystem integration advantages create unified customer data workflows within the Adobe Experience Cloud.

-Cons

- Implementation complexity requires substantial technical resources and extended deployment timelines.

- Mixed AI performance reveals 8% higher engagement but 9% lower conversion rates compared to non-AI traffic.

- Cost barriers include pricing ranging from $48,000 to over $350,000 annually.

One highlighted feature and why it's amazing

Adobe Analytics offers 9+ customizable attribution models compared to Google Analytics 4's 6 fixed options.

Another highlighted feature of why it’s amazing

Provides anomaly detection, propensity scoring, and algorithmic attribution capabilities.

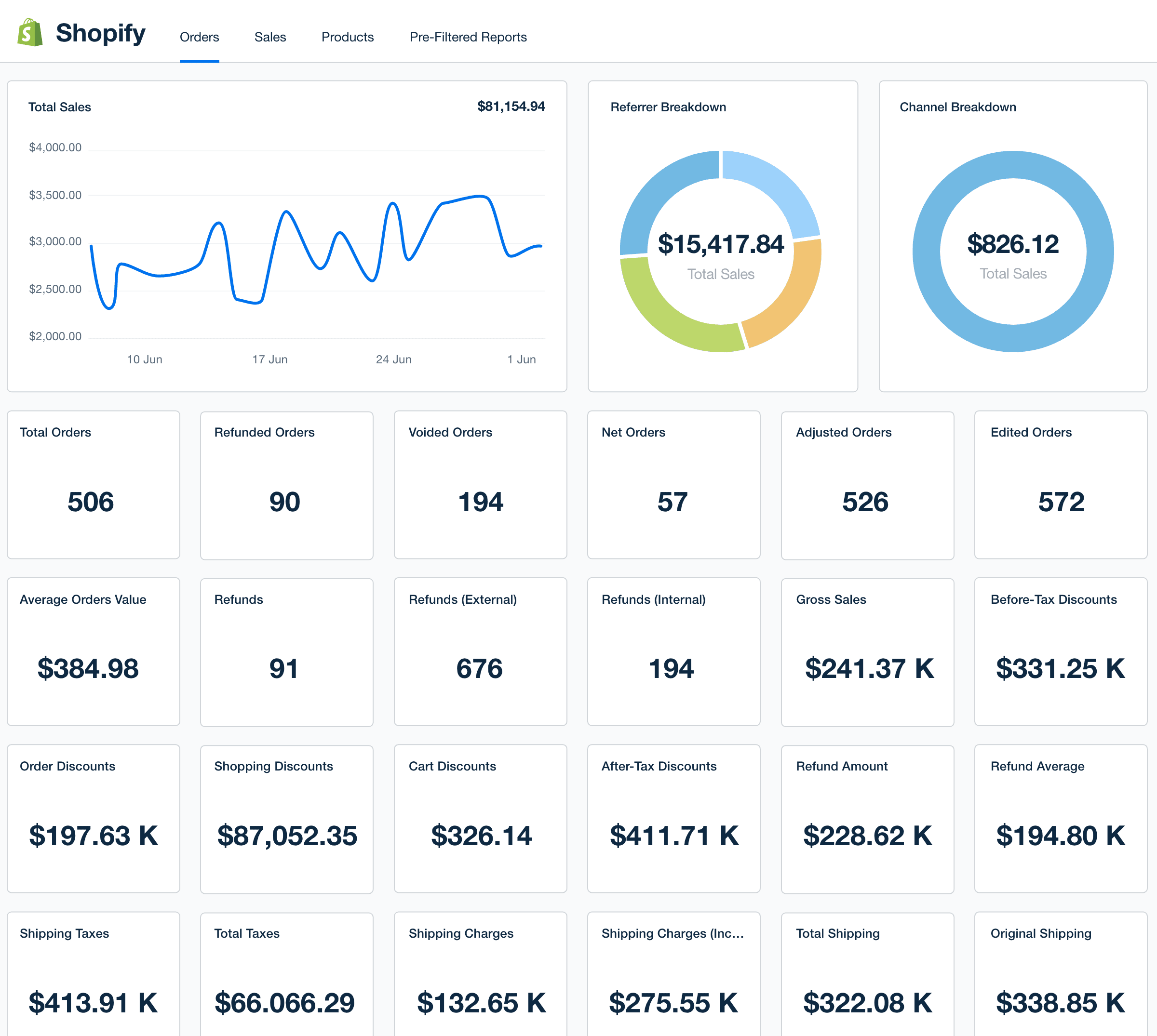

2. Shopify Analytics

+Pros

- Native Integration Excellence eliminates data synchronization challenges affecting 74% of traditional analytics implementations.

- Rapid Deployment Capability delivers 2-4 week implementation timelines compared to 6-9 months for enterprise platforms like Adobe Analytics.

- Conversational AI Innovation through Sidekick transforms analytics accessibility, enabling natural language queries that correlate multiple data sources.

- Cost Predictability through bundled pricing eliminates licensing complexity common with standalone analytics platforms.

-Cons

- Ecosystem Constraints limit cross-platform data synthesis capabilities compared to specialized analytics providers.

- Advanced Analytics Gaps include constrained funnel visualization for multi-touch attribution and limited cross-device journey tracking.

- Implementation Dependencies include theme compatibility requirements that may force redesigns for advanced analytics capabilities.

- Mobile Functionality Limits restrict dashboard editing capabilities on mobile devices despite voice chat and screenshare features.

One highlighted feature and why it's amazing

Shopify Sidekick represents the platform's primary differentiator, utilizing transformer-based NLP to process natural language queries like 'Why are Q3 sales declining in Midwest regions?'.

Another highlighted feature of why it’s amazing

Creates comprehensive profiles by synthesizing social media engagement, in-store purchase history, cart abandonment patterns, and customer service interactions.

How We Researched This Guide

About This Guide: This comprehensive analysis is based on extensive competitive intelligence and real-world implementation data from leading AI vendors. StayModern updates this guide quarterly to reflect market developments and vendor performance changes.

211+ verified sources per analysis including official documentation, customer reviews, analyst reports, and industry publications.

- • Vendor documentation & whitepapers

- • Customer testimonials & case studies

- • Third-party analyst assessments

- • Industry benchmarking reports

Standardized assessment framework across 8 key dimensions for objective comparison.

- • Technology capabilities & architecture

- • Market position & customer evidence

- • Implementation experience & support

- • Pricing value & competitive position

Research is refreshed every 90 days to capture market changes and new vendor capabilities.

- • New product releases & features

- • Market positioning changes

- • Customer feedback integration

- • Competitive landscape shifts

Every claim is source-linked with direct citations to original materials for verification.

- • Clickable citation links

- • Original source attribution

- • Date stamps for currency

- • Quality score validation

Analysis follows systematic research protocols with consistent evaluation frameworks.

- • Standardized assessment criteria

- • Multi-source verification process

- • Consistent evaluation methodology

- • Quality assurance protocols

Buyer-focused analysis with transparent methodology and factual accuracy commitment.

- • Objective comparative analysis

- • Transparent research methodology

- • Factual accuracy commitment

- • Continuous quality improvement

Quality Commitment: If you find any inaccuracies in our analysis on this page, please contact us at research@staymodern.ai. We're committed to maintaining the highest standards of research integrity and will investigate and correct any issues promptly.