Alternatives to Recruit CRM

1. CVViZ AI Hiring Tools for HR Professionals

+Pros

- Specialized technical assessment capabilities through the integrated live code editor for developer roles

- Contextual NLP technology exceeding basic keyword matching through semantic analysis

- Broad sourcing integration with 2,000+ job boards including specialized platforms like GitHub and Stack Overflow

-Cons

- Significant verification challenges with multiple company web resources inaccessible during research

- Absence of native mobile apps limiting field recruitment

- Unclear SOC 2 certification status creating compliance gaps

One highlighted feature and why it's amazing

Using proprietary NLP technology, the platform performs semantic analysis beyond keyword matching .

Another highlighted feature of why it’s amazing

Automated candidate sourcing across 2,000+ job boards .

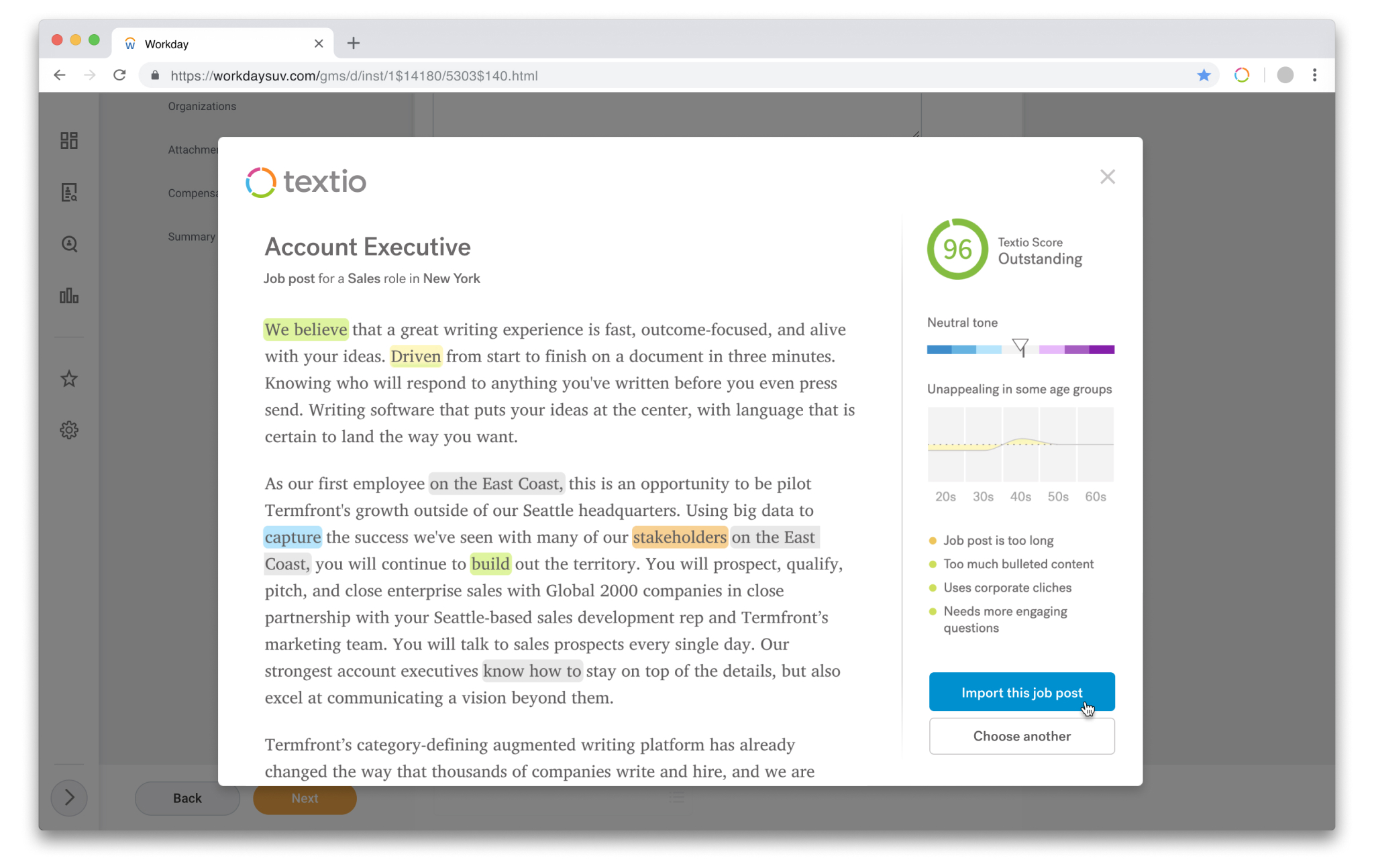

2. Textio

+Pros

- Proven bias reduction capabilities with documented 17% increases in women applicants

- Rapid deployment through browser extension integration

- Real-time optimization capabilities through gender meters and age graphs

-Cons

- Specialized focus may require integration with broader talent management systems

- Chrome extension dependency for some ATS integrations creates potential compatibility constraints

One highlighted feature and why it's amazing

Provides predictive grading for recruitment communications based on correlation with successful hiring outcomes.

Another highlighted feature of why it’s amazing

Gender meters and age graphs allow HR teams to understand how language choices impact different candidate segments.

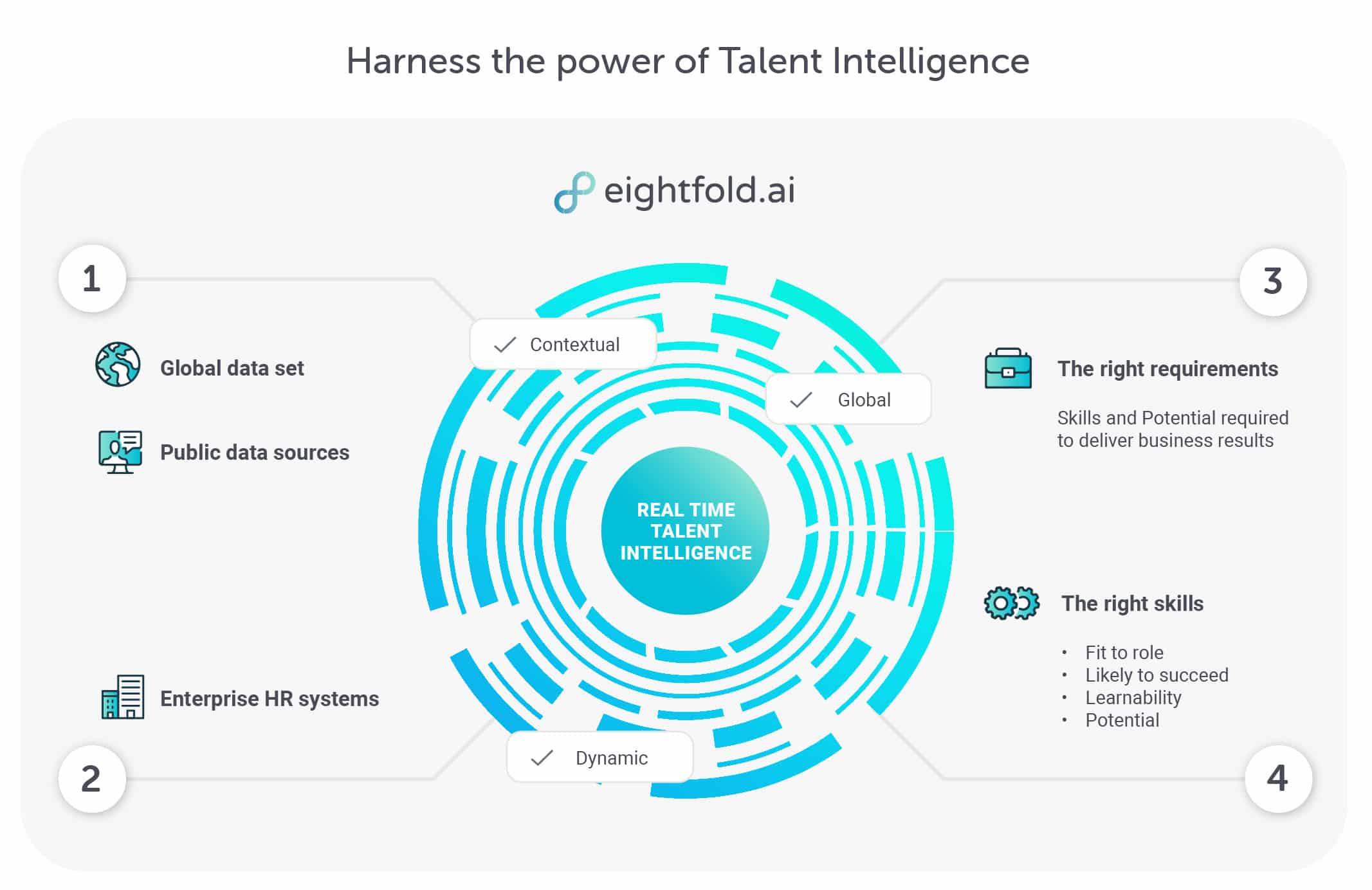

3. Eightfold AI

+Pros

- Validated bias mitigation capabilities with measurable proof through the 1,213-interview gender bias elimination study.

- Proven diversity outcomes with a 47% increase in diverse hires within the first year.

- Enterprise-scale capabilities including ≥10,000 applications daily processing capacity.

-Cons

- Implementation complexity requiring substantial organizational resources including 5.1 FTE for configuration and 6.0 FTE for training.

- Integration challenges with some ATS systems creating deployment risks.

- Cost barriers through enterprise-focused pricing starting at $650/month for core modules.

One highlighted feature and why it's amazing

Leverages patented algorithms to analyze candidate skills, experience patterns, and career trajectory potential. The platform processes both traditional qualifications and non-traditional indicators like volunteer work and personal projects.

Another highlighted feature of why it’s amazing

Automatically removes gender, age, and educational institution identifiers during initial screening, ensuring evaluation focuses purely on skills and potential. Validation across 1,213 interview selections demonstrated complete elimination of gender bias.

Other Alternatives

iCIMS Talent Cloud with AI Copilot for HR

Paradox

Phenom TXM Platform

HireVue Video Interviewing Platform

Leoforce Arya AI Sourcing Platform

How We Researched This Guide

About This Guide: This comprehensive analysis is based on extensive competitive intelligence and real-world implementation data from leading AI vendors. StayModern updates this guide quarterly to reflect market developments and vendor performance changes.

204+ verified sources per analysis including official documentation, customer reviews, analyst reports, and industry publications.

- • Vendor documentation & whitepapers

- • Customer testimonials & case studies

- • Third-party analyst assessments

- • Industry benchmarking reports

Standardized assessment framework across 8 key dimensions for objective comparison.

- • Technology capabilities & architecture

- • Market position & customer evidence

- • Implementation experience & support

- • Pricing value & competitive position

Research is refreshed every 90 days to capture market changes and new vendor capabilities.

- • New product releases & features

- • Market positioning changes

- • Customer feedback integration

- • Competitive landscape shifts

Every claim is source-linked with direct citations to original materials for verification.

- • Clickable citation links

- • Original source attribution

- • Date stamps for currency

- • Quality score validation

Analysis follows systematic research protocols with consistent evaluation frameworks.

- • Standardized assessment criteria

- • Multi-source verification process

- • Consistent evaluation methodology

- • Quality assurance protocols

Buyer-focused analysis with transparent methodology and factual accuracy commitment.

- • Objective comparative analysis

- • Transparent research methodology

- • Factual accuracy commitment

- • Continuous quality improvement

Quality Commitment: If you find any inaccuracies in our analysis on this page, please contact us at research@staymodern.ai. We're committed to maintaining the highest standards of research integrity and will investigate and correct any issues promptly.