Alternatives to Ordoro

1. ChannelAdvisor

+Pros

- Comprehensive marketplace reach with 420+ integrations.

- AI-driven inventory orchestration achieving 99.5% accuracy rates.

- Proven enterprise scalability demonstrated through implementations like American Apparel's 750-store deployment.

-Cons

- Substantial implementation complexity requiring 4-7 months with 10+ full-time employees.

- Cost competitiveness with CedCommerce offering similar capabilities at $499/year versus ChannelAdvisor's premium pricing structure.

- Data preparation requirements consuming 50% of implementation effort.

One highlighted feature and why it's amazing

Utilizes RFID and WMS integrations to maintain 99.5% inventory accuracy across channels, preventing overselling issues.

Another highlighted feature of why it’s amazing

Leverages sophisticated AI algorithms that achieve 85-90% efficiency in margin optimization compared to 60-70% for traditional rule-based systems.

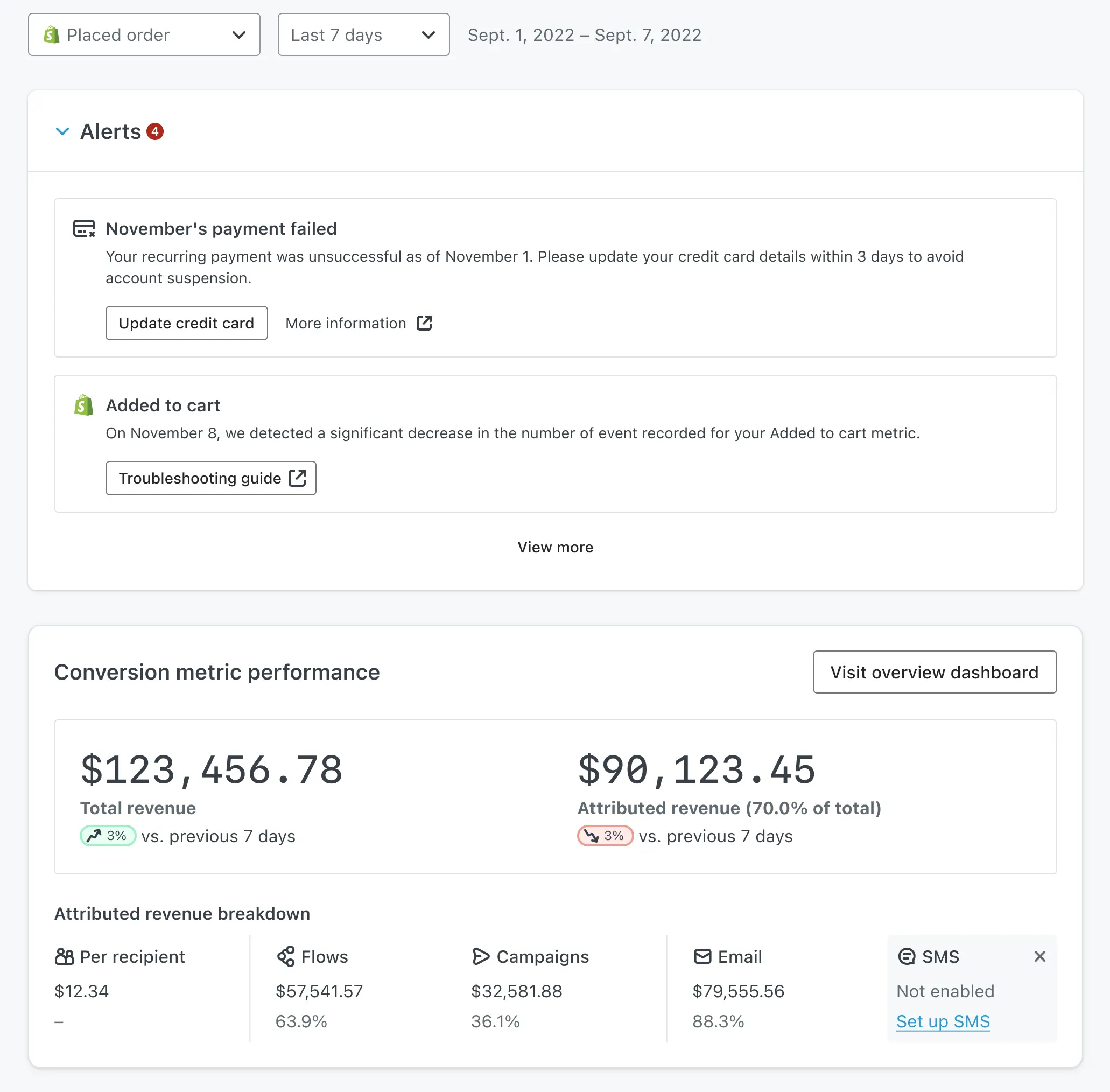

2. Klaviyo

+Pros

- Unified marketing automation combining email, SMS, and review management with AI-powered personalization .

- Deep Shopify integration providing automated data sync and behavioral tracking .

- Proven ROI delivery across multiple customer implementations .

-Cons

- Implementation complexity despite moderate technical ratings .

- Active profile billing methodology can penalize businesses with large but inactive customer databases .

- 90-day 'suppression jail' limits reactivation of unengaged contacts .

One highlighted feature and why it's amazing

Transforms audience building from manual rule configuration to natural language interaction, enabling complex behavioral targeting without requiring technical expertise .

Another highlighted feature of why it’s amazing

Generate personalized content while maintaining brand voice consistency through machine learning models trained on existing brand communications .

3. Sellbrite

+Pros

- Specialized Amazon FBA integration and operational reliability for multichannel inventory management.

- Cost-effectiveness with $49-$149/month pricing.

-Cons

- Absence of AI-powered features like dynamic pricing, predictive demand forecasting, or personalized customer experiences.

- Limited reporting capabilities requiring separate analytics tools.

One highlighted feature and why it's amazing

Designed specifically for Amazon FBA sellers expanding to additional marketplaces.

Another highlighted feature of why it’s amazing

Automatically syncs Multi-Channel Fulfillment (MCF) inventory across connected channels including eBay, Etsy, and Walmart.

Other Alternatives

Skubana

Zentail

How We Researched This Guide

About This Guide: This comprehensive analysis is based on extensive competitive intelligence and real-world implementation data from leading AI vendors. StayModern updates this guide quarterly to reflect market developments and vendor performance changes.

211+ verified sources per analysis including official documentation, customer reviews, analyst reports, and industry publications.

- • Vendor documentation & whitepapers

- • Customer testimonials & case studies

- • Third-party analyst assessments

- • Industry benchmarking reports

Standardized assessment framework across 8 key dimensions for objective comparison.

- • Technology capabilities & architecture

- • Market position & customer evidence

- • Implementation experience & support

- • Pricing value & competitive position

Research is refreshed every 90 days to capture market changes and new vendor capabilities.

- • New product releases & features

- • Market positioning changes

- • Customer feedback integration

- • Competitive landscape shifts

Every claim is source-linked with direct citations to original materials for verification.

- • Clickable citation links

- • Original source attribution

- • Date stamps for currency

- • Quality score validation

Analysis follows systematic research protocols with consistent evaluation frameworks.

- • Standardized assessment criteria

- • Multi-source verification process

- • Consistent evaluation methodology

- • Quality assurance protocols

Buyer-focused analysis with transparent methodology and factual accuracy commitment.

- • Objective comparative analysis

- • Transparent research methodology

- • Factual accuracy commitment

- • Continuous quality improvement

Quality Commitment: If you find any inaccuracies in our analysis on this page, please contact us at research@staymodern.ai. We're committed to maintaining the highest standards of research integrity and will investigate and correct any issues promptly.