Alternatives to Google Vertex AI Vision

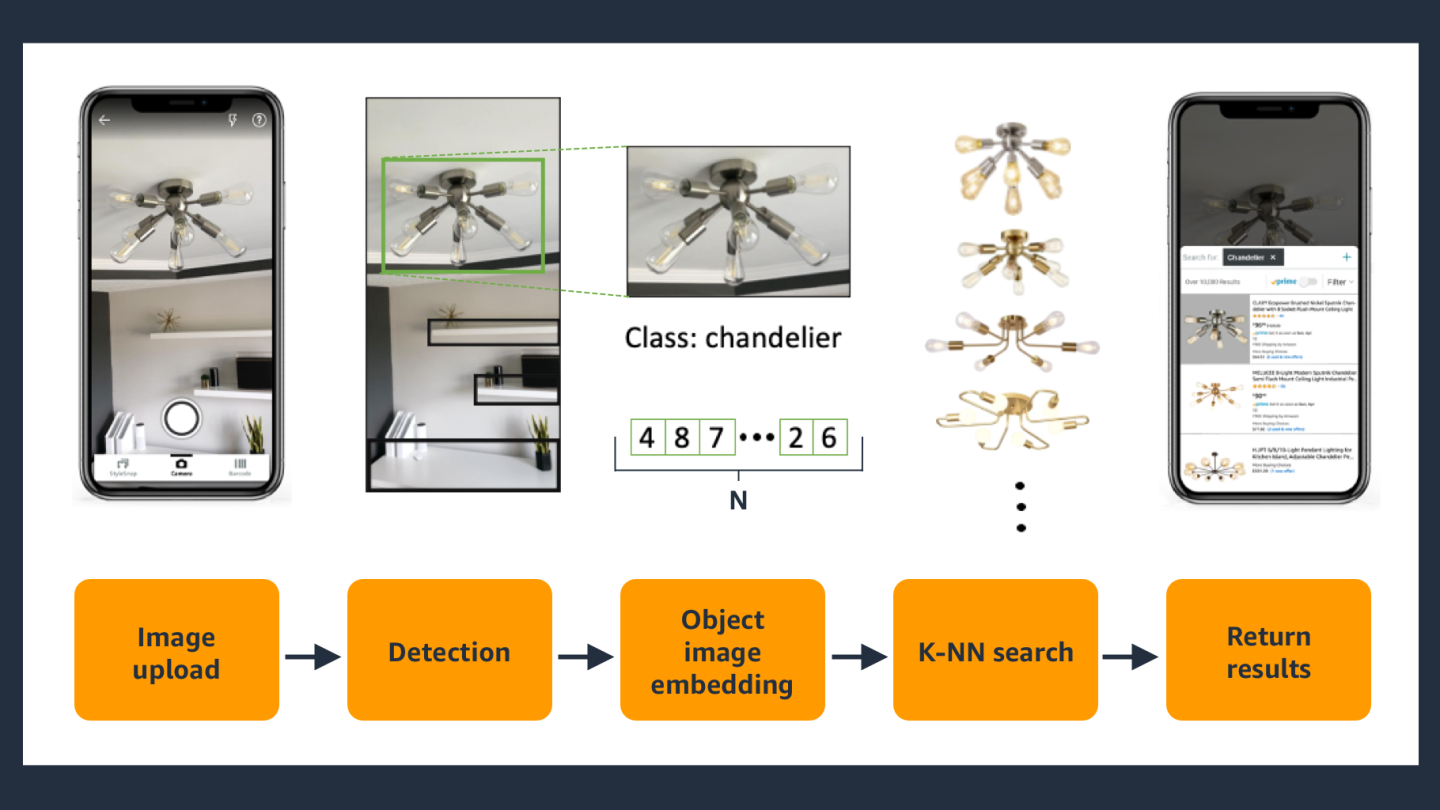

1. Amazon StyleSnap

+Pros

- Seamless integration within Amazon's ecosystem

- Zero direct cost model

- Multi-category processing across fashion and home goods

- Enhanced angle-invariant recognition through 3D product models

-Cons

- Catalog restriction to Amazon's inventory

- Performance inconsistencies with accessories like hats and sunglasses

- Struggles with low-light images

- Occasionally produces mismatched recommendations for abstract concepts

One highlighted feature and why it's amazing

StyleSnap employs sophisticated convolutional neural networks that analyze multiple apparel attributes including color, pattern, and fit across comprehensive product categories spanning dresses, tops, bottoms, shoes, and bags in both womenswear and menswear.

Another highlighted feature of why it’s amazing

The platform extends beyond fashion into home goods, enabling furniture identification through screenshot uploads and demonstrating versatile AI capabilities.

2. Clarifai

+Pros

- Hybrid deployment flexibility supporting cloud, on-premises, and edge environments

- Transparent token-based pricing ($0.0012–$0.07 per request) providing clearer cost structure than enterprise competitors

- Proven retail specialization delivering 3x higher visual search accuracy compared to generic alternatives

-Cons

- Scale constraints compared to Google Vision API and AWS Rekognition may limit suitability for enterprise deployments requiring millions of daily image processing operations

- Resource requirements demanding 3-5 dedicated ML engineers for custom model development exceed capabilities of organizations lacking internal AI expertise

One highlighted feature and why it's amazing

Center on image classification, object detection, and similarity matching through deep learning models optimized for ecommerce applications. The platform processes visual data through proprietary neural networks, delivering 3x higher visual search accuracy compared to generic alternatives in documented retail implementations.

Another highlighted feature of why it’s amazing

Features enable automated compliance for marketplace operators, achieving 98% accuracy in detecting luxury brands like Louis Vuitton and Chanel in optimal conditions. NSFW detection capabilities reduce manual review workload, as demonstrated in 9GAG's implementation.

3. Microsoft Azure Computer Vision

+Pros

- Comprehensive compliance framework with FIPS 140-2 validation

- Hybrid deployment architecture

- Enterprise ecosystem integration with Microsoft 365 and Azure services

-Cons

- Struggles with images below 36x36 pixel resolution

- Performs poorly in low lighting conditions below 50 lux

- Limited workflow integration with specialized design tools

One highlighted feature and why it's amazing

Azure Computer Vision provides comprehensive face detection with 27 landmark points, face verification for identity confirmation, and face identification against stored databases .

Another highlighted feature of why it’s amazing

The platform delivers sophisticated facial attribute analysis including age estimation, emotion detection, and facial hair recognition.

Other Alternatives

Nyris Visual Search

Slyce

How We Researched This Guide

About This Guide: This comprehensive analysis is based on extensive competitive intelligence and real-world implementation data from leading AI vendors. StayModern updates this guide quarterly to reflect market developments and vendor performance changes.

198+ verified sources per analysis including official documentation, customer reviews, analyst reports, and industry publications.

- • Vendor documentation & whitepapers

- • Customer testimonials & case studies

- • Third-party analyst assessments

- • Industry benchmarking reports

Standardized assessment framework across 8 key dimensions for objective comparison.

- • Technology capabilities & architecture

- • Market position & customer evidence

- • Implementation experience & support

- • Pricing value & competitive position

Research is refreshed every 90 days to capture market changes and new vendor capabilities.

- • New product releases & features

- • Market positioning changes

- • Customer feedback integration

- • Competitive landscape shifts

Every claim is source-linked with direct citations to original materials for verification.

- • Clickable citation links

- • Original source attribution

- • Date stamps for currency

- • Quality score validation

Analysis follows systematic research protocols with consistent evaluation frameworks.

- • Standardized assessment criteria

- • Multi-source verification process

- • Consistent evaluation methodology

- • Quality assurance protocols

Buyer-focused analysis with transparent methodology and factual accuracy commitment.

- • Objective comparative analysis

- • Transparent research methodology

- • Factual accuracy commitment

- • Continuous quality improvement

Quality Commitment: If you find any inaccuracies in our analysis on this page, please contact us at research@staymodern.ai. We're committed to maintaining the highest standards of research integrity and will investigate and correct any issues promptly.