Alternatives to Forter

1. DataVisor

+Pros

- Patented unsupervised machine learning technology

- Sub-100ms decision latency

- Comprehensive fraud detection capabilities

-Cons

- Implementation complexity requiring SQL expertise

- UI stability concerns noted in customer feedback

One highlighted feature and why it's amazing

Patented unsupervised machine learning to identify unknown fraud patterns without requiring historical labels or training data .

Another highlighted feature of why it’s amazing

Leverages generative AI for automated rule refinement and feature generation, reducing false positives while maintaining explainability .

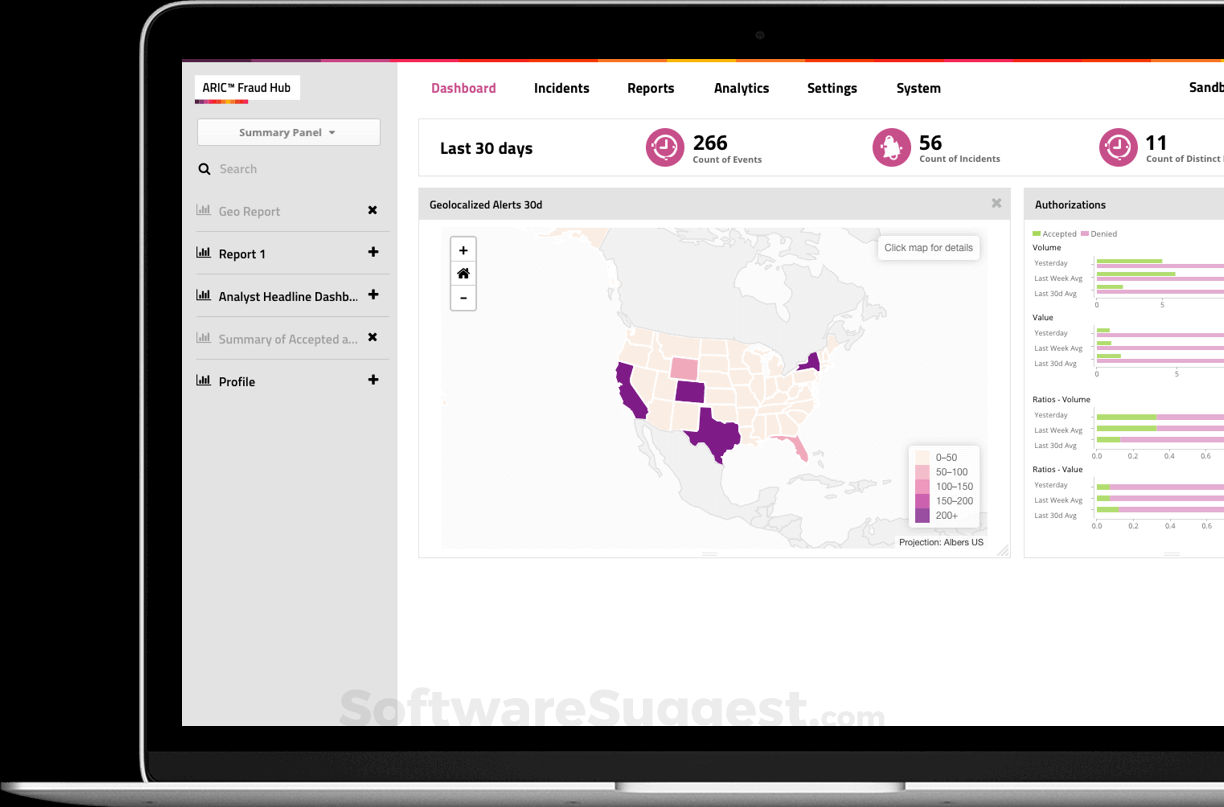

2. Featurespace ARIC

+Pros

- Sophisticated behavioral analytics capabilities that differentiate ARIC from traditional rule-based systems and network-effect competitors.

- Proven technical capabilities demonstrate enterprise-grade performance with documented 75% false positive reduction , 86% value detection rates at 5% false positive rates , and sub-200ms authorization processing for payment gateway integrations .

-Cons

- Critical limitations center on ecommerce market validation gaps.

- Implementation complexity presents significant constraints with enterprise deployments requiring 14-26 weeks and dedicated program management resources .

One highlighted feature and why it's amazing

Center on Adaptive Behavioral Analytics and Automated Deep Behavioral Networks that create individual customer profiles through real-time pattern analysis .

Another highlighted feature of why it’s amazing

Include real-time processing of 80+ data feeds including behavioral biometrics and third-party risk scores, enabling sub-200ms authorization decisions for payment gateway integrations .

3. Kount

+Pros

- Proven chargeback reduction capabilities with documented customer success .

- Dual-ML approach and policy customization engine provide sophisticated fraud detection .

-Cons

- Pricing transparency concerns that may complicate evaluation processes .

- Enterprise implementation complexity requiring 2-4 weeks with dedicated technical resources .

One highlighted feature and why it's amazing

Core AI capabilities center on Kount's dual-ML approach combining supervised and unsupervised machine learning to analyze transaction patterns and historical behaviors .

Another highlighted feature of why it’s amazing

Allows businesses to configure granular risk thresholds and outcomes including block, challenge, or decline actions based on specific transaction characteristics .

Other Alternatives

Ravelin

Riskified

Sift

Signifyd

How We Researched This Guide

About This Guide: This comprehensive analysis is based on extensive competitive intelligence and real-world implementation data from leading AI vendors. StayModern updates this guide quarterly to reflect market developments and vendor performance changes.

210+ verified sources per analysis including official documentation, customer reviews, analyst reports, and industry publications.

- • Vendor documentation & whitepapers

- • Customer testimonials & case studies

- • Third-party analyst assessments

- • Industry benchmarking reports

Standardized assessment framework across 8 key dimensions for objective comparison.

- • Technology capabilities & architecture

- • Market position & customer evidence

- • Implementation experience & support

- • Pricing value & competitive position

Research is refreshed every 90 days to capture market changes and new vendor capabilities.

- • New product releases & features

- • Market positioning changes

- • Customer feedback integration

- • Competitive landscape shifts

Every claim is source-linked with direct citations to original materials for verification.

- • Clickable citation links

- • Original source attribution

- • Date stamps for currency

- • Quality score validation

Analysis follows systematic research protocols with consistent evaluation frameworks.

- • Standardized assessment criteria

- • Multi-source verification process

- • Consistent evaluation methodology

- • Quality assurance protocols

Buyer-focused analysis with transparent methodology and factual accuracy commitment.

- • Objective comparative analysis

- • Transparent research methodology

- • Factual accuracy commitment

- • Continuous quality improvement

Quality Commitment: If you find any inaccuracies in our analysis on this page, please contact us at research@staymodern.ai. We're committed to maintaining the highest standards of research integrity and will investigate and correct any issues promptly.