Alternatives to Finale Inventory

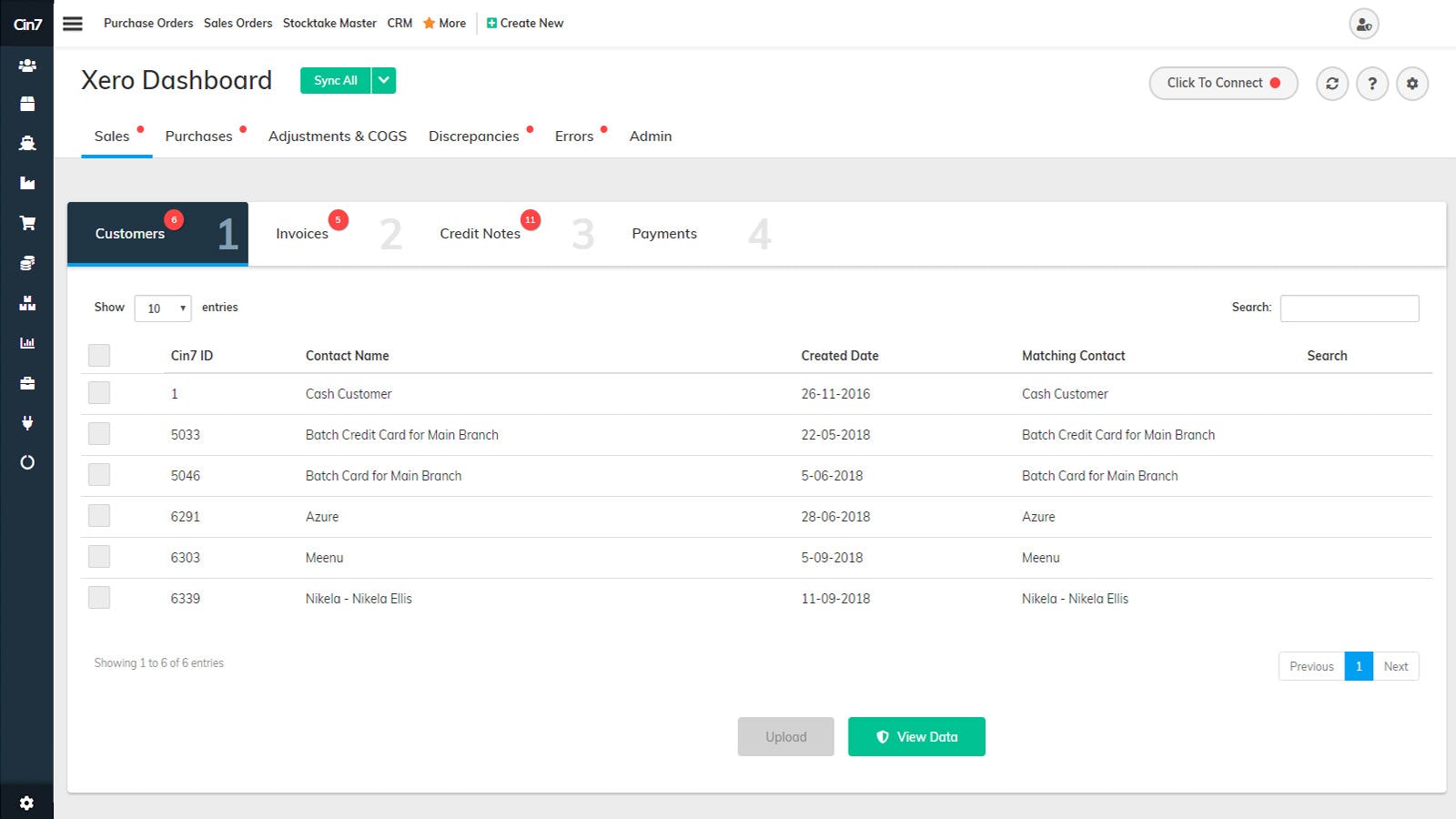

1. Cin7 Omni

+Pros

- AI-Driven Forecasting Excellence

- Native Integration Architecture

- Enterprise-Grade Scalability

- Proven Customer Outcomes

-Cons

- Implementation Complexity

- Pricing Volatility

- Customer Satisfaction Inconsistency

- Data Requirements

One highlighted feature and why it's amazing

Provides 24-month prediction capabilities with automated replenishment suggestions for businesses with adequate sales history.

Another highlighted feature of why it’s amazing

Distinguish Cin7 Omni from competitors requiring third-party middleware, providing real-time warehouse synchronization capabilities that reduce integration complexity.

2. ClickUp

+Pros

- Unified workspace approach consolidates project management, documentation, and communication tools within a single platform.

- ClickUp Brain's AI capabilities provide sophisticated automation and knowledge synthesis that surpasses many competitors.

- Proven ROI delivery with documented cases showing 1645% ROI in construction and 37% productivity gains in technology implementations.

- Customization flexibility through 15+ view types and advanced configuration options.

-Cons

- Mobile experience limitations with slow loading times and sync delays.

- Steep learning curve for advanced features requiring substantial training investment.

- Data quality dependencies affecting AI prediction accuracy.

- Performance variability based on implementation approach.

One highlighted feature and why it's amazing

Generates task descriptions, assigns directly responsible individuals (DRIs), and creates progress reports with minimal manual oversight.

Another highlighted feature of why it’s amazing

Scans entire workspaces to answer contextual queries by pulling relevant data from multiple sources simultaneously.

3. Katana Manufacturing ERP

Other Alternatives

NetSuite

Oracle Retail Merchandising

TradeGecko by QuickBooks Commerce

Unleashed Software

Zoho Inventory

How We Researched This Guide

About This Guide: This comprehensive analysis is based on extensive competitive intelligence and real-world implementation data from leading AI vendors. StayModern updates this guide quarterly to reflect market developments and vendor performance changes.

208+ verified sources per analysis including official documentation, customer reviews, analyst reports, and industry publications.

- • Vendor documentation & whitepapers

- • Customer testimonials & case studies

- • Third-party analyst assessments

- • Industry benchmarking reports

Standardized assessment framework across 8 key dimensions for objective comparison.

- • Technology capabilities & architecture

- • Market position & customer evidence

- • Implementation experience & support

- • Pricing value & competitive position

Research is refreshed every 90 days to capture market changes and new vendor capabilities.

- • New product releases & features

- • Market positioning changes

- • Customer feedback integration

- • Competitive landscape shifts

Every claim is source-linked with direct citations to original materials for verification.

- • Clickable citation links

- • Original source attribution

- • Date stamps for currency

- • Quality score validation

Analysis follows systematic research protocols with consistent evaluation frameworks.

- • Standardized assessment criteria

- • Multi-source verification process

- • Consistent evaluation methodology

- • Quality assurance protocols

Buyer-focused analysis with transparent methodology and factual accuracy commitment.

- • Objective comparative analysis

- • Transparent research methodology

- • Factual accuracy commitment

- • Continuous quality improvement

Quality Commitment: If you find any inaccuracies in our analysis on this page, please contact us at research@staymodern.ai. We're committed to maintaining the highest standards of research integrity and will investigate and correct any issues promptly.