Alternatives to Clarifai

1. Bloomreach Discovery

+Pros

- Commerce-Specific AI Expertise with Loomi AI engine trained on over 14 years of commerce data.

- Proven Performance Results with consistent value delivery across diverse customer implementations.

- Enterprise-Scale Technical Architecture with server-side execution and 24/7 enterprise SLA coverage.

- Automated Merchandising Capabilities reducing manual operational tasks by 30-50%.

-Cons

- Implementation Complexity with enterprise deployments requiring 20+ weeks for custom Java integrations.

- Pricing Volatility Concerns with unexpected price changes during contract periods.

- Limited Front-End Flexibility compared to alternatives like Algolia.

- Reliability Risks with documented outages during holiday code freezes.

One highlighted feature and why it's amazing

Uses natural language processing to interpret contextual queries, successfully distinguishing between similar terms like 'dress shirt' versus 'shirt dress'.

Another highlighted feature of why it’s amazing

Combines real-time user behavior with historical data to dynamically adjust search results and category pages for individual users.

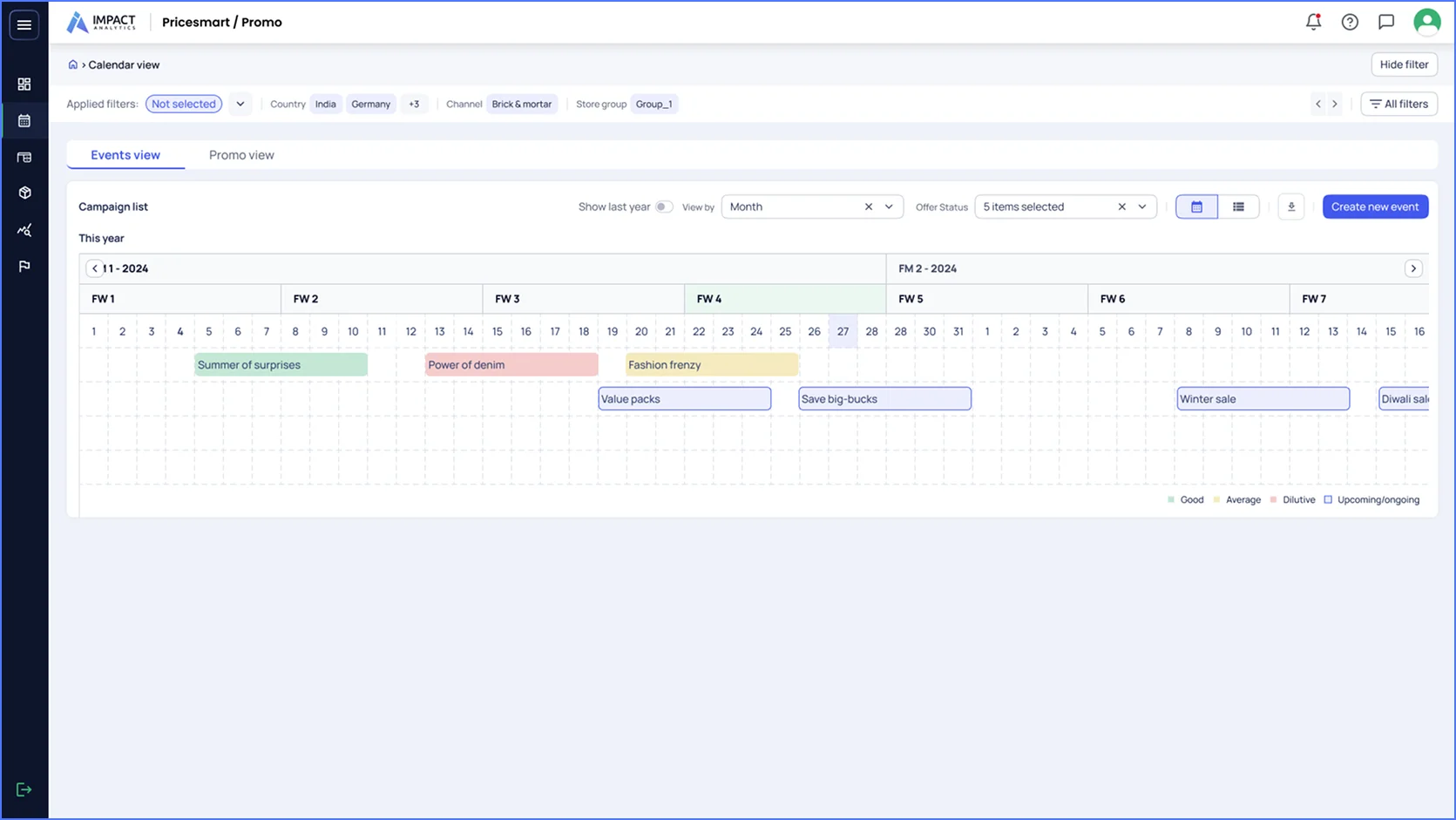

2. Impact Analytics AttributeSmart

+Pros

- Comprehensive platform approach enabling product attributes to support multiple business processes beyond basic catalog management

- Pre-trained library of over 10,000 attributes across diverse product categories provides potential deployment advantages

- Claimed 95%+ accuracy and 60% cost savings suggest strong technical and economic performance

-Cons

- Limited verifiable customer evidence compared to established competitors with documented success stories

- Lack of transparent pricing information complicates budget planning and ROI analysis for prospective buyers

One highlighted feature and why it's amazing

Automated attribute generation from multiple data sources using computer vision algorithms for image analysis, natural language processing for text interpretation, and neural network models for consistency validation.

Another highlighted feature of why it’s amazing

Pre-trained library of over 10,000 attributes across diverse product categories, enabling rapid deployment without extensive training data requirements.

3. Lily AI

+Pros

- Customer-centric attribute approach provides clear differentiation from traditional merchant-focused tagging systems.

- Proven performance outcomes demonstrate measurable business impact.

- Rapid implementation capabilities through the Shopify integration enable 'one-click' deployment with minimal technical resources.

- Continuous learning functionality adapts to changing consumer language patterns.

-Cons

- Vertical specialization limits the platform's applicability to fashion, home goods, and beauty categories.

- Proprietary taxonomy dependency could create vendor lock-in concerns.

- Pricing transparency limitations require direct vendor engagement for cost assessment.

- Data quality dependencies mean that poor input images or descriptions may limit AI accuracy.

One highlighted feature and why it's amazing

Bridges the gap between merchant language and actual shopper search behavior with a proprietary taxonomy of 25,000+ customer-oriented attributes.

Another highlighted feature of why it’s amazing

Processes product photography to extract visual attributes including color, pattern, and style characteristics.

Other Alternatives

Syte.ai Visual Discovery

Tagalys

YesPlz AI

How We Researched This Guide

About This Guide: This comprehensive analysis is based on extensive competitive intelligence and real-world implementation data from leading AI vendors. StayModern updates this guide quarterly to reflect market developments and vendor performance changes.

211+ verified sources per analysis including official documentation, customer reviews, analyst reports, and industry publications.

- • Vendor documentation & whitepapers

- • Customer testimonials & case studies

- • Third-party analyst assessments

- • Industry benchmarking reports

Standardized assessment framework across 8 key dimensions for objective comparison.

- • Technology capabilities & architecture

- • Market position & customer evidence

- • Implementation experience & support

- • Pricing value & competitive position

Research is refreshed every 90 days to capture market changes and new vendor capabilities.

- • New product releases & features

- • Market positioning changes

- • Customer feedback integration

- • Competitive landscape shifts

Every claim is source-linked with direct citations to original materials for verification.

- • Clickable citation links

- • Original source attribution

- • Date stamps for currency

- • Quality score validation

Analysis follows systematic research protocols with consistent evaluation frameworks.

- • Standardized assessment criteria

- • Multi-source verification process

- • Consistent evaluation methodology

- • Quality assurance protocols

Buyer-focused analysis with transparent methodology and factual accuracy commitment.

- • Objective comparative analysis

- • Transparent research methodology

- • Factual accuracy commitment

- • Continuous quality improvement

Quality Commitment: If you find any inaccuracies in our analysis on this page, please contact us at research@staymodern.ai. We're committed to maintaining the highest standards of research integrity and will investigate and correct any issues promptly.