Alternatives to Centric PLM

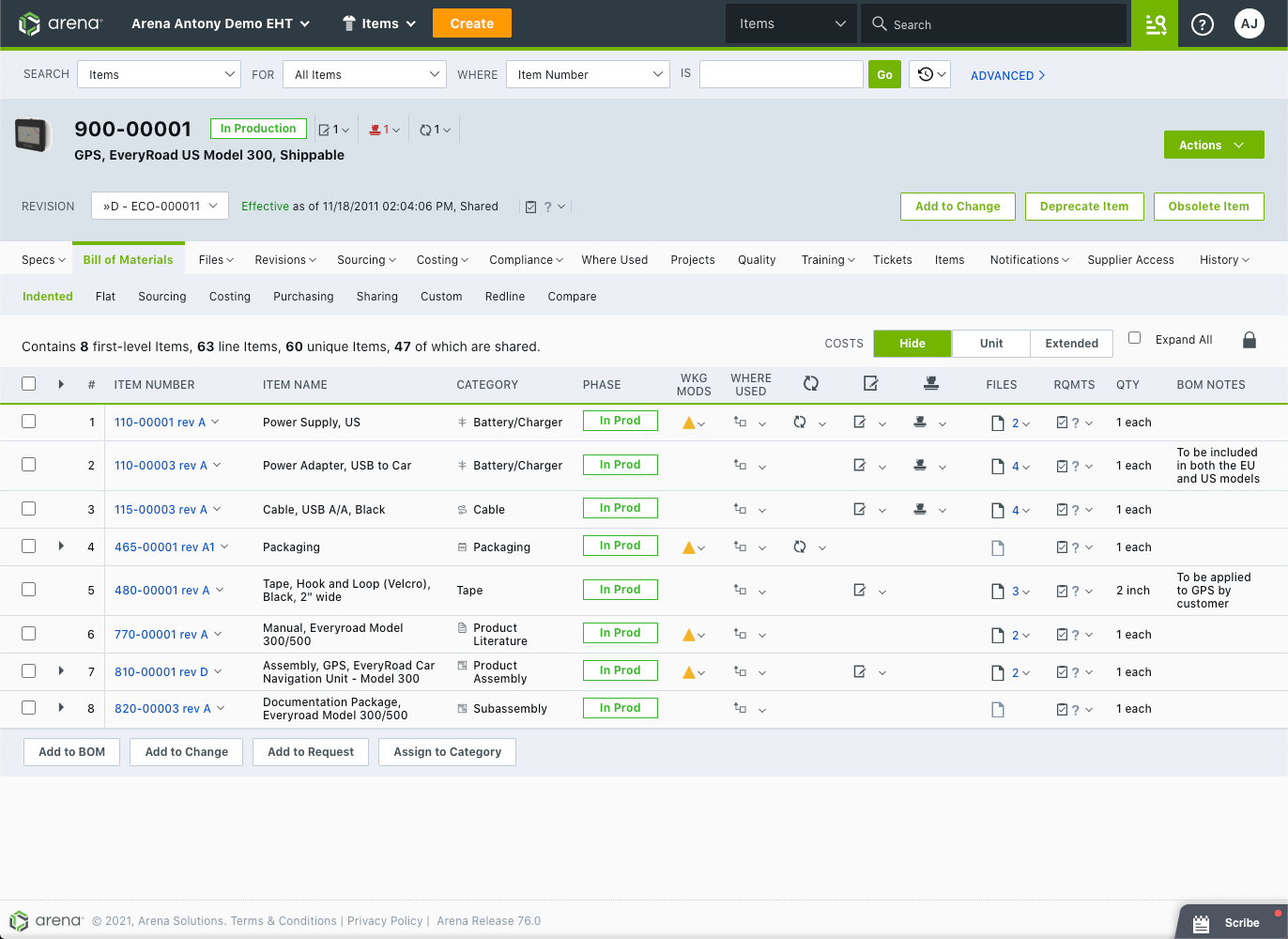

1. Arena Solutions

+Pros

- Rapid deployment capabilities

- Regulatory compliance automation

- Cloud-native architecture

- User-friendly interface

-Cons

- Limited AI capabilities

- Scalability concerns

- Integration constraints with legacy systems

- User experience challenges

One highlighted feature and why it's amazing

Provides unified BOM management, automated workflow routing, and supply chain collaboration tools built specifically for cloud deployment .

Another highlighted feature of why it’s amazing

Particularly FDA 21 CFR Part 11 compliance and ISO documentation requirements for medical device manufacturers .

2. Autodesk Fusion Lifecycle

+Pros

- Native CAD-PLM integration with Autodesk's design ecosystem

- Configurable workflows provide change management flexibility

- Cloud-native architecture offers accessibility advantages for distributed teams

-Cons

- Many marketed 'AI features' represent rules-based automation rather than genuine machine learning

- Performance limitations emerge when handling large assemblies or high SKU volumes

- Limited native ecommerce platform integration requires middleware solutions

One highlighted feature and why it's amazing

Centralized BOM management with supplier collaboration features .

Another highlighted feature of why it’s amazing

Automated change control processes that reduce ECO processing time .

Other Alternatives

Oracle Agile PLM

PTC Windchill/FlexPLM

Propel

Siemens Teamcenter

How We Researched This Guide

About This Guide: This comprehensive analysis is based on extensive competitive intelligence and real-world implementation data from leading AI vendors. StayModern updates this guide quarterly to reflect market developments and vendor performance changes.

292+ verified sources per analysis including official documentation, customer reviews, analyst reports, and industry publications.

- • Vendor documentation & whitepapers

- • Customer testimonials & case studies

- • Third-party analyst assessments

- • Industry benchmarking reports

Standardized assessment framework across 8 key dimensions for objective comparison.

- • Technology capabilities & architecture

- • Market position & customer evidence

- • Implementation experience & support

- • Pricing value & competitive position

Research is refreshed every 90 days to capture market changes and new vendor capabilities.

- • New product releases & features

- • Market positioning changes

- • Customer feedback integration

- • Competitive landscape shifts

Every claim is source-linked with direct citations to original materials for verification.

- • Clickable citation links

- • Original source attribution

- • Date stamps for currency

- • Quality score validation

Analysis follows systematic research protocols with consistent evaluation frameworks.

- • Standardized assessment criteria

- • Multi-source verification process

- • Consistent evaluation methodology

- • Quality assurance protocols

Buyer-focused analysis with transparent methodology and factual accuracy commitment.

- • Objective comparative analysis

- • Transparent research methodology

- • Factual accuracy commitment

- • Continuous quality improvement

Quality Commitment: If you find any inaccuracies in our analysis on this page, please contact us at research@staymodern.ai. We're committed to maintaining the highest standards of research integrity and will investigate and correct any issues promptly.