Alternatives to Blue Yonder Fulfillment & Replenishment

1. Inventoro

+Pros

- Cost-Effective Positioning: Turnover-based pricing model makes AI forecasting accessible for SMB ecommerce retailers.

- Integration Simplicity: Pre-built connectors for Shopify, Square, and Exact enable rapid deployment without custom development.

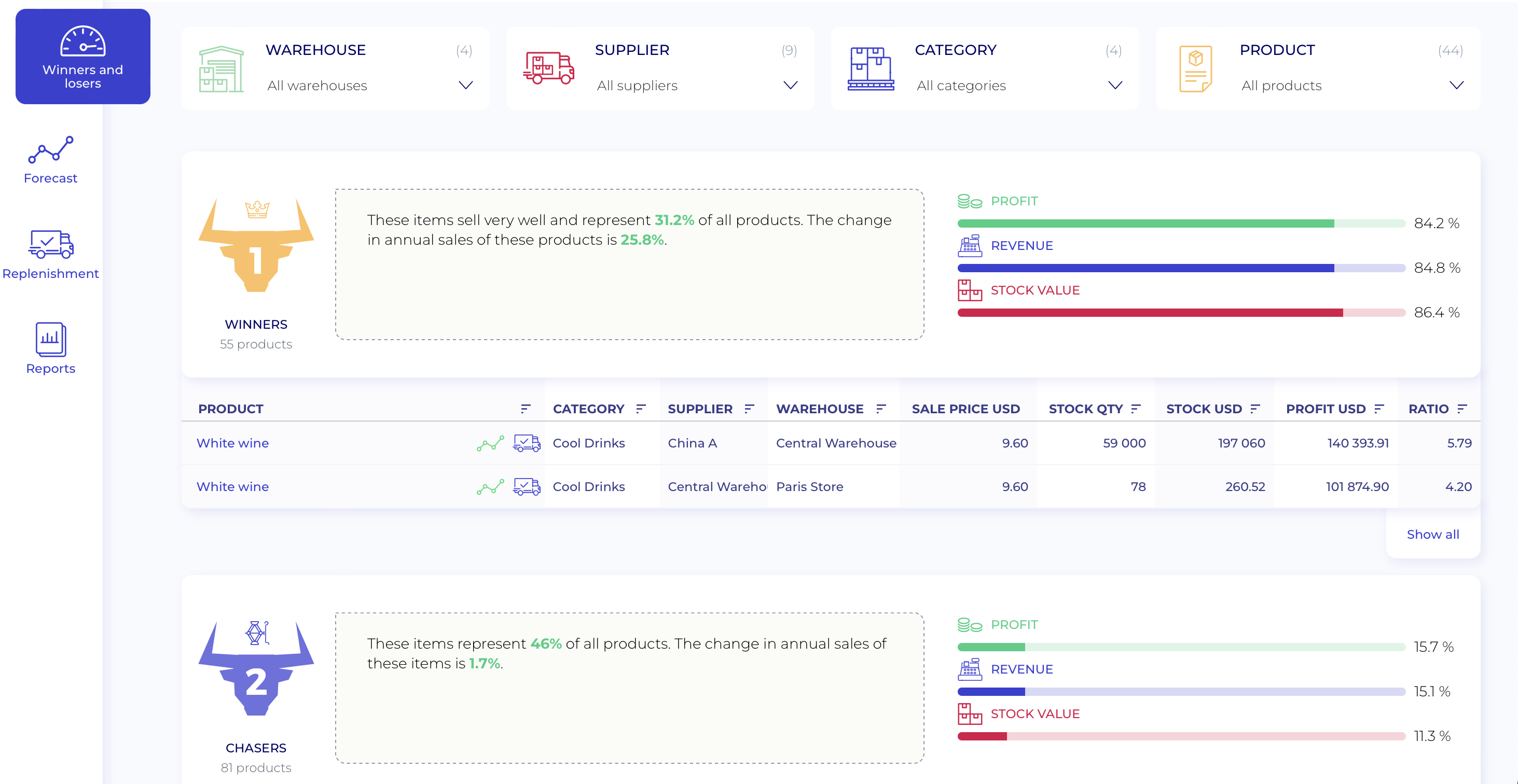

- Practical Segmentation: Three-category product classification (Winners, Chasers, Losers) provides actionable inventory insights.

- Operational Efficiency: Demonstrated time savings of up to 20 hours per week through automated replenishment.

- Measurable Impact: Customer evidence shows up to 40% inventory reduction and potential 5% revenue growth.

-Cons

- Limited External Data Integration: Minimal incorporation of social media trends, weather patterns, or economic indicators compared to enterprise solutions.

- Forecasting Sophistication: Lacks advanced features like multi-echelon optimization, sophisticated demand sensing, or comprehensive scenario modeling.

- Scalability Constraints: May be insufficient for larger ecommerce businesses with complex supply chain requirements.

- Industry Specialization: Apparel retailers requiring size-level forecasting or businesses with perishable inventory may find capabilities insufficient.

- Support Limitations: Enterprise-level support options appear limited, potentially constraining scalability for larger deployments.

One highlighted feature and why it's amazing

Algorithms analyze historical sales patterns to generate demand predictions and replenishment recommendations.

Another highlighted feature of why it’s amazing

System adapts forecasts during demand fluctuations to maintain accuracy.

2. Kinaxis RapidResponse

+Pros

- Concurrent planning architecture enables simultaneous optimization across supply chain functions.

- Proven enterprise capabilities with documented success in complex operational environments.

- Advanced AI integration through Demand.AI and Maestro AI agents provides sophisticated forecasting and workflow automation capabilities.

-Cons

- Limited ecommerce-specific validation with primary evidence from manufacturing implementations.

- Implementation complexity requiring 6-9 months for enterprise deployments.

- Enterprise pricing structure excludes many mid-market ecommerce businesses.

One highlighted feature and why it's amazing

Enables simultaneous optimization across demand, supply, and inventory functions rather than the siloed approaches used by traditional ERP systems.

Another highlighted feature of why it’s amazing

Delivers advanced forecasting capabilities that can reduce forecast errors by 20-50% under stable conditions, though users report challenges with AI interpretability during market volatility.

3. Logility

+Pros

- Gartner Leader recognition and 94% customer satisfaction rating demonstrate proven market acceptance and technical capabilities.

- AI transparency through DemandAI+'s visualization of demand drivers addresses buyer concerns about black-box forecasting while maintaining sophisticated enterprise capabilities.

- Documented performance improvements include 25-50% forecast error reduction and 10-20% inventory cost reductions across client implementations.

-Cons

- Implementation complexity with 3-6 month deployment timelines requiring mature ERP integration capabilities and substantial training investment.

- Data quality dependencies create implementation risks, as the platform performs optimally with clean, comprehensive historical data spanning multiple demand cycles.

- Enterprise focus may introduce unnecessary complexity for smaller retailers, while the custom pricing model makes cost evaluation challenging compared to transparent mid-market alternatives.

One highlighted feature and why it's amazing

Serves as Logility's core inventory optimization engine, analyzing transactional data to reconcile master data with actuals while providing dynamic inventory recommendations.

Another highlighted feature of why it’s amazing

Incorporates real-time data sources including POS, social sentiment, and weather patterns to generate dynamic forecasts that adapt to changing market conditions.

Other Alternatives

Lokad

How We Researched This Guide

About This Guide: This comprehensive analysis is based on extensive competitive intelligence and real-world implementation data from leading AI vendors. StayModern updates this guide quarterly to reflect market developments and vendor performance changes.

204+ verified sources per analysis including official documentation, customer reviews, analyst reports, and industry publications.

- • Vendor documentation & whitepapers

- • Customer testimonials & case studies

- • Third-party analyst assessments

- • Industry benchmarking reports

Standardized assessment framework across 8 key dimensions for objective comparison.

- • Technology capabilities & architecture

- • Market position & customer evidence

- • Implementation experience & support

- • Pricing value & competitive position

Research is refreshed every 90 days to capture market changes and new vendor capabilities.

- • New product releases & features

- • Market positioning changes

- • Customer feedback integration

- • Competitive landscape shifts

Every claim is source-linked with direct citations to original materials for verification.

- • Clickable citation links

- • Original source attribution

- • Date stamps for currency

- • Quality score validation

Analysis follows systematic research protocols with consistent evaluation frameworks.

- • Standardized assessment criteria

- • Multi-source verification process

- • Consistent evaluation methodology

- • Quality assurance protocols

Buyer-focused analysis with transparent methodology and factual accuracy commitment.

- • Objective comparative analysis

- • Transparent research methodology

- • Factual accuracy commitment

- • Continuous quality improvement

Quality Commitment: If you find any inaccuracies in our analysis on this page, please contact us at research@staymodern.ai. We're committed to maintaining the highest standards of research integrity and will investigate and correct any issues promptly.