Alternatives to Bill.com

1. Ramp

+Pros

- Template-Free Extraction Technology eliminates extensive setup and configuration .

- Rapid Deployment Capabilities deliver SMB implementations in 2-4 weeks .

- Proven Performance Metrics include processing time reductions from 5-8 minutes to 1-2 minutes per invoice .

-Cons

- OCR Accuracy Constraints affect 15% of transactions involving handwritten or complex documents .

- Mobile Approval Experience represents an area noted for improvement in user feedback .

One highlighted feature and why it's amazing

AI that suggests GL codes without pre-mapped templates .

Another highlighted feature of why it’s amazing

Delivers measurable processing improvements, reducing invoice handling from 5-8 minutes to 1-2 minutes per invoice .

2. Rossum

+Pros

- Template-Free Processing Leadership

- Proven Enterprise-Scale Performance

- Sophisticated ERP Integration

- IDC MarketScape Leader Recognition

-Cons

- Enterprise-Tier Investment Requirements

- Implementation Complexity and Timeline

- Change Management Challenges

- Document Format Limitations

One highlighted feature and why it's amazing

Utilizing the proprietary Aurora engine trained on millions of invoices to automatically adapt to diverse document formats without manual configuration.

Another highlighted feature of why it’s amazing

Provides real-time validation against ERP records, addressing critical reconciliation challenges that affect 30% of invoices in typical operations.

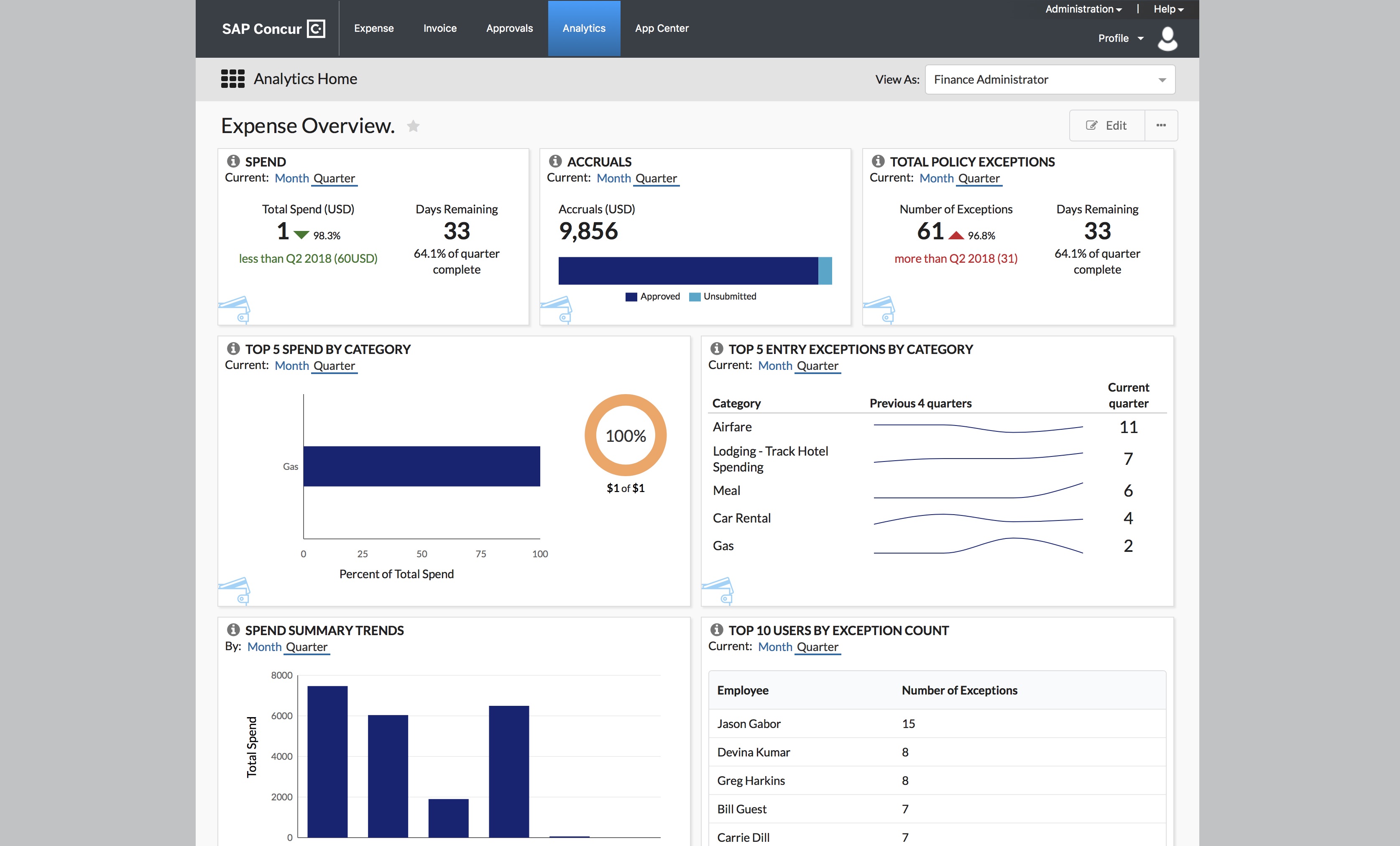

3. SAP Concur

+Pros

- Market-leading integration capabilities

- Proven enterprise scalability

- Advanced AI capabilities

- Comprehensive compliance features

-Cons

- Potential scalability constraints beyond 400 monthly invoices

- Cost structure challenges with premium pricing

- User experience concerns with UX complexity

One highlighted feature and why it's amazing

Leverages template-free data extraction that automatically captures vendor information, line items, and compliance details from diverse document formats without requiring pre-configured templates.

Another highlighted feature of why it’s amazing

Distinguishes SAP Concur from point solutions by providing unified travel, expense, and invoice management within a single platform.

Other Alternatives

Stampli

Tipalti

UiPath

Yooz

How We Researched This Guide

About This Guide: This comprehensive analysis is based on extensive competitive intelligence and real-world implementation data from leading AI vendors. StayModern updates this guide quarterly to reflect market developments and vendor performance changes.

248+ verified sources per analysis including official documentation, customer reviews, analyst reports, and industry publications.

- • Vendor documentation & whitepapers

- • Customer testimonials & case studies

- • Third-party analyst assessments

- • Industry benchmarking reports

Standardized assessment framework across 8 key dimensions for objective comparison.

- • Technology capabilities & architecture

- • Market position & customer evidence

- • Implementation experience & support

- • Pricing value & competitive position

Research is refreshed every 90 days to capture market changes and new vendor capabilities.

- • New product releases & features

- • Market positioning changes

- • Customer feedback integration

- • Competitive landscape shifts

Every claim is source-linked with direct citations to original materials for verification.

- • Clickable citation links

- • Original source attribution

- • Date stamps for currency

- • Quality score validation

Analysis follows systematic research protocols with consistent evaluation frameworks.

- • Standardized assessment criteria

- • Multi-source verification process

- • Consistent evaluation methodology

- • Quality assurance protocols

Buyer-focused analysis with transparent methodology and factual accuracy commitment.

- • Objective comparative analysis

- • Transparent research methodology

- • Factual accuracy commitment

- • Continuous quality improvement

Quality Commitment: If you find any inaccuracies in our analysis on this page, please contact us at research@staymodern.ai. We're committed to maintaining the highest standards of research integrity and will investigate and correct any issues promptly.