Alternatives to Baremetrics

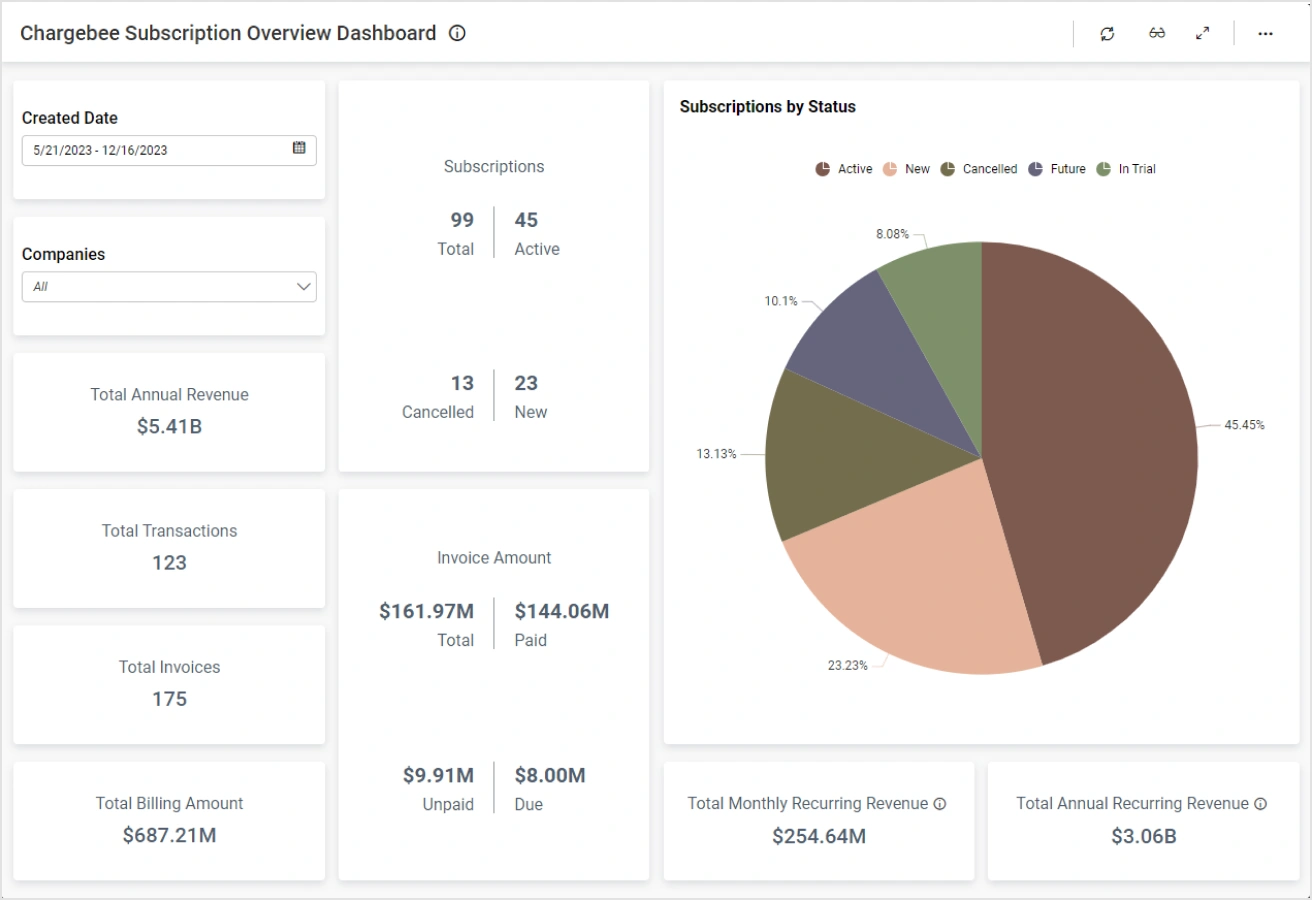

1. Chargebee

+Pros

- Comprehensive global compliance capabilities supporting 180+ currencies with automated VAT/GST calculation

- AI-driven churn prediction with documented customer success

- Schemaless usage ingestion handling unstructured AI product usage data

-Cons

- UI complexity that may challenge less technical users

- Portal customization restrictions potentially impacting brand consistency

- 0.75% overage fee that can become significant for high-growth businesses

One highlighted feature and why it's amazing

Uses machine learning to analyze subscription patterns and identify at-risk customers, enabling proactive retention through ML-based 'Smart Targeting' .

Another highlighted feature of why it’s amazing

Schemaless usage ingestion that handles unstructured AI product usage data for real-time billing alignment .

2. ChartMogul

+Pros

- Industry benchmarking from 2,500+ companies providing competitive context .

- Unified data integration that merges billing sources with CRM information through 99.8% reliable sync processes .

- AI-powered enrichment automatically enhances customer records with firmographic data .

-Cons

- 24-hour data sync latency preventing real-time decision-making capabilities .

- Manual workarounds required for non-standard billing cycles .

One highlighted feature and why it's amazing

Automatically merges billing data from Stripe, Chargebee, Braintree, and Recurly with CRM information through 99.8% reliable sync processes .

Another highlighted feature of why it’s amazing

Automatically enhances customer records with firmographic data and behavioral insights, enabling personalized retention strategies without manual data entry .

3. ProfitWell

+Pros

- Freemium accessibility eliminating cost barriers

- Intuitive dashboard design requiring minimal training

- Payment processor integration enabling automated data collection

-Cons

- Payment processor dependency excluding PayPal and marketplace payments

- Data accuracy challenges with promotional pricing requiring manual oversight

- Rules-based architecture limiting advanced AI capabilities

One highlighted feature and why it's amazing

Center on real-time MRR tracking, churn analysis, and LTV calculations through automated data collection from supported payment processors.

Another highlighted feature of why it’s amazing

Delivers automated dunning workflows and payment retry protocols starting at $1,000/month, incorporating predictive elements for churn intervention though primarily through rules-based systems rather than advanced AI.

Other Alternatives

Recharge Analytics

Recurly

Stripe Billing

Zuora

How We Researched This Guide

About This Guide: This comprehensive analysis is based on extensive competitive intelligence and real-world implementation data from leading AI vendors. StayModern updates this guide quarterly to reflect market developments and vendor performance changes.

204+ verified sources per analysis including official documentation, customer reviews, analyst reports, and industry publications.

- • Vendor documentation & whitepapers

- • Customer testimonials & case studies

- • Third-party analyst assessments

- • Industry benchmarking reports

Standardized assessment framework across 8 key dimensions for objective comparison.

- • Technology capabilities & architecture

- • Market position & customer evidence

- • Implementation experience & support

- • Pricing value & competitive position

Research is refreshed every 90 days to capture market changes and new vendor capabilities.

- • New product releases & features

- • Market positioning changes

- • Customer feedback integration

- • Competitive landscape shifts

Every claim is source-linked with direct citations to original materials for verification.

- • Clickable citation links

- • Original source attribution

- • Date stamps for currency

- • Quality score validation

Analysis follows systematic research protocols with consistent evaluation frameworks.

- • Standardized assessment criteria

- • Multi-source verification process

- • Consistent evaluation methodology

- • Quality assurance protocols

Buyer-focused analysis with transparent methodology and factual accuracy commitment.

- • Objective comparative analysis

- • Transparent research methodology

- • Factual accuracy commitment

- • Continuous quality improvement

Quality Commitment: If you find any inaccuracies in our analysis on this page, please contact us at research@staymodern.ai. We're committed to maintaining the highest standards of research integrity and will investigate and correct any issues promptly.