Alternatives to Attentive

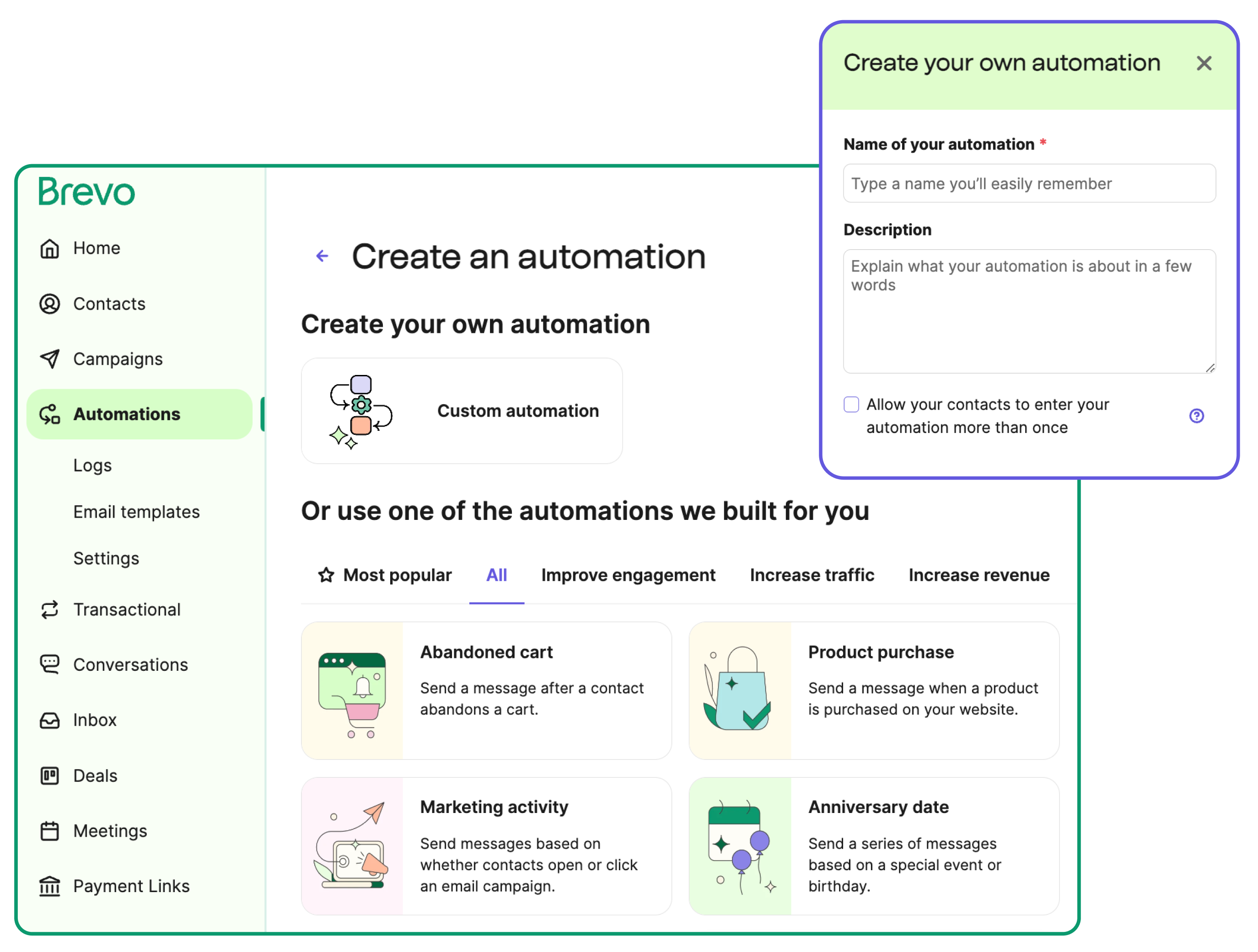

1. Brevo

+Pros

- Unified multichannel platform combining email, SMS, WhatsApp, and live chat capabilities.

- Volume-based pricing model with 300 emails daily and unlimited contacts up to 100,000 on the free tier.

- GDPR compliance capabilities and secure data handling validated through the Doctolib healthcare partnership.

- Aura AI assistant operates within existing workflow tools rather than requiring separate interfaces.

-Cons

- Klaviyo offers deeper native Shopify revenue attribution and more sophisticated predictive analytics capabilities.

- Mailchimp provides broader third-party integration ecosystem and more extensive template libraries.

- Users report varying performance across email providers with Gmail presenting particular difficulties.

- Integration with legacy systems presents challenges.

One highlighted feature and why it's amazing

Brevo integrates email, SMS, WhatsApp, and live chat capabilities under a single interface, eliminating tool fragmentation that typically requires multiple vendor relationships and separate training investments.

Another highlighted feature of why it’s amazing

The platform's core AI functionality centers on Aura, launched in 2025 following significant platform investment, providing content generation for subject lines, email copy, and CTAs with brand tone adjustment capabilities.

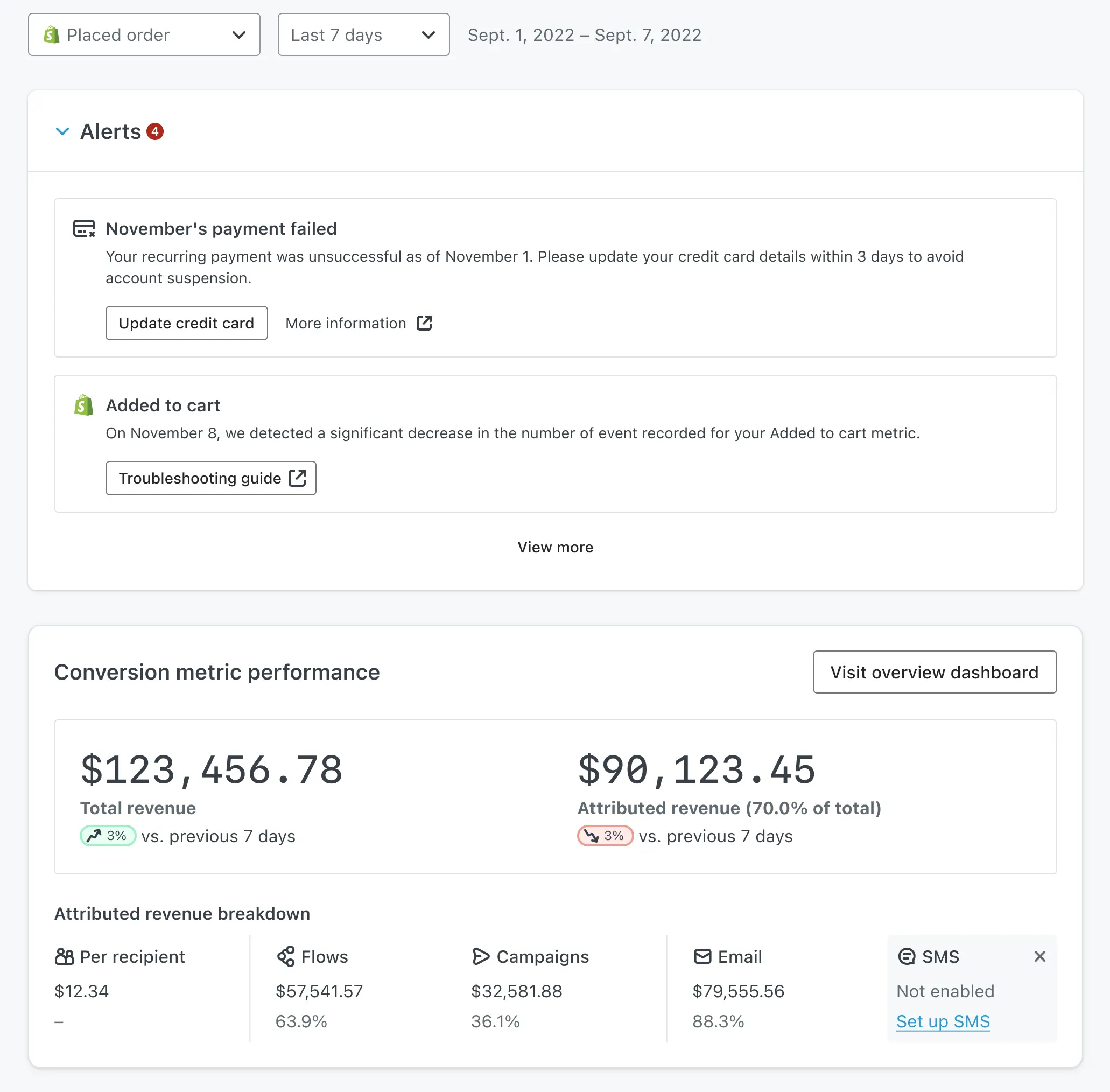

2. Klaviyo

+Pros

- Unified marketing automation combining email, SMS, and review management with AI-powered personalization .

- Deep Shopify integration providing automated data sync and behavioral tracking .

- Proven ROI delivery across multiple customer implementations .

-Cons

- Implementation complexity despite moderate technical ratings .

- Active profile billing methodology can penalize businesses with large but inactive customer databases .

- 90-day 'suppression jail' limits reactivation of unengaged contacts .

One highlighted feature and why it's amazing

Transforms audience building from manual rule configuration to natural language interaction, enabling complex behavioral targeting without requiring technical expertise .

Another highlighted feature of why it’s amazing

Generate personalized content while maintaining brand voice consistency through machine learning models trained on existing brand communications .

3. Omnisend

+Pros

- Integrated omnichannel capabilities managing email, SMS, and push notifications through centralized analytics

- Proven implementation success across documented customer stories

- Accessible deployment for SMBs through pre-built integrations, particularly with Shopify

-Cons

- Technical limitations in product recommendation accuracy for complex catalog environments

- Implementation challenges in data mapping inconsistencies causing delays in multi-platform environments

One highlighted feature and why it's amazing

AI email generator that creates editable templates and subject line generator providing A/B-testable options .

Another highlighted feature of why it’s amazing

Utilizes RFM analysis to automatically categorize customers based on purchase frequency, recency, and monetary value .

Other Alternatives

Postscript

SMSBump

Sendlane

SlickText

How We Researched This Guide

About This Guide: This comprehensive analysis is based on extensive competitive intelligence and real-world implementation data from leading AI vendors. StayModern updates this guide quarterly to reflect market developments and vendor performance changes.

207+ verified sources per analysis including official documentation, customer reviews, analyst reports, and industry publications.

- • Vendor documentation & whitepapers

- • Customer testimonials & case studies

- • Third-party analyst assessments

- • Industry benchmarking reports

Standardized assessment framework across 8 key dimensions for objective comparison.

- • Technology capabilities & architecture

- • Market position & customer evidence

- • Implementation experience & support

- • Pricing value & competitive position

Research is refreshed every 90 days to capture market changes and new vendor capabilities.

- • New product releases & features

- • Market positioning changes

- • Customer feedback integration

- • Competitive landscape shifts

Every claim is source-linked with direct citations to original materials for verification.

- • Clickable citation links

- • Original source attribution

- • Date stamps for currency

- • Quality score validation

Analysis follows systematic research protocols with consistent evaluation frameworks.

- • Standardized assessment criteria

- • Multi-source verification process

- • Consistent evaluation methodology

- • Quality assurance protocols

Buyer-focused analysis with transparent methodology and factual accuracy commitment.

- • Objective comparative analysis

- • Transparent research methodology

- • Factual accuracy commitment

- • Continuous quality improvement

Quality Commitment: If you find any inaccuracies in our analysis on this page, please contact us at research@staymodern.ai. We're committed to maintaining the highest standards of research integrity and will investigate and correct any issues promptly.