Alternatives to Amazon Forecast

1. Blue Yonder Fulfillment

+Pros

- Advanced AI capabilities with cognitive demand planning and predictive analytics

- Proven enterprise-scale performance with high-profile implementations

- Microsoft Azure partnership providing technical infrastructure advantages

- Sophisticated omnichannel capabilities enabling complex multi-channel operations

-Cons

- Implementation complexity and high total investment requirements

- Enterprise focus creating accessibility barriers for mid-market organizations

- Data quality dependencies creating implementation risks

- Vendor lock-in considerations through Microsoft Azure partnership

One highlighted feature and why it's amazing

Uses machine learning algorithms to reconcile partial-week forecasts and disaggregate demand across multiple dimensions .

Another highlighted feature of why it’s amazing

Operates as a comprehensive digital twin, enabling concurrent simulations of order fulfillment under various capacity constraints .

2. Inventory Planner

+Pros

-Cons

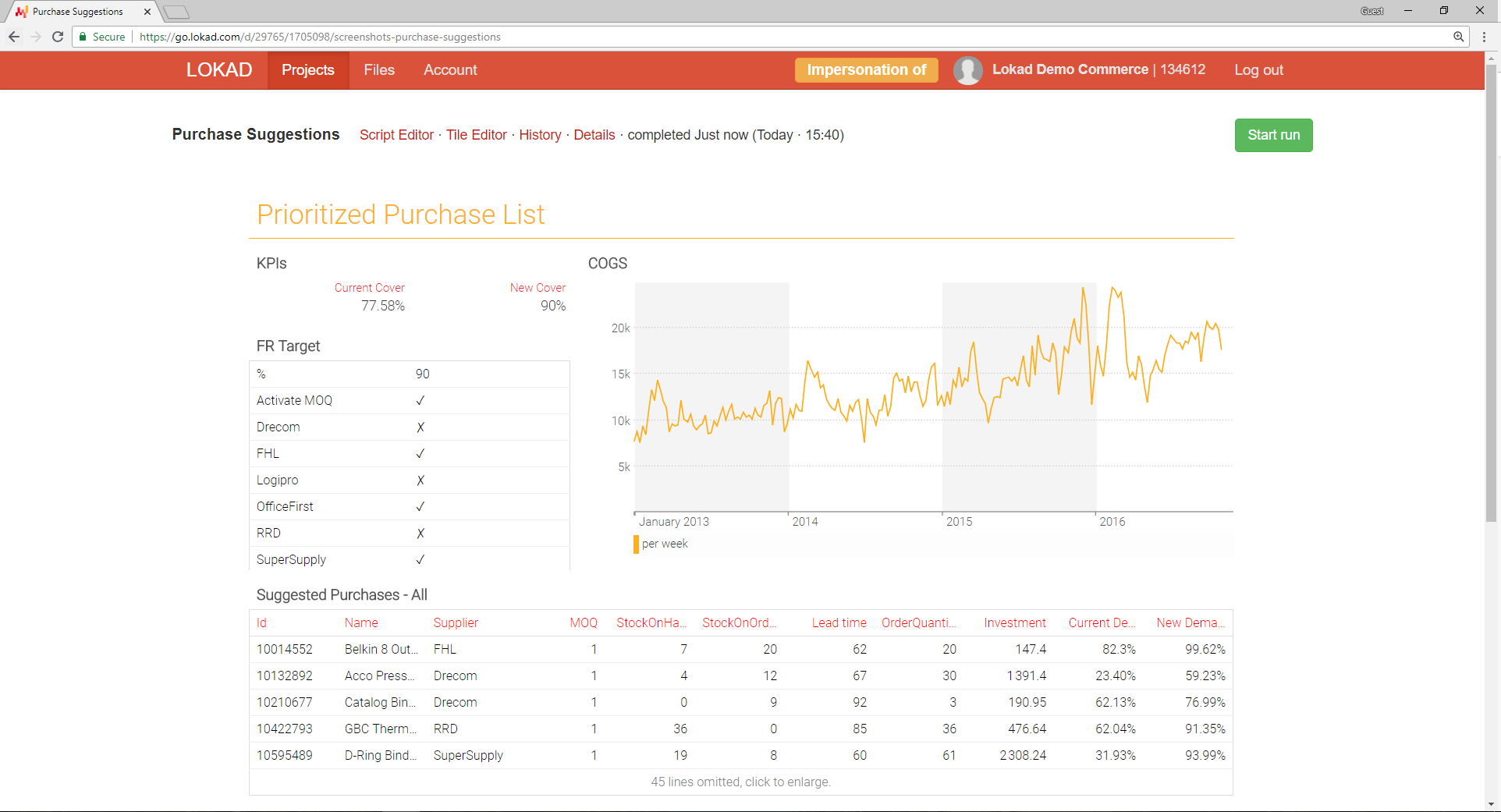

3. Lokad

+Pros

- Probabilistic forecasting capabilities that generate demand distributions rather than single-point predictions.

- Proprietary Envision programming language allows custom economic logic integration.

- Superior handling of intermittent demand patterns through correlation analysis.

-Cons

- Significant implementation complexity that exceeds simpler alternatives.

- Resource requirements demand dedicated data engineering capabilities.

- Data dependency creates accuracy degradation with inconsistent historical records.

One highlighted feature and why it's amazing

Generates demand distributions rather than single-point predictions to enable risk-adjusted inventory decisions.

Another highlighted feature of why it’s amazing

Allows custom economic logic integration, incorporating business constraints like minimum order quantities, shelf-life risks, and promotional impacts directly into forecasting models.

Other Alternatives

Netstock

Oracle Warehouse Management

RELEX Solutions

SAP Commerce Cloud

Shopify Sidekick

How We Researched This Guide

About This Guide: This comprehensive analysis is based on extensive competitive intelligence and real-world implementation data from leading AI vendors. StayModern updates this guide quarterly to reflect market developments and vendor performance changes.

206+ verified sources per analysis including official documentation, customer reviews, analyst reports, and industry publications.

- • Vendor documentation & whitepapers

- • Customer testimonials & case studies

- • Third-party analyst assessments

- • Industry benchmarking reports

Standardized assessment framework across 8 key dimensions for objective comparison.

- • Technology capabilities & architecture

- • Market position & customer evidence

- • Implementation experience & support

- • Pricing value & competitive position

Research is refreshed every 90 days to capture market changes and new vendor capabilities.

- • New product releases & features

- • Market positioning changes

- • Customer feedback integration

- • Competitive landscape shifts

Every claim is source-linked with direct citations to original materials for verification.

- • Clickable citation links

- • Original source attribution

- • Date stamps for currency

- • Quality score validation

Analysis follows systematic research protocols with consistent evaluation frameworks.

- • Standardized assessment criteria

- • Multi-source verification process

- • Consistent evaluation methodology

- • Quality assurance protocols

Buyer-focused analysis with transparent methodology and factual accuracy commitment.

- • Objective comparative analysis

- • Transparent research methodology

- • Factual accuracy commitment

- • Continuous quality improvement

Quality Commitment: If you find any inaccuracies in our analysis on this page, please contact us at research@staymodern.ai. We're committed to maintaining the highest standards of research integrity and will investigate and correct any issues promptly.