Alternatives to AfterShip Returns

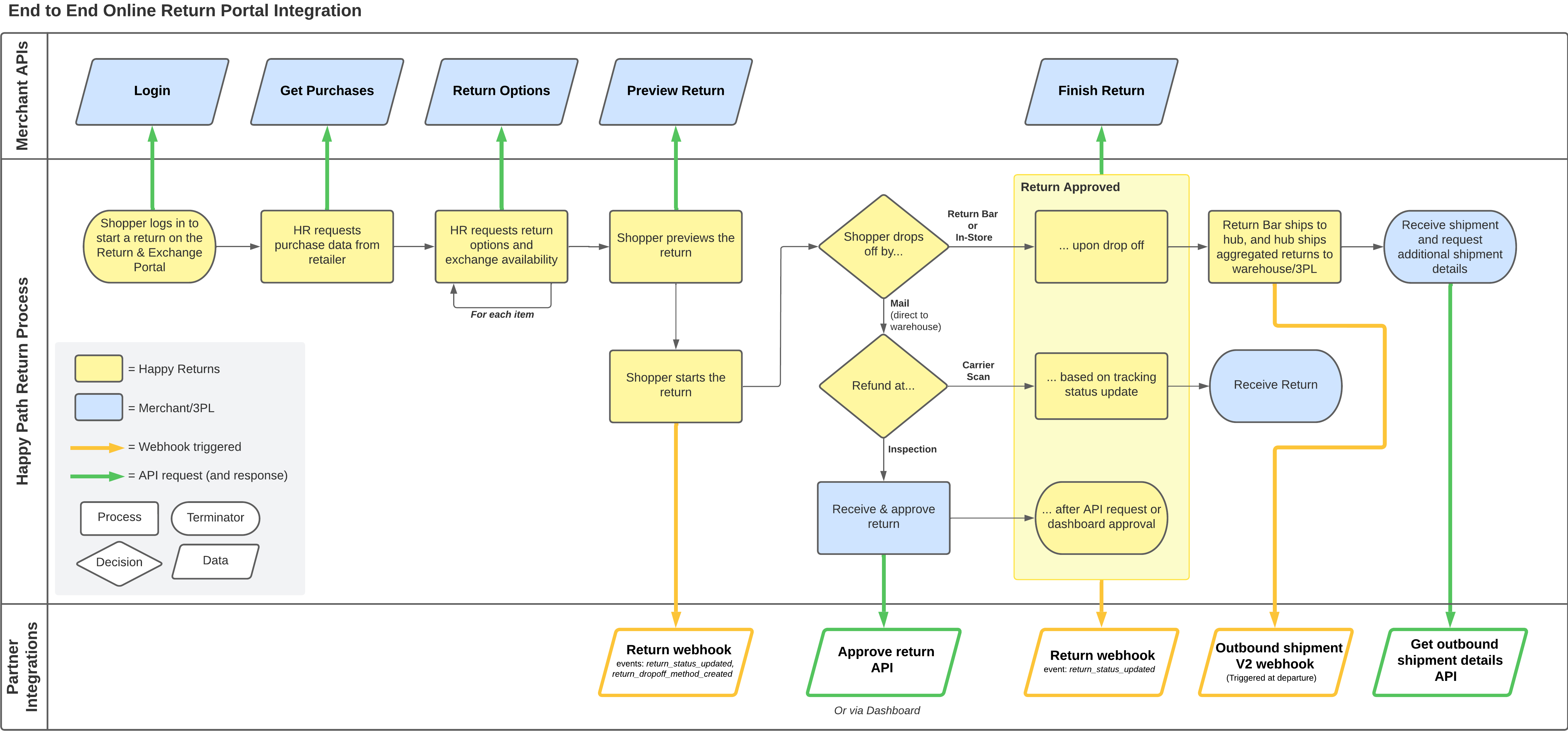

1. Happy Returns

+Pros

- Unique physical infrastructure providing 10,000+ Return Bar locations

- Measurable operational benefits including 70% shipping cost reduction

- Fraud prevention capabilities through barcode verification systems

-Cons

- Limited international presence beyond U.S. coverage

- Limited AI capabilities beyond logistics optimization

- Hardware deployment and iPad dependency at Return Bar locations

One highlighted feature and why it's amazing

The vendor provides automated return portal functionality with package tracking and reporting, combined with barcode verification systems for fraud prevention.

Another highlighted feature of why it’s amazing

Happy Returns implements item scanning at drop-off points through its Return Bar network, providing real-time fraud prevention.

2. Loop Returns

+Pros

- Shopify ecosystem integration provides seamless connectivity .

- Machine learning fraud detection system recovers $0.87 per $1 lost to fraud .

- Exchange optimization capabilities achieve 37% higher conversion rates compared to manual offers .

-Cons

- Requires 500+ monthly returns for optimal ROI .

- Shopify-centric approach creates dependency on that ecosystem.

- AI features require 50,000+ historical returns for optimal pattern recognition .

One highlighted feature and why it's amazing

Loop Returns employs machine learning algorithms to analyze return characteristics including geographic anomalies, customer history, and device details, providing real-time risk assessment during return submission .

Another highlighted feature of why it’s amazing

The platform's AI-driven incentive system analyzes customer behavior and product affinity to present personalized exchange options, achieving 37% higher exchange rates compared to manual offers .

3. Narvar

+Pros

- Sophisticated AI capabilities with IRIS™ processing over 42 billion annual consumer interactions.

- Proven revenue impact with documented outcomes like $0.43 revenue retention per $1 returned.

- Enterprise infrastructure advantages including the 1,100+ Kohl's location partnership for packageless returns.

-Cons

- GDPR compliance restrictions make IRIS™ AI features unavailable in EU/UK markets.

- Negative ROI for retailers with sub-500 monthly returns and $150,000+ annual investment requirements.

- Omnichannel constraints with limited cross-channel capabilities compared to competitors like ReturnGO.

One highlighted feature and why it's amazing

Processes over 42 billion annual consumer interactions to deliver real-time fraud detection, personalized return experiences, and intelligent exchange optimization.

Another highlighted feature of why it’s amazing

Provides real-time pattern recognition to identify suspicious returns including empty-box scams, cross-retailer fraud, and wardrobing schemes.

Other Alternatives

Optoro RMS

Returnly

ReverseLogix

How We Researched This Guide

About This Guide: This comprehensive analysis is based on extensive competitive intelligence and real-world implementation data from leading AI vendors. StayModern updates this guide quarterly to reflect market developments and vendor performance changes.

287+ verified sources per analysis including official documentation, customer reviews, analyst reports, and industry publications.

- • Vendor documentation & whitepapers

- • Customer testimonials & case studies

- • Third-party analyst assessments

- • Industry benchmarking reports

Standardized assessment framework across 8 key dimensions for objective comparison.

- • Technology capabilities & architecture

- • Market position & customer evidence

- • Implementation experience & support

- • Pricing value & competitive position

Research is refreshed every 90 days to capture market changes and new vendor capabilities.

- • New product releases & features

- • Market positioning changes

- • Customer feedback integration

- • Competitive landscape shifts

Every claim is source-linked with direct citations to original materials for verification.

- • Clickable citation links

- • Original source attribution

- • Date stamps for currency

- • Quality score validation

Analysis follows systematic research protocols with consistent evaluation frameworks.

- • Standardized assessment criteria

- • Multi-source verification process

- • Consistent evaluation methodology

- • Quality assurance protocols

Buyer-focused analysis with transparent methodology and factual accuracy commitment.

- • Objective comparative analysis

- • Transparent research methodology

- • Factual accuracy commitment

- • Continuous quality improvement

Quality Commitment: If you find any inaccuracies in our analysis on this page, please contact us at research@staymodern.ai. We're committed to maintaining the highest standards of research integrity and will investigate and correct any issues promptly.