Alternatives to 99minds

1. Blackhawk Network

+Pros

- Advanced fraud prevention achieving reported 95% fraud reduction.

- Real-time balance synchronization across channels.

- Comprehensive multi-jurisdictional compliance management.

-Cons

- Substantial technical resource requirements demanding .NET/PHP development capabilities and API integration expertise.

- Implementation complexity creates barriers for organizations lacking dedicated technical resources.

One highlighted feature and why it's amazing

Advanced fraud prevention through machine learning-based transaction analysis.

Another highlighted feature of why it’s amazing

Cross-channel redemption with real-time balance synchronization.

2. Gift Up!

+Pros

- Cost transparency with a 3.49% transaction fee and no setup fees or monthly subscriptions.

- Rapid deployment with 60-second widget installation for Shopify and WooCommerce.

- Zero-commitment pricing model benefits SMBs and seasonal businesses.

-Cons

- AI capabilities lag behind specialized competitors, with fraud prevention relying on third-party payment processors.

- Integration complexity affecting custom implementations, particularly with legacy POS systems.

One highlighted feature and why it's amazing

Gift Up!'s core product features center on straightforward gift card issuance and management through widget-based integration for major ecommerce platforms. The platform offers 60-second installation for Shopify and WooCommerce stores, enabling rapid deployment without extensive technical resources.

Another highlighted feature of why it’s amazing

The 3.49% transaction fee structure eliminates setup fees and monthly subscriptions, while complimentary card pricing offers the first 5 cards free monthly, then 1.99% fee for balances exceeding $50.

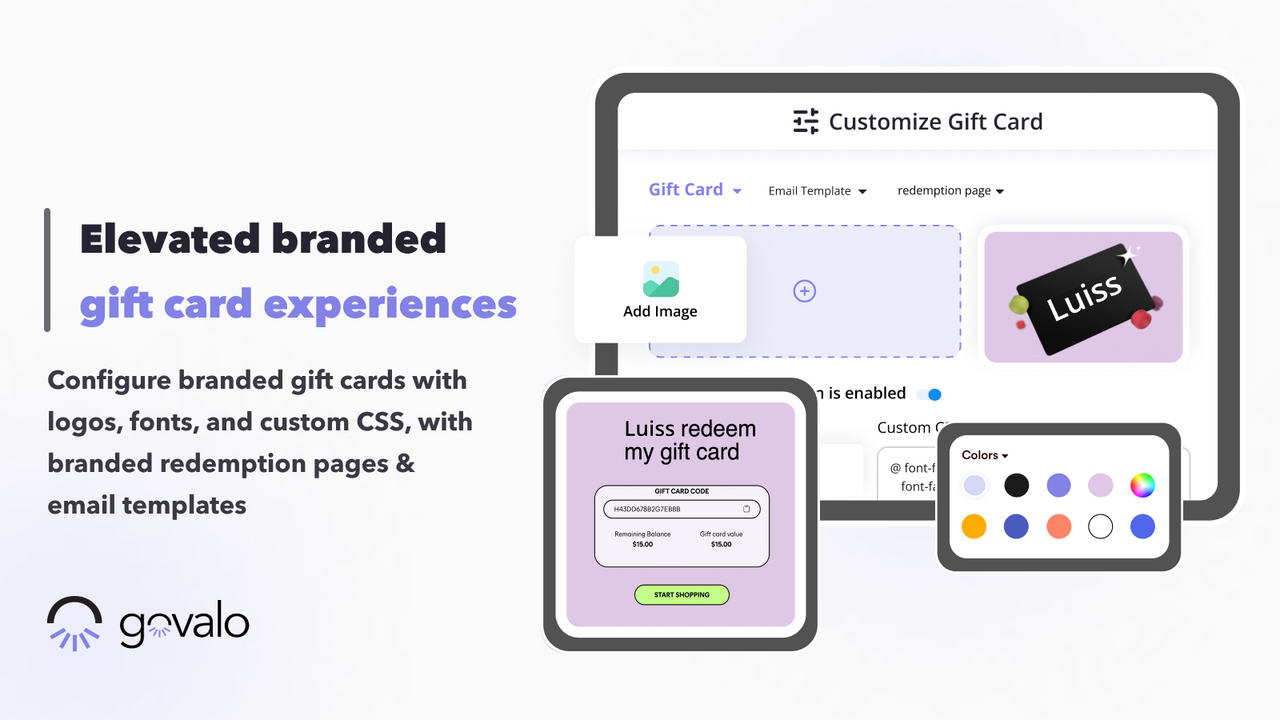

3. Govalo

+Pros

- Shopify-native integration with basic setup taking less than 30 minutes for Essential tier users

- Transparent pricing with SMB-friendly entry points starting at $5/month plus 2.9% transaction fees

- Giftable products functionality and out-of-stock integration address specific ecommerce pain points

-Cons

- Claimed 'AI capabilities' represent standard UX customization features rather than artificial intelligence

- Lacks AI-driven fraud detection, predictive analytics, or machine learning capabilities

- Support quality inconsistencies with multiple customers reporting unresolved tickets lasting months

One highlighted feature and why it's amazing

Govalo enables gift card personalization through multiple images per card (up to 20), scheduled delivery options, and recipient-specific messaging capabilities .

Another highlighted feature of why it’s amazing

Recipients can select product variants and shipping preferences, addressing the limitation of traditional fixed-value gift cards .

Other Alternatives

Tango Card

Tremendous

Voucherify

How We Researched This Guide

About This Guide: This comprehensive analysis is based on extensive competitive intelligence and real-world implementation data from leading AI vendors. StayModern updates this guide quarterly to reflect market developments and vendor performance changes.

288+ verified sources per analysis including official documentation, customer reviews, analyst reports, and industry publications.

- • Vendor documentation & whitepapers

- • Customer testimonials & case studies

- • Third-party analyst assessments

- • Industry benchmarking reports

Standardized assessment framework across 8 key dimensions for objective comparison.

- • Technology capabilities & architecture

- • Market position & customer evidence

- • Implementation experience & support

- • Pricing value & competitive position

Research is refreshed every 90 days to capture market changes and new vendor capabilities.

- • New product releases & features

- • Market positioning changes

- • Customer feedback integration

- • Competitive landscape shifts

Every claim is source-linked with direct citations to original materials for verification.

- • Clickable citation links

- • Original source attribution

- • Date stamps for currency

- • Quality score validation

Analysis follows systematic research protocols with consistent evaluation frameworks.

- • Standardized assessment criteria

- • Multi-source verification process

- • Consistent evaluation methodology

- • Quality assurance protocols

Buyer-focused analysis with transparent methodology and factual accuracy commitment.

- • Objective comparative analysis

- • Transparent research methodology

- • Factual accuracy commitment

- • Continuous quality improvement

Quality Commitment: If you find any inaccuracies in our analysis on this page, please contact us at research@staymodern.ai. We're committed to maintaining the highest standards of research integrity and will investigate and correct any issues promptly.